Revenues in IBM’s third fiscal 2021 quarter, ended September 30, were $17.6 billion — up 0.3 per cent year-on-year. There was a profit of $1.1 billion — 33.5 per cent lower than a year ago — but storage revenues rose 11 per cent annually.

The revenues were effectively flat and profit was down — not a lot to write home about. SVP and CFO James Kavanaugh’s results statement emphasised the positives and said: “We again had solid cash generation for the quarter and over the last year, while maintaining a strong balance sheet and the liquidity to support our hybrid cloud and AI strategy.”

IBM’s Chairman and CEO Arvind Krishna’s results statement ignored the headline numbers and looked ahead: “With the separation of Kyndryl early next month, IBM takes the next step in our evolution as a platform-centric hybrid cloud and AI company. We continue to make progress in our software and consulting businesses, which represent our higher growth opportunities. With our increased focus and agility to better serve clients, we are confident in achieving our medium-term objectives of mid-single digit revenue growth and strong free cash flow generation.”

Kyndryl is the name of the to-be-separated-out IT Infrastructure Services unit of IBM’s Global Technology Services business unit, and will become an independent company next month. The corporation reckons it will exit this fiscal year able to deliver mid-single-digit revenue growth and $35 billion free cash flow in 2022–2024.

IBM’s business segment results:

- Cloud & Cognitive software — $5.7 billion, up 2.5 per cent;

- Global Business Services — $4.4 billion, up 11.6 per cent;

- Global Technology Services — $6.2 billion, down 4.8 per cent;

- Systems — $1.107 billion, down 11.9 per cent;

- Global Financing — $220 million, down 19.2 per cent;

The Systems segment revenue decline was driven by declines in Z mainframes (down 33 per cent) and Power systems (down 24 per cent). Storage Systems grew 11 per cent. Cloud revenue was down 42 per cent. The growth in storage was driven by entry-level and tape systems.

IBM launched an entry-level FlashSystem 5200 in February — faster and higher in capacity, yet 20 per cent lower in price than the prior 5100 — and it has obviously done well. The growth in archival data storage needs has probably accounted for the tape systems revenue increase.

The mainframe and Power revenue declines were attributed to cycle dynamics, implying a revenue uplift should hopefully be coming from new hardware and software.

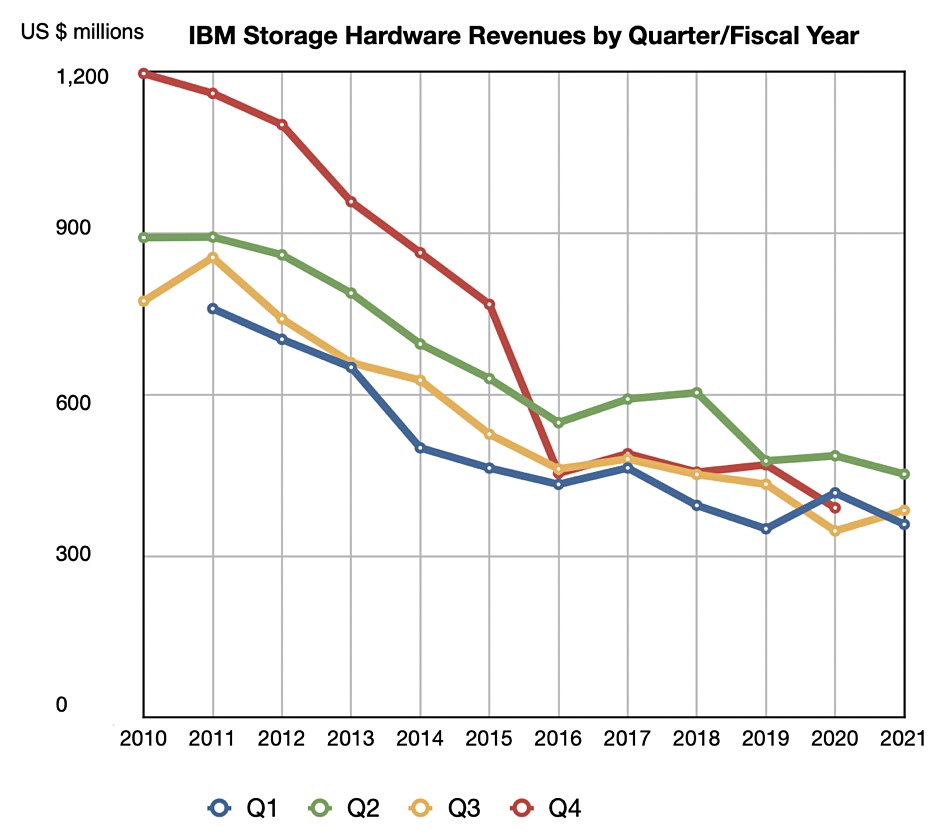

Systems provided $0.8 billion in hardware revenues and $0.3 billion in operating systems software revenues. IBM has provided percentage change numbers for the storage part of its systems business, and our records anchor these to an actual storage revenue number provided many quarters ago. We have recalculated the quarterly storage revenue number using these percentage changes and expect we are progressively becoming less accurate as a result.

This proviso is spelled out before we include our chart of IBM’s quarterly storage revenues by fiscal year to show the historical trends:

One quarter’s growth after many declining quarters does not make a trend, but IBM can be hopeful that a corner may have been turned.

We must note that most of IBM’s storage software revenues are not included in the Systems storage segment number. IBM is odd in that it does not provide a central and all-inclusive storage revenue number — at least in its public numbers. We simply do not know how IBM is doing from a storage software revenue perspective.