Revenues in Western Digital’s latest quarter grew 29 per cent – more than the previous quarter’s 15 per cent as demand held up at a high level – but supply chain issues are coming to the fore.

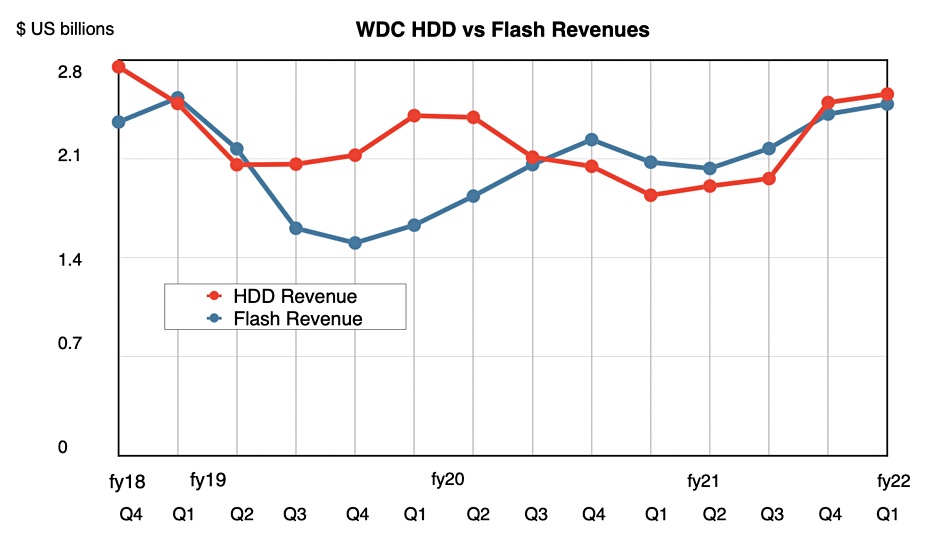

Its first fiscal 2022 quarter ended on September 30 and saw revenues of $5.05 billion with profits of $610 million – a whole lot better than the year-ago $60 million loss. Hard disk drive revenues were $2.56 billion – 38.9 per cent more than a year ago – while NAND Flash revenues saw an increase of 19.8 per cent year-on-year to land at $2.49 billion. There was nearly 30 per cent sequential growth in enterprise SSD revenue.

CEO David Goekler put out a results statement: “Strong demand across diverse end markets, particularly for our cloud products, combined with Western Digital’s strong innovation engine, broad routes to market and sharpened execution, enabled us to deliver solid results within our guidance range, even in the face of significant COVID impacts and supply chain disruptions.”

Flash revenues were driven by enterprise SSD demand and 5G phone production ramps using WD’s BiCS5 node NAND. Disk revenues soared due to mass capacity nearline drive demand.

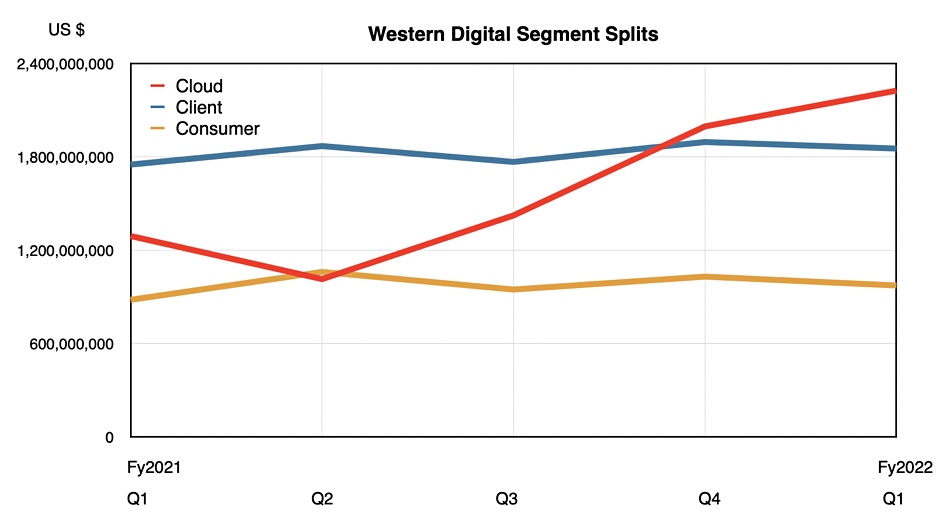

WD used to divide its overall revenues into three end market segments: datacentre devices and solutions, client solutions, and client devices. That’s all changed with three new segments: Cloud (enterprise datacentres and hyperscalers), Client (desktop/notebook, etc. via OEM and distribution), and Consumer (retail and other end-user) – nice and simple. The results for each segment:

- Cloud – $2.23B, up 72 per cent year-on-year;

- Client – $1.85B, up 6 per cent;

- Consumer – $973M, up 10 per cent.

WD said Cloud represented a record 44 per cent of total revenue, led by record capacity enterprise hard drive revenue and nearly 30 per cent sequential growth in enterprise SSD revenue. In the Client sector the flash business unit experienced growth in mobile, gaming, automotive, IoT and industrial applications. It sold 24.1 million disk drives, compared to 23 million a year ago, with the average price rising from $79 to $102 as capacities rose.

In Consumer, revenue from both the flash and hard drive business units declined on a sequential basis due to supply disruptions and uneven geographic demand due to COVID lockdowns.

The outlook for next quarter is $4.8 billion give or take $100 million, which will be a 21.7 per cent increase at the mid-point.

Financial summary

- Cash flow from operations – $521M ($363M a year ago);

- Free cash flow – $224M ($196M a year ago);

- Gross margin – 33 per cent (23 per cent a year ago);

- EPS – $1.93 ($0.20 a year ago);

- Cash and cash equivalents – $3.3B.

Earnings call

In the earnings call with analysts, Goekler and CFO Bob Eulau both highlighted growing component supply chain issues affecting WD itself and its customers.

Goekler said: “Maybe a quarter or two ago we were seeing it in maybe certain parts of the business, some of the OEM, PC OEMs. Now we’re seeing it more broadly. Even the big datacenter players are having their demand impacted … So, it’s really become a much more broad-based issue across the portfolio.”

The HDD revenue guide for the next quarter is down 15 per cent sequentially due to this issue, with HDD controller supply a large part of that. The company thinks the supply chain issues will improve after the next (December) quarter. It described the past quarter as an aberration, and not the new normal.

Goekler was asked about the media focus on Kioxia and Western Digital merging. All he said was that Kioxia is a tremendous and valued partner. “We’re really happy with the partnership and we’re going to … continue to get the best out of it.”

After the call Wells Fargo senior analyst Aaron Rakers thought WD’s flash revenues in the quarter were weaker than those of Samsung and SK hynix in average system price (ASP) terms. Overall, he told subscribers, the results and the guidance for next quarter were both disappointing.