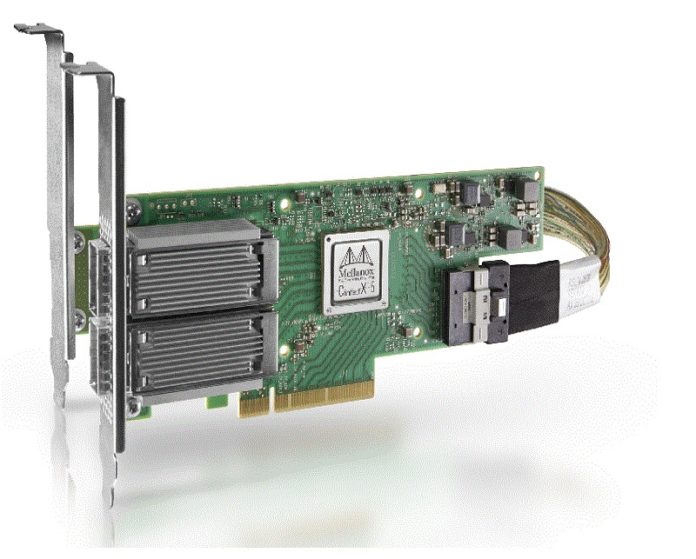

Nvidia is buying Mellanox, the Ethernet and InfiniBand data centre networking supplier, for $6.9 billion.

Nvidia will acquire all of the issued and outstanding common shares of Mellanox for $125 per share in cash. Mellanox was capitalised at $5.9bn on Friday, March 8, the last trading day before the acquisition was announced.

Aaron Rakers, a senior Wells Fargo analyst writes: “We think this acquisition would provide Nvidia with greater scale in the data centre market where we think low-latency interface technology is becoming an increasingly important architectural component / consideration.”

Nvidia makes most of its GPU revenues from computer games equipment and has been moving into the data centre with Tesla GPUs, aimed at the AI and machine learning markets. Its market capitalisation is $91bn.

Announcing the acquisition, Nvidia said: “Together, Nvidia’s computing platform and Mellanox’s interconnects power over 250 of the world’s TOP500 supercomputers and have as customers every major cloud service provider and computer maker.”

Its NVLINK technology links GPUs together and an InfiniBand/Ethernet NVLINK interface is a logical step.

The rise of NVMe over Fabrics technology is increasing demand for Ethernet and InfiniBand in data centre networking.

When two become one

With Mellanox under its wings, Nvidia will optimise data centre-scale workloads across the entire computing, networking and storage stack to achieve higher performance, greater utilisation and lower operating cost for customers.

Jensen Huang, founder and CEO of Nvidia, said: “The emergence of AI and data science, as well as billions of simultaneous computer users, is fuelling skyrocketing demand on the world’s data centres. Addressing this demand will require holistic architectures that connect vast numbers of fast computing nodes over intelligent networking fabrics to form a giant data centre-scale compute engine.”

Customer sales and support will not change as a result of this transaction.

Acquisition target

Mellanox has effectively been in acquisition play since June 2018 when it rebuffed a bid by Marvell. That triggered the interest of Starboard Value, an activist investor, which gained board-level influence over the company.

In October 2018, Mellanox hired an investment bank to help find a buyer, and Intel reportedly bid $5.5bn-$6bn in January 2019. Microsoft and Xilinx have been associated with $5bn bids for the company.

Mellanox posted 2018 revenues of $1.1bn, up 36 per cent on 2017, and net income of $134.3m. It lost $2.6m in 2017. Fourth quarter 2018 revenues were $290.1m, up 22.1 per cent, and net income was $42.8m. That compares to a $2.6m loss a year before. Mellanox said sales were helped by high demand for Spectrum Ethernet switches and LinkX cables and transceivers.