Analysis: N-able provides data protection and other services to more than 25,000 MSPs, yet many of us in the storage world have not heard of it – which is unsurprising. Although the company was started in 2000, it was bought by SolarWinds in 2013 ($120M in cash) and disappeared, so to speak, becoming the SolarWinds MSP business when combined with LOGICNow, which SolarWinds acquired in 2016. Now it has come back into public view, reappearing in July last year as an independent company.

What happened and what kind of data protection company is N-able?

Spin-off

Although parent company SolarWinds was affected by a cyberattack on 14 December 2020, the separation of N-able had been discussed from August 2020 onwards. In the cyber incident, Sunburst malicious code was injected into SolarWinds’ Orion software. N-able said it had found no evidence of Sunburst in its own systems.

However, in N-able’s March 2021 SEC 10-12B registration statement it declared: “We believe the cyber incident has caused reputational harm to SolarWinds and also had an adverse impact on our reputation, new subscription sales and net retention rates, although the extent of such impact was not significant in our financial results during 2020. In the final weeks of December 2020 and in the first quarter of 2021, we experienced an adverse impact to new subscription sales and expansion rates relative to historical levels. We believe this was due in part to our decision in response to the Cyber Incident to temporarily reduce investments in demand generation activities through January 2021, as well as a result of certain of our MSP partners delaying their purchasing decisions as they assessed the potential impact of the Cyber Incident.”

Seen in this context it’s conceivable that N-able’s separation had added impetus.

When N-able was spun off, it claimed more than 25,000 MSP partners and more than 500,000 SME customers for its services from those MSPs. The majority shareholders are SolarWinds itself, SolarWinds shareholders, Silver Lake, and Thoma Bravo.

Image vs file backup

In an IT Press Tour briefing this month, N-able laid out why it thought its cloud-based data protection services were a good deal for its MSP customers. The basic reason is that it provides file-based rather than virtual machine image-based protection. This means it requires less storage capacity than image-based protection while still enabling recovery via VM creation.

Chris Groot, GM for N-able’s data protection business, said “If you’re capturing all the information from within the operating system. You can actually bring back a full machine as a virtual machine, because a virtual machine is just a series of files organised in a very specific way. So being able to rehydrate that way is actually a different approach. One that we take, and at the end of it, it does provide that image recovery experience.”

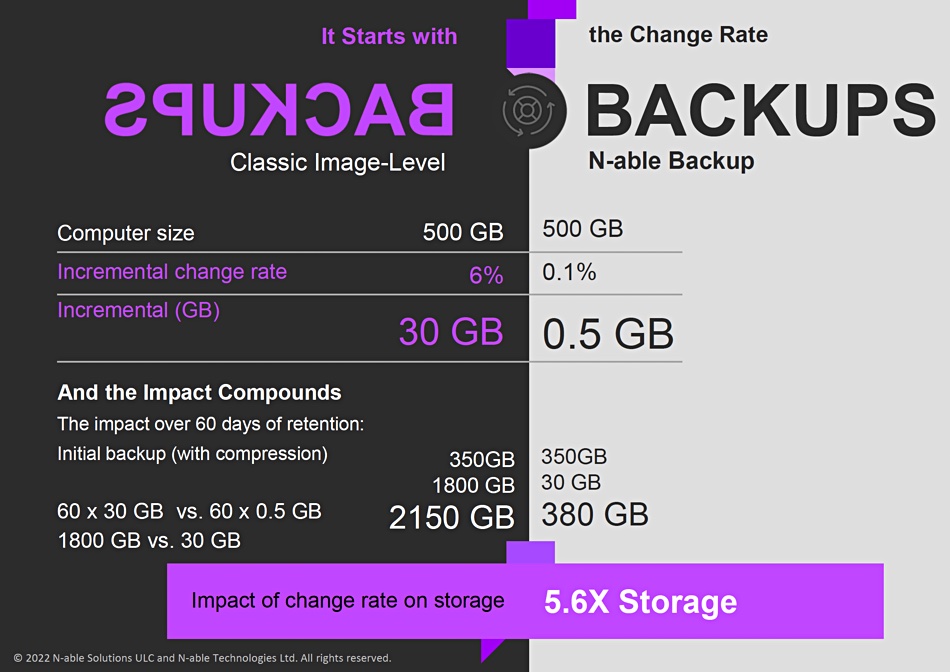

A comparison between the two styles of backup showed that incremental image backups could consume 30GB/day while the file-level alternative used up 0.5GB, due to change rate differences – as the slide below illustrates.

When compounded over 60 days, and taking compression into account, the image backups need 2,150GB of capacity while N-able’s file-level ones needed 380GB – giving it a 5.6x capacity advantage. There’s also a time and bandwidth advantage as shooting 0.5GB up to N-able’s cloud takes far less of both than pumping up 30GB.

Groot said when “running an incremental backup in one hour; with 30 gigs, you’re going to need an upload speed of 68 megabits. That same example, if you’re reading with half a gig, you’re going to need an upload speed of 1.1 megabits. So that just means … you don’t have to worry about those bandwidth constraints.”

It can also mean that more backups can be run, improving backup granularity as customers have more restore points available.

Business results

As N-able is now a public company it has to report on its activities. Its revenues in the third 2021 quarter, ended 30 September, were $88.4 million, 16 per cent higher than a year ago. It made a profit of $1.87 million, which compares to the year-ago loss of $1.13 million.

There was subscription revenue of $86.1 million, representing approximately 17 per cent year-over-year growth.

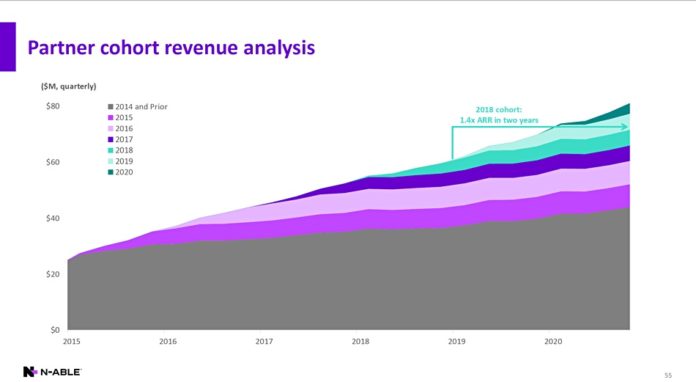

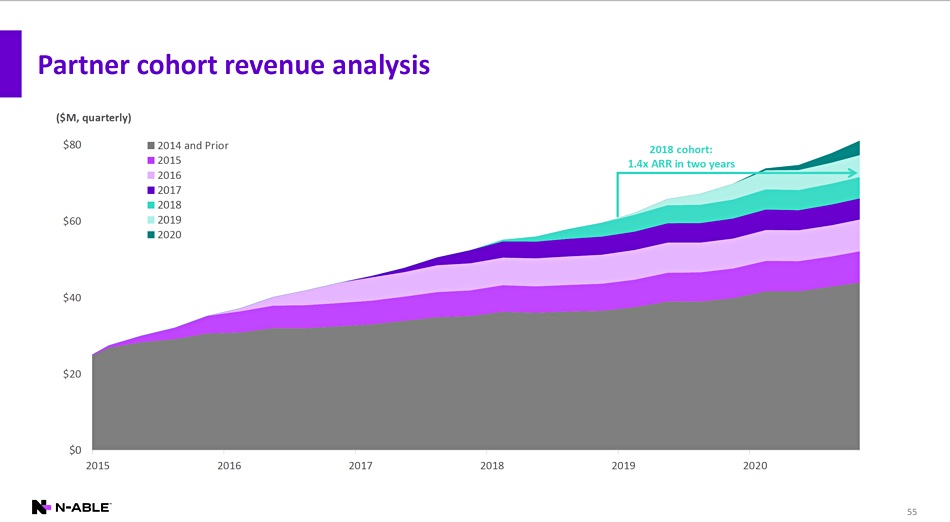

Growth has been consistent over the years, as indicated by a chart showing MSP cohort revenues by year since 2015:

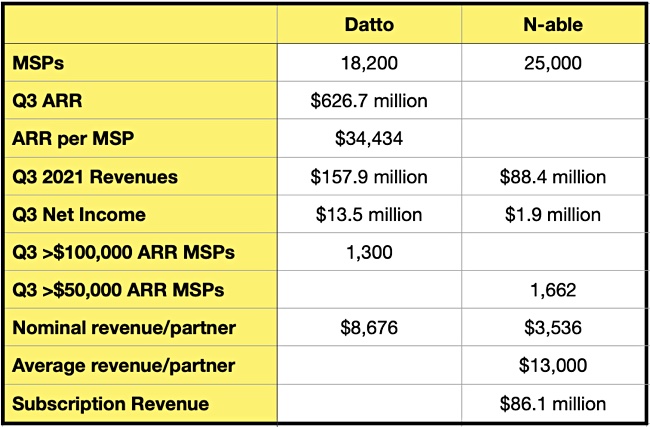

We’ve been able to compare some of N-able’s Q3 numbers with fellow MSP backup provider Datto:

Datto’s revenues of $157.9 million were almost double N-able’s $88.4 million. They both have huge numbers of MSP customers and both provide, albeit differently, their number of high income MSPs: 1,300 >$100,000 customers for Datto vs 1,662 >$50,000 customers for N-able.

We’ve computed the nominal revenue per MSP for each and Datto comes out ahead – at $8,676, vs N-able’s $3,563. N-able says its average revenue per partner is $13,000. Multiplying that by its 25,000 total partner number gives us $325 million, so we think this could be average revenue per year or for a subset of its partners.

Datto is also more profitable than N-able – $13.5 million vs $1.9 million.

All of which goes to show that N-able has a lot of room for growth. It competes with Kaseya and Veeam for MSP data protection business. Privately owned Kaseya doesn’t reveal the number of its MSP partners or the revenue it gets from them. Neither does publicly owned Veeam. We have no means of comparing N-able’s position in the MSP data protection market with either Veeam or Kaseya.

Footnote: N-able has just announced DNS Filtering which, it says, strengthens an MSP’s ability to proactively safeguard itself and its customers from threats and cyberattacks from within the N-central dashboard. DNS Filtering provides real-time, smart identification of malicious websites, multi-client management from a single platform and single screen, a fast, redundant Anycast network, and on-demand, drill down reporting and analytics.

N-able says 12,000 of its 25,000 MSPs use its data protection/backup offering.