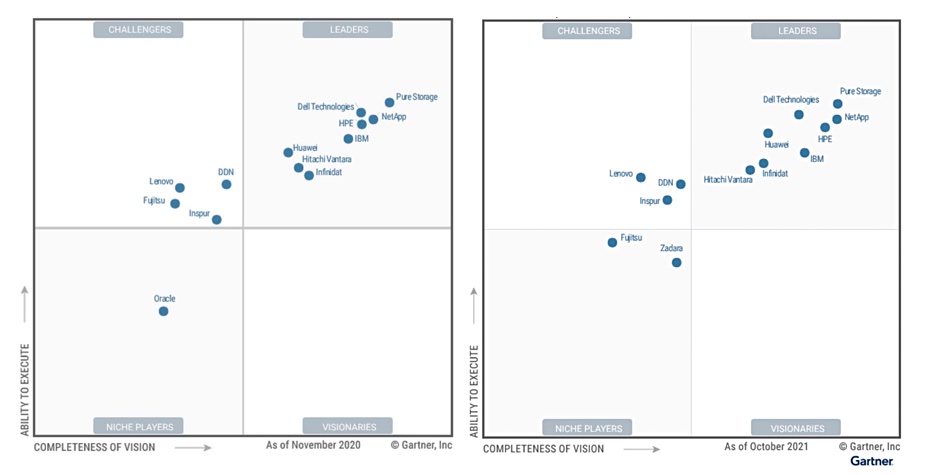

Gartner’s latest annual primary array Magic Quadrant shows a late-stage mature market with little differentiating innovation and moderately stable supplier positions.

Update; Vast Data Comment added. October 18, 2021.

There is incremental innovation, but it is common to most suppliers. Gartner analysts cite hybrid cloud IT operation models, artificial intelligence for IT operations (AIOps), software-defined storage and as-a-service/subscription consumption models as characteristics of the enterprise primary array market.

In the Leaders quadrant Pure stays at the top, where it was last year, Huawei has moved up past IBM on Ability To Execute but is trailing Big Blue on its Completeness of Vision. Infinidat has moved past Hitachi Vantara on both counts. There are eight Leaders — the others are Dell, NetApp, and HPE.

The Challengers box sees Fujitsu exit to become a Niche Player; it has withdrawn from the North American market, with both Inspur and Lenovo getting closer to DDN.

Down in the Niche Players box, Oracle has exited the 2021 MQ, having failed to meet the inclusion criteria — it is increasingly cloud-focussed. A new entrant is managed storage service supplier Zadara.

The Visionaries quadrant is empty, as it was last year. We are a little surprised that VAST Data is not included as a Visionary, but amongst Gartner’s inclusion criteria is a need to “have generated more than $50 million in recognised primary storage revenue (GAAP) during the past four quarters [and/or] an installed base of at least 500 customers in the upper-midsize and large enterprise market.” Newcomer VAST will find that a stretch, especially as it sells to large enterprises.

VAST president Mike Wing tweeted: “The Gartner rules are not designed for a company like VAST Data. We are completely ignoring the low to mid end of the market and winning massive deals at the high end!! That’s okay!! Our revenue results are second to none!!”

The lack of Challengers also points to the maturity of primary array technology, with incumbents rapidly adopting NVMe drives, being supportive of NVMe-over-Fabrics (NVMe-oF), and moving to subscription and service-based consumption models. All suppliers support a hybrid on-premises/public cloud capability and all are adopting container technology, with Kubernetes CSI plugins as the starting point.

This quick adoption of new technology leaves little scope for startups based on new technology to make inroads. Witness how the past decade’s wave of NVMe drive and NVMe-oF startups has fizzled out, and how Zadara is the sole managed-array-as-a-service startup.

There are other innovative primary array startups, but they are finding it hard going. Pavilion Data is yet to capitalise on its technology, although incoming CEO Dario Zamarian may inject a dose of growth juice into its arteries. Vexata near-failed and was bought up by StorCentric. StorONE is opposed to the idea of buying growth through large-scale VC funding and is making steady but not spectacular progress.

MQ description

Our standard MQ explainer notes: the “Magic Quadrant” is defined by axes labelled “Ability To Execute” and “Completeness of Vision”, and split into four squares tagged “Visionaries”, “Niche Players”, “Challengers” and “Leaders”.

As we wrote in October last year: “A Gartner MQ is like a doubles tennis court with Niche Players and Visionaries one side of the net, and Challengers and Leaders the other. The objective, rather than blast balls across the net and out of court, is to move into the Leaders section of the court and as far from the net and to the edge of the court as possible.”