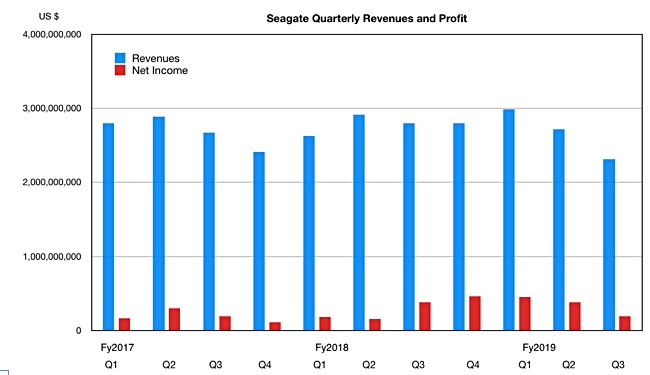

Seagate’s third fiscal 2019 quarter was hit by falling disk drive demand.

Revenues of $2.3bn ($2.8bn Q3, 2018) were 17.5 per cent lower and net income fell 488 per cent to $195m ($381m).

Seagate’s fourth quarter outlook is continued decline, with mid-point revenues of approximately $2.32bn, down 17.1 per cent ($2.8bn).

Nonetheless the relative performance was better than arch-rival Western Digital accomplished with its latest quarter’s revenues of $3.7bn – 26 per cent down on a year ago. Last year’s $61m net income turned into a thumping $581m loss for WD.

Seagate CEO Dave Mosley talked of successfully navigating “near-term demand head-winds.” And he expects “broader demand recovery starting in the second half of the calendar year.”

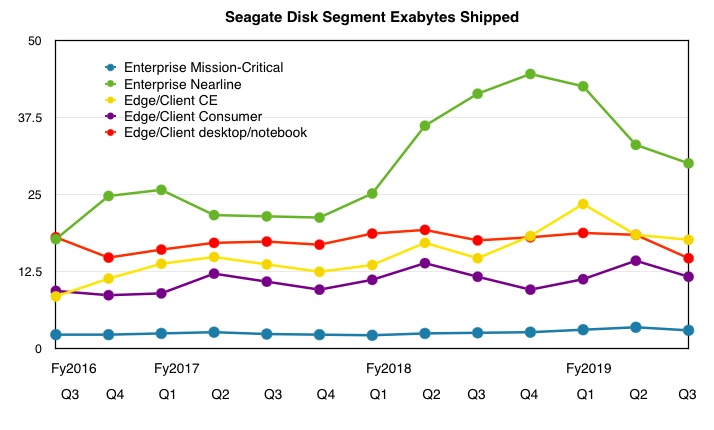

In the earnings call Mosley said: “In the edge compute market, revenue was impacted by the expected transition to SSDs, ongoing CPU shortages, and seasonal demand slowdown for Notebooks and desktop PCs. In the surveillance market, revenue remained suppressed by economic and geopolitical uncertainties…In the enterprise market, both seasonal and macroeconomic challenges weighed on revenue for our Nearline drives.”

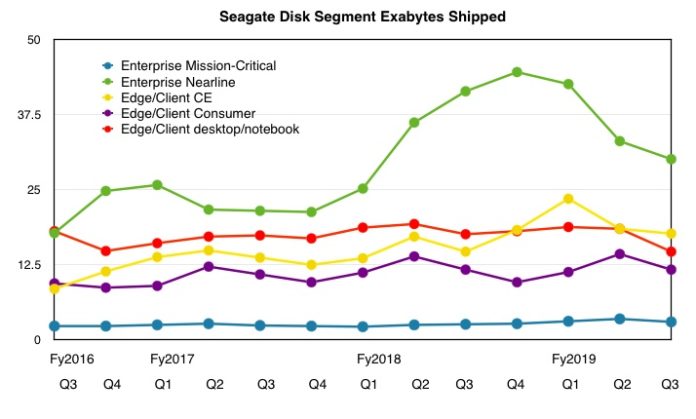

Shipments

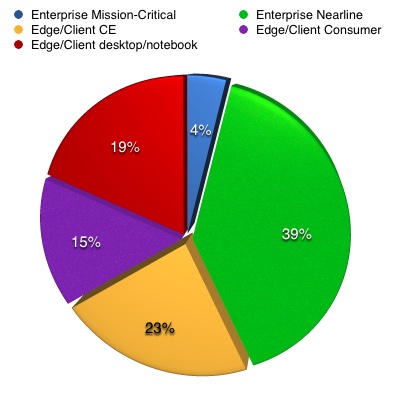

The company shipped 76.7EB of capacity, which was divided between five categories of drive.

A pie chart shows the segment split for the latest quarter:

HAMR time

Mosley also dropped a surprise into the results release: “We began shipping the industry’s first 16-terabyte high capacity drives in the fiscal third quarter and expect to ramp high volume production in the second half calendar 2019.” Deliveries started in March and “qualifications are underway at many major cloud and enterprise customers.”

Seagate expects to “begin ramping to high volume later in calendar 2019 and expect 16 terabyte drives will be our highest revenue SKU by this time next year”.

Seagate’s 16TB monster is a 9-platter/18 head drive. Western Digital is prepping an 8-platter/16 head MAMR drive for launch in late 2019. It hopes the lower platter and head component count will give it a cost advantage.

Seagate is developing an 18TB drive by using shingled magnetic recording technology.

Mosley expects to ‘introduce drives with over 20 terabytes of capacity in calendar year 2020.” These will use its Heat-Assisted Magnetic Recording (HAMR) technology.

He added: “We believe HAMR high density drives combined with our multi-actuator technology will not only address the heavy workloads and high utilisation rates required by large cloud data centres, but also new use cases that are emerging at the edge.”