After spinning off the unwanted Kyndryl (Global Technology Services business) IBM’s fourth 2021 quarter revenues grew compared to the restated year-ago quarter, and profits rose as well. But, despite, assertions of greater transparency, IBM’s storage hardware numbers were not visible – ending our ability to track them.

Revenues in the quarter ended Dec 31 were $16.7 billion, up 6.5 per cent year-on-year compared to the restated (ex-Kyndryl) Q4 2020 quarter’s $15.68 billion. Before restatement the Q4 2020 revenue was $20.37 billion – see how IBM has shrunk by spinning off Kyndryl. There was a profit of $2.3 billion, up 71.9 per cent on the restated year-ago quarter’s profit of $1.36 billion; it was $1.3 billion before restatement.

Arvind Krishna, IBM’s Chairman and CEO, said “Our fourth quarter results reinforce our confidence in our strategy and model. With solid revenue growth, we are on track to the mid-single digit trajectory we had laid out in our investor briefing last October.”

New segment reporting

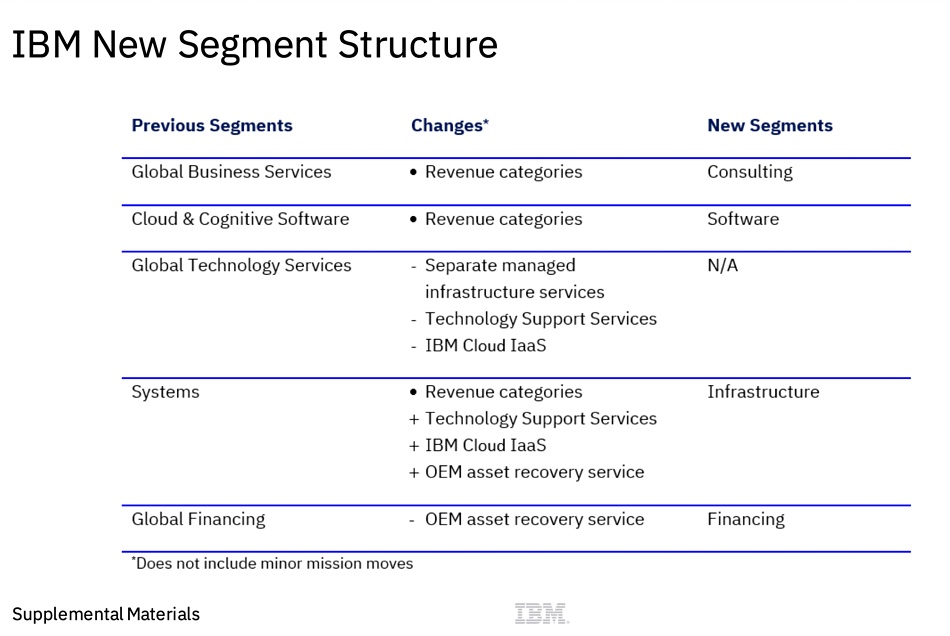

The old and new segment structures look like this:

SVP and CFO Jim Kavanaugh described the new structure: “We have put in place a simplified management system and segment structure aligned to our platform-centric model. And within the segments, we’re now providing new revenue categories and metrics that will provide greater transparency into business trends and drivers.” But there is no greater transparency into storage sales. In fact there is less.

Unlike previously there is now no way for us to get IBM’s storage hardware revenue number, meaning we can no longer track its progress. The storage software revenue number has never been provided for the 12-year period we have been following IBM storage, and we haven’t ever been able to track its progress.

IBM storage

We can say that IBM storage products are now sold through two business units. Here they are together with segment and component revenues:

1. Software (includes Hybrid Platform & Solutions, Transaction Processing) – revenues of $7.3 billion, up 8.2 per cent year-on-year.

- Hybrid Platform & Solutions – up 7 percent

- Red Hat up 19 per cent, and 21 per cent of segment revenue

- Automation (including AIOps and Management) up 13 per cent, and 15 per cent of segment revenue

- Data & AI up 1 per cent, and just 3 per cent of segment revenue

- Security down 2 per cent, and less than 1 per cent of segment revenue.

- Transaction Processing – up 11 per cent (including about 16 points from incremental external sales to Kyndryl.)

Software segment hybrid cloud revenue was up 22 per cent.

2. Infrastructure (includes Hybrid Infrastructure, Infrastructure Support) – revenues of $4.4billion, down 0.2 per cent (including about 5 points from incremental external sales to Kyndryl).

- Hybrid Infrastructure flat (including about 4 points from incremental external sales to Kyndryl) at $2.9 billion

- IBM Z down 6 per cent,

- Distributed Infrastructure up 5 per cent, driven by storage

- Infrastructure Support down 1 per cent (including about 6 points from incremental external sales to Kyndryl) at $1.5 billion

- Infrastructure segment hybrid cloud revenue down 12 per cent.

Distributed Infrastructure includes Power hardware and operating system, storage hardware, IBM Cloud IaaS, and OEM asset recovery service. Kavanaugh said “Infrastructure [is] more of a value vector [and] tends to follow product cycles,” compared to Software and Consulting which are called growth vectors.

“Tends to follow product cycles” refers, we think, mostly to the mainframe product cycle and, therefore, mostly to mainframe-attached DS8000 storage arrays.

Krishna said “Infrastructure had a good quarter, especially with regards to IBM Z and storage.” That’s an odd thing to say as IBM Z revenues were down 6 per cent. But Kavanaugh explained: “We had some large, perpetual license transactions given the good expansion in IBM Z capacity we’ve seen this cycle.” We think this means it could have been worse.

He also said “In Distributed Infrastructure, revenue was up 7 per cent driven by pervasive strength across our storage portfolio.” That’s good news and we expect it includes FlashSystem sales. These include previously separate Storwize array products.

IBM’s outlook is for mid-single-digit growth throughout 2022. Kavanaugh said a new Z mainframe introduction in the first half of 2022 should drive Infrastructure segment revenues higher.

IBM shares are now trading at $134.50; they were $124.86 just before the results were posted.