Though Pure Storage and Nutanix can now be regarded as incumbents, they still behave like growth-hungry startups.

Nutanix went public in 2016 following Pure’s 2015 IPO. Since then Nutanix has amassed 20,700 customers and enjoyed $1.39 billion in revenues in its fiscal 2021. Pure Storage has just under 10,000 customers and reported $1.68 billion in revenues for its fiscal 2021.

Both have embraced the cloud and subscription business models and both face strongly placed legacy incumbent vendors such as Dell EMC, HPE, IBM, and NetApp with all-flash arrays for Pure. Nutanix competes primarily with VMware and also with hyperconverged infrastructure appliances (HCIA) from Dell EMC, Cisco, and HPE.

And yet the two companies are markedly different in a couple of respects. Pure’s on-premises arrays are based on proprietary hardware – its homegrown solid-state modules – whereas Nutanix is a software-only supplier. Secondly Nutanix has a history of making increasingly large losses whereas Pure, while still loss-making, is almost conservatively run in contrast.

Nutanix

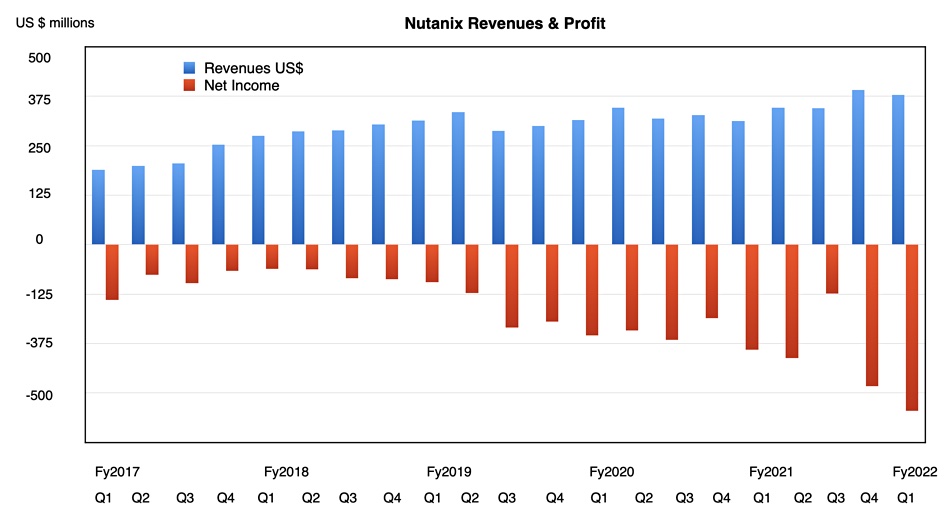

Here is Nutanix’s quarterly revenue and profit/loss history:

Its latest quarter losses, $418.9 million, exceeded revenues of $378.5 million. The annual revenue and profit/loss history shows a pattern of losses increasing faster than revenues from its fiscal 2019 onwards:

A look at quarterly revenues cut by fiscal year shows that Nutanix revenue growth hit a wall in its fiscal 2019 and only now, in the last two quarters, has it regained a high growth rate:

Despite this, Nutanix is in no danger of running out of cash. That’s thanks to Bain Capital in large part, as a look at its cash and short-term investment history illustrates:

Why the jump in Q1 2021? CFO Dustin Williams said in that quarter’s earnings call: “We closed the quarter with cash and short-term investments of $1.32 billion versus $720 million in Q4 ’20. The Q1 cash total includes $750 million from the Bain convertible note, less expenses, and $125 million stock buyback.”

The Bain Capital private equity convertible note was a $750 million investment through stock purchase in August 2020 with the intention of helping Nutanix grow. Note also that Nutanix spent $125 million cash to buy back its own shares at that time.

Pure Storage

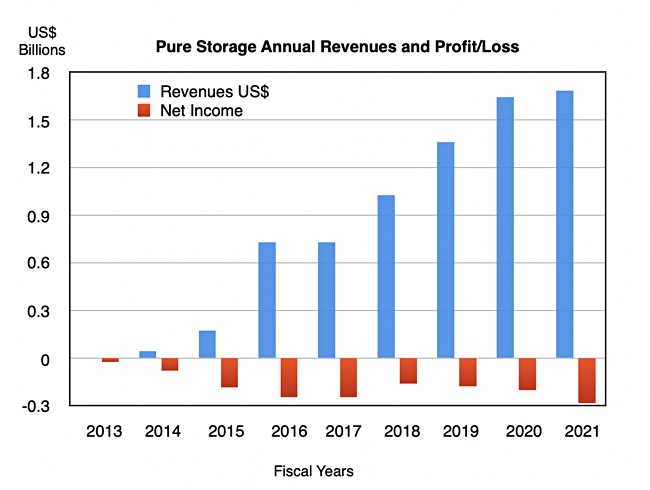

Pure looks to be a conservatively run company in comparison – with a much lower level of losses, and a more consistent growth rate. Here’s the quarterly revenue and profit/loss story:

The annual one:

And a look at quarterly revenues by fiscal year to view the revenue growth trajectory:

Apart from a blip in its fiscal 2021 Pure has grown consistently, with a much more consistent set of curves than the equivalent Nutanix chart.

On its storage array front Pure is facing two burgeoning startups in the form of Infinidat and VAST Data, both angling for enterprises to use their kit for storing primary and secondary data. VAST doesn’t have a block-based offering but punts its product as being Universal Storage. Then there are other all-flash startups with their hats in the ring, such as Pavilion Data and StorONE.

Nutanix is in a safer position in that there are no new startups offering hyperconverged appliance software and equivalent platform functionality. Attention has moved to Kubernetes and the HCIA startup era is finished. In that sense Nutanix, unlike Pure, is safe from being attacked from below by hungry startups.

Profitability

Eventually both will have to become profitable. That’s the whole point of their customer growth – to amass a customer base large enough to sell into at a profit. Just how many customers does Nutanix want before it decides profitability should be prioritised over growth? 25,000? 50,000? VMware’s vSAN had passed 30,000 customers in 2020’s fourth quarter, according to IDC. Perhaps that’s Nutanix’s aim: equal the vSAN customer count.

Pure should have a much easier path to profitability – its losses are a fraction of Nutanix’s. A look at the quarterly revenue history chart indicates that, were it to push revenues up to the $600 million level, it would probably enter profit territory.

Nutanix might do the same, if its revenues were up at the $800million per quarter level, which is a much higher mountain to climb. Put another way, growth is more important to Nutanix than Pure and profits are closer to Pure than they are for Nutanix.