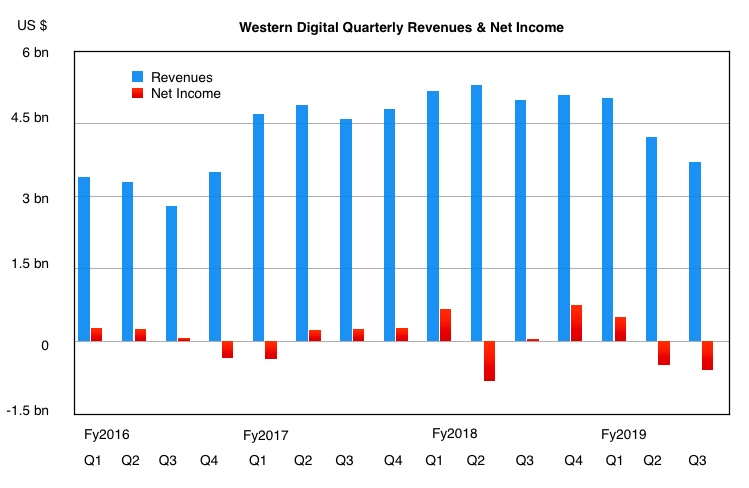

Western Digital was hit by weak disk drive demand and over-supply-induced flash price cuts in its third fiscal 2019 quarter. When will things improve for the flash, SSD and disk drive manufacturer?

Revenues of $3.7bn were 26 per cent down on a year ago. Last year’s $61m net income turned into a thumping $581m loss.

Discussing the results Steve Milligan, Western Digital CEO, saw “initial indications of improving trends…our expectation is for the demand environment to further improve for both flash and hard drive products for the balance of calendar 2019.”

Q3 2019 revenue fell in all three business divisions: Data Centre Devices and Solutions, Client Solutions, and Client Devices.

- Data Centre devices revenues were $1.25bn ($1.66bn a year ago)

- Client Devices revenues were $1.63bn ($2.3bn)

- Client Solutions revenues were $0.8bn ($1.04bn)

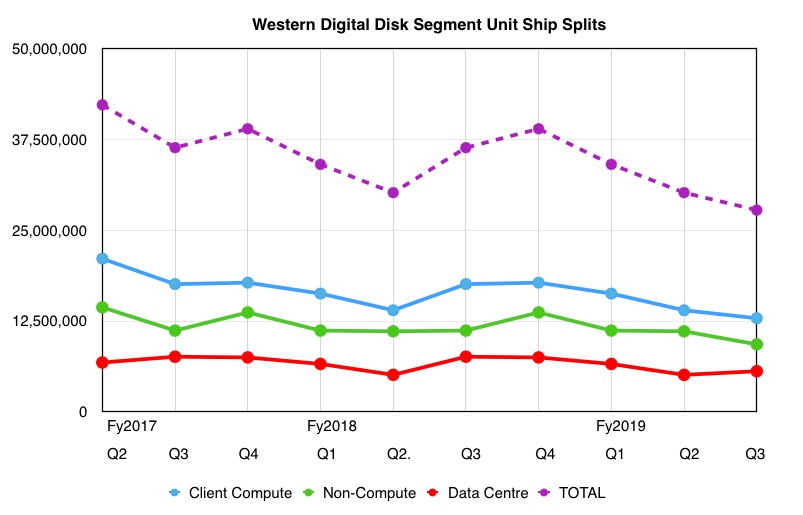

We charted the recent disk drive unit ship historical trends:

There is a discernible recent quarter-on-quarter pickup in data centre disk drive units.

WD attributed the fall in mobile embedded revenues to weak handset demand. Notebook and desktop revenue declined due to seasonality and flash price declines.

In the data centre devices unit, demand for capacity enterprise drives was better than expected.

WD was hit by a double whammy in the quarter. Total HDD revenues were $2.64bn a year ago and $2.1bn in the latest quarter. The equivalent flash revenues were $2.4bn a year ago and $1.6bn in Q3 fy’19. Wells Fargo senior analyst Aaron Rakers said flash capacity shipped was down 5 per cent year on year.

It’s not all bad. Rakers noted “client SSD Exabyte shipments more than doubled year-on-year,”

And WD’s OEMs are qualifying new NVMe eSSDs, with shipments expected to start in three months or so.

WD said it is on-track to launch 16TB and 18TB MAMR disk drives later in calendar 2019.