StoneFly has over 10,000 customers, but you’ve probably never heard of it. It supplies a unified SAN, NAS and object storage system has a three-layer virtual air gap system.

The biz supplies storage hardware and software presenting as an iSCSI SAN, Fibre Channel SAN, scale-out NAS and S3 object system, or all three with its StoneFly Fusion OS. This also powers hyper-converged infrastructure (HCI), backup and disaster recovery appliances which have the virtual air-gapping as a standard feature. Its Air-Gapped Vault runs in both on-premises deployments and also public cloud installations.

CEO Mo Tahmasebi told us: “None of our customers have suffered from ransomware-corrupted data.”

StoneFly has an interesting and eventful past. It employs 125 people – 75 employees with contractors making up the rest. There are 25 salespeople, with Tahmasebi informing an IT Press Tour audience at its Hayward, CA, office: “I can close deals in 45 minutes.”

He said StoneFly has more than 10,000 customers, over 50,000 deployments and in excess of 2.5EB of storage capacity deployed. The customers include consumers, small-to-medium businesses, government agencies, universities, hospitals, financial institutions and Fortune 500 businesses. StoneFly products have been deployed in US Navy Littoral Combat Ships (LCS) and Virginia Class Nuclear Submarines.

Tahmasebi said: “We run our own datacenters, in Fremont, Oregon, and Massachusetts, using caged areas in co-los.” He also claims StoneFly has “high, very high” revenue and is “very profitable.” It spends virtually no money on marketing and gains customers by referral and word of mouth.

According to Tahmasebi, StoneFly kit is a third of the price of competitors like Dell and HPE, and lower cost than iXsystems. Its object backup target can be used with Veeam and costs less than an ObjectFirst Ootbi appliance.

Stonefly sells to Samsung and Toshiba in Korea and has undisclosed OEM partners.

Air-gapping

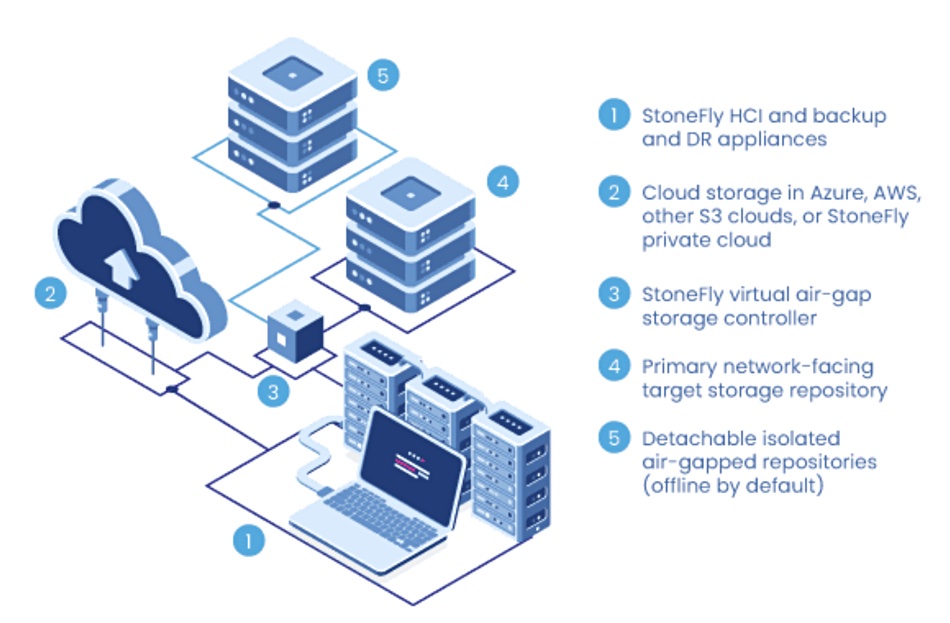

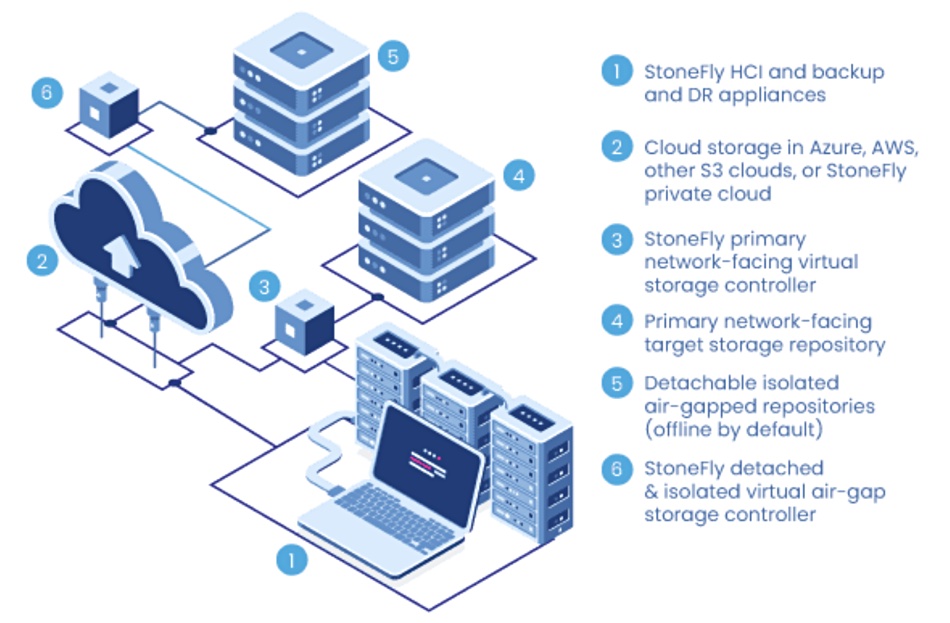

The air-gapping layers are at the repository, controller, and node levels.

Air-gapped repositories consist of one virtual storage controller connected to two target storage repositories. One target repository is network-facing, always accessible and available to user-groups, applications, etc. The second target repository is air-gapped, detached, and isolated.

StoneFly says air-gapped repositories can be deployed on popular hypervisors and public clouds. Policies can be defined to automatically turn-on (attach/connect) and turn-off (detach/disconnect) air-gapped repositories.

The node-level air-gapping involves the chassis power being turned off so the node becomes invisible from the network point of view. The virtual air-gap then becomes a physical air-gap.

Stonefly history

Present day StoneFly came into being through an acquisition after the original company – founded as StoneFly Networks an iSCI storage supplier in San Diego in 2000, and owning the www.iscsi.com website – ran into not-making-enough-sales trouble in 2003. It was VC-funded with Allen Yuhas as its CEO from 2002 onwards by which time it had raised $12 million in funding. StoneFly competed with LeftHand Networks (bought by HP in 2008), EqualLogic (bought by Dell) and Intransa (crashed in 2013) in the IP SAN market.

Dynamic Network Factory (DNF) bought StoneFly Networks’ assets in 2006, paying $205,000 for them, changing the name to StoneFly and operating it initially as a San Diego-based DNF subsidiary. By then StoneFly had taken in a total of $34 million in funding developing its IP SAN products and had sold around 175 systems over a 13-month period.

That year, 2006, SAN interconnect hardware supplier QLogic became an OEM for Stonefly, as did Permabit. StoneFly integrated Permabit’s Albireo deduplication technology into the StoneFusion Network Storage Platform software, and Permabit was bought by Red Hat in 2017. QLogic was bought by Cavium in 2016, and Cavium was bought by Marvell in 2018.

DNF was founded by President and CEO Mo (Mohammed) Tahmasebi and CFO Macy Tafreshian in 1989. It started as a US subsidiary of Japanese conglomerate CSK Electronics, and focussed on storage software and hardware from 1998 onwards. DNF was spun off into a privately held entity in 1990, with Tahmasebi and Tafreshian self-funding it.

DNF has thousands of customers and major partners include Microsoft, Intel, Western Digital, Seagate, and Red Hat. The customer list includes include UC Berkeley, MIT, John Hopkins, the Department of Defense, the Federal Aviation Administration, Lockheed Martin, Bank of America, Citibank, Wells Fargo, Fujitsu, Nordstrom’s, Toshiba, PG&E, Safeway Corporation, Looksmart, CNET, and LSI.

Prior to starting DNF, Tahmasebi:

- Worked at Sun Microsystems as an EnterpriseEngineering manager from 1982 to 1990;

- Co-founded Pars which ran from 1990-1998 before being acquired;

- Started up Tzone Corp & Research in 1997 and it was acquired in 2000;

- Founded Computer Training Academy in 1997 which was acquired in 2000;

- Set up Salesforce1 in 1997 – it was acquired in 2014;

- Founded Trundl in 2014 for it to be acquired in 2019.

StoneFly CFO Macy Tafreshian worked with Tahmasebi as a VP at Pars, and was a co-founder at Salesforce1.com and DNF.