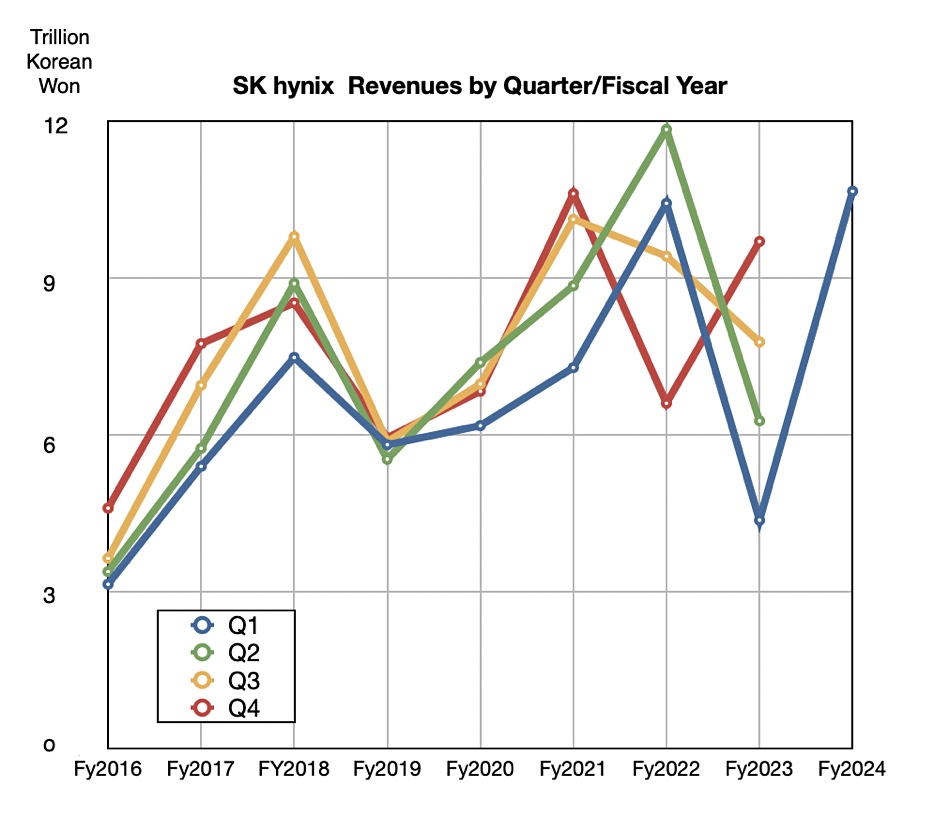

SK hynix saw first 2024 quarter revenues soar 144 percent as demand for high-bandwidth memory (HBM) chips rocketed.

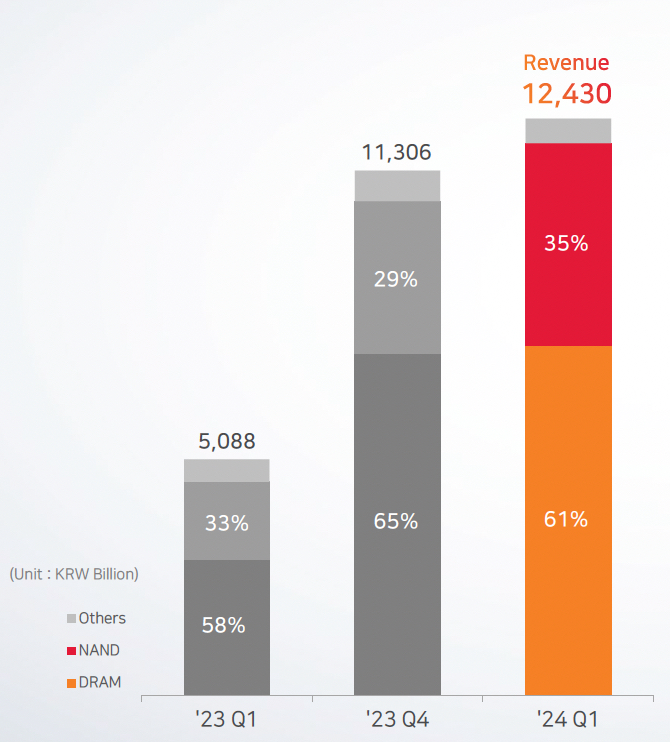

The DRAM and NAND manufacturer reported ₩12.43 trillion ($9.03 billion) in revenues with a ₩1.92 trillion ($1.4 billion) profit compared to last year’s ₩2.6 trillion ($1.9 billion) loss. This was a record first quarter revenue amount. DRAM accounted for 61 percent of its revenue and NAND 35 percent, with the remainder coming from other activities.

CFO Kim Woohyun said: “With the industry’s best technology in the AI memory space led by HBM, we have entered a clear recovery phase.”

It attributed the rise to demand for its HBM in GPU-powered AI servers, with the GPUs needing HBM rather than x86 server-style socket-attached DRAM.

In order to keep the GPUs busy, more memory bandwidth and capacity is needed than can be supported by the socket-attach method, which connects planar (single layer) DRAM to CPUs. HBM is built up from multiple layers – 4, 8, or 12-high – with a more direct connection to GPUs providing the needed capacity and bandwidth.

According to Reuters, HBM chips now account for 15 percent of the general memory market, compared to 8 percent last year. SK hynix has the largest market share in the HBM market, where demand has skyrocketed due to the generative AI boom fueling demand for Nvidia GPUs. It is the sole supplier of HBM3 memory to Nvidia, which has 80 percent of the AI GPU market, and started mass-producing the latest generation HBM3E generation in March.

Competing suppliers such as Micron and Samsung are developing their own HBM products to stop SK hynix dominating the market.

For example, Micron said in February that it would build 24 GB HBM3E, with 8 x 3 GB stacked DRAM dies, for use by Nvidia in its H200 Tensor Core GPUs shipping this quarter. It also started sampling a 36 GB 12-high HBM3E product in March. Samsung announced its own 12-high, 36 GB HBM3E device earlier this year.

Looking ahead, Micron is developing an HBM4 product, with 12 or 16 decks, meaning 36 GB or 48 GB capacity, and a >1.5 TBps data rate. HBM3E data rates are in the 1.2 TBps area. SK hynix has signed an MOU with TSMC for HBM4 development and its next-generation packaging technology.

It predicts that the general memory market will follow a steady growth path in the coming months as HBM demand continues to rise and the conventional DRAM market begins to recover in the second half of the year. New technology DRAM will be introduced, specifically 32 GB DDR5 chips built with the 1bnm process

SK hynix said that its premium or eSSD sales also rose. This, along with price rises, sent SSD revenues up as well. The company said it will “aggressively increase” its own 16-channel and Solidigm business unit’s QLC-based eSSD sales. SK hynix will also launch a new generation of capacity SSDs for the AI market.

It sees DRAM and NAND demand rises in its three main market areas: PCs, mobile phones, and servers. PC market recovery is expected in the second half, driven by enterprise demand due to the ending of Windows 10 support and AI PCs prompting an installed base replacement. The smartphone market should also see more memory shipments in the second half as phones get AI apps.

In the server area, demand is divided between AI (GPU) servers and ordinary (x86) servers. AI server demand is high due to GenAI and general or datacenter server replacement coming as servers from 2017/2018 reach end of life. Both AI servers and x86 servers will need SSDs to store data for GenAI training and inferencing needs. It plans to launch PCIe gen 5 SSDs later this year for use in AI PCs.

SK hynix is investing in new chip building capacity both in Korea and the US. The new M15X foundry in Korea should be ready by November 2025 and will focus on HBM production. It’s also building an advanced packaging plant in Indiana, with production scheduled to start in 2028. Having gained an HBM market advantage, SK hynix will be reluctant to give it up.