A Forrester Data Resiliency Wave study shows that Commvault is rated ahead of Cohesity and Rubrik, and the three lead all other suppliers. It also gives a measure of the included suppliers’ revenues streams from those products, which most take care not to reveal.

This “Forrester Wave: Data Resilience Solution Suites, Q4 2022” report looks at just nine suppliers, not representing the entire market. It defines data resilience as the capability to back up and secure data in hybrid on-premises/public cloud environments supporting SaaS and container environments. Products or services should secure the backup infrastructure from cyberthreats, recover from failure, navigate shared-responsibility models for hosted services, and address data privacy and sovereignty concerns.

Commvault’s Ranga Rajagopalan, SVP for Products, said in a statement: “We believe our position as a Leader in the Forrester Wave for Data Resilience Solutions Suite validates the completeness of our current offerings and our vision in future-proofing the data protection strategy for our customers.”

The highlighted comments about suppliers include:

- Commvault leads with breadth of backup support and attention to enterprise needs.

- Rubrik encapsulates a well-featured backup system with a security focus.

- Cohesity bridges the divide between backup and data management.

- Druva simplifies backup operations but mainly focuses on modern workloads.

- Veeam Software is powerful and flexible, but software-only delivery is double-edged.

- Dell Technologies’ customer relationships bolster its position in the market.

- Veritas has strong backup capability, but its market growth has been tepid.

- Zerto is known for supporting aggressive RPOs but has limited backup functionality.

- IBM’s Spectrum Protect suite provides core functionality with piecemeal integration.

Here’s the data resiliency suppliers’ Wave diagram:

This 4-box variation diagram positions suppliers in a square space defined by a vertical weaker-to-stronger current offering axis and a weaker-strategy-to-stronger-strategy horizontal axis. There are three concentric quarter circles – waves – for Contenders, Strong Performers and Leaders with the remaining space for Challengers.

Each vendor’s position on the vertical axis of the Forrester Wave graphic indicates what it sees as the strength of its current product set. Placement on the horizontal axis indicates the strength of the vendors’ strategies. Market presence is represented by the size of the markers on the graphic.

Vendors were selected on the basis of having generally available comprehensive backup-and-restore functionality for both legacy and modern workloads, ransomware recovery capabilities, comprehensive reporting resilience and consolidated management interface, significant product revenue (at least $100 million in last fiscal year), and Forrester client interest.

The product revenue barrier obviously limits the supplier choices for the Forrester analysts. It also tells us that Druva had revenues of at least $100 million in its latest financial year, as did HPE’s acquired Zerto business.

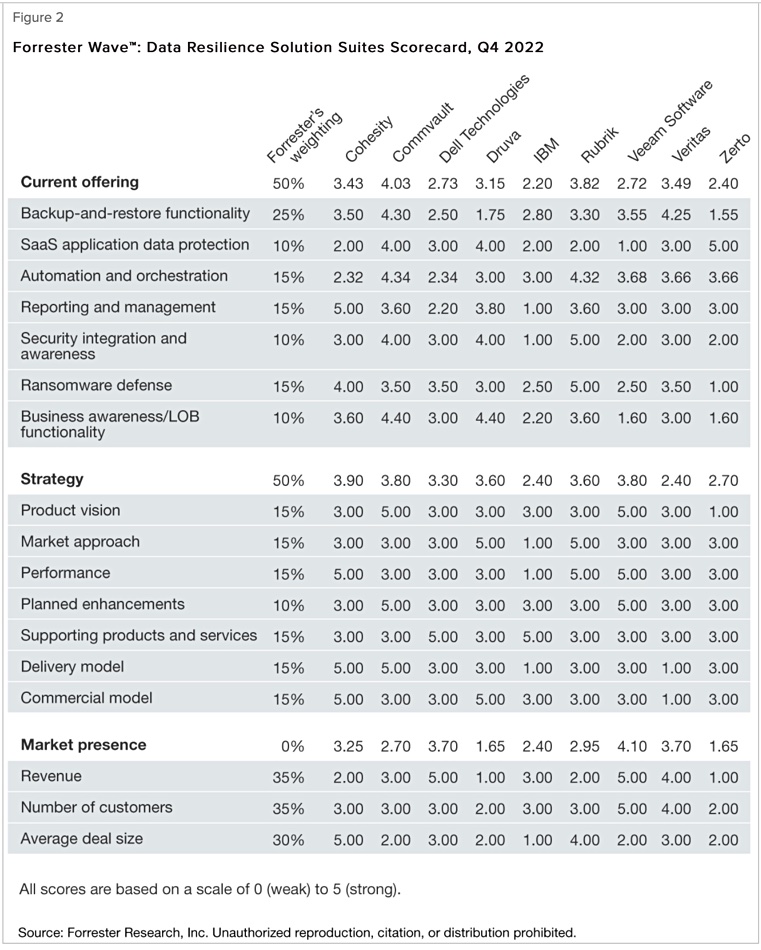

The basis for the Wave rankings is an evaluation table of the suppliers’ offerings:

Forrester’s analysts rate suppliers’ offerings in 17 categories grouped into three sets – current offering, strategy and market presence – with averages per supplier for each group. The scores are also given weightings and then overall rank scores calculated, but not published in the report.

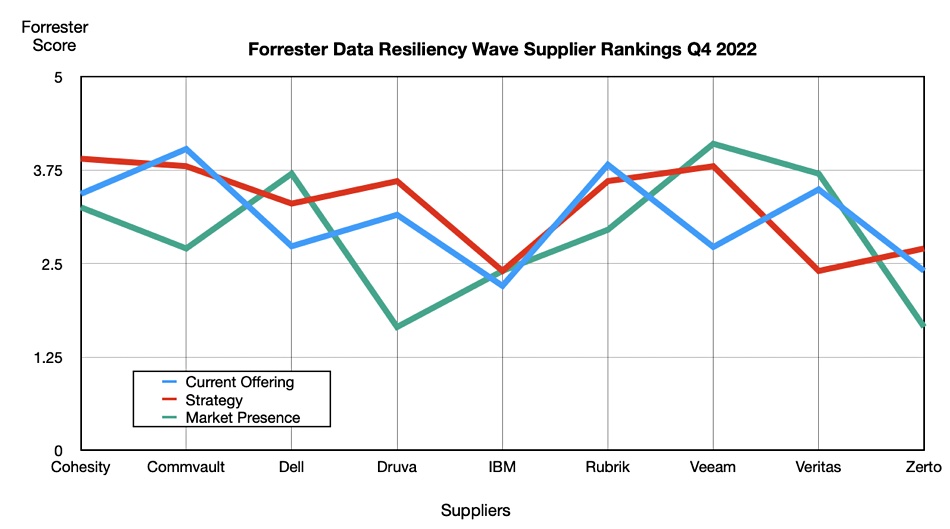

If we chart the three set averages per supplier we get a quick and dirty look at their rankings:

It’s immediately obvious that Veeam scores high on market presence but the Forrester weighting algorithm downplays this strength and so relegates Veeam from a Leader to Strong Performer. Druva. also scores low on the market presence factor, almost as low as Zerto.

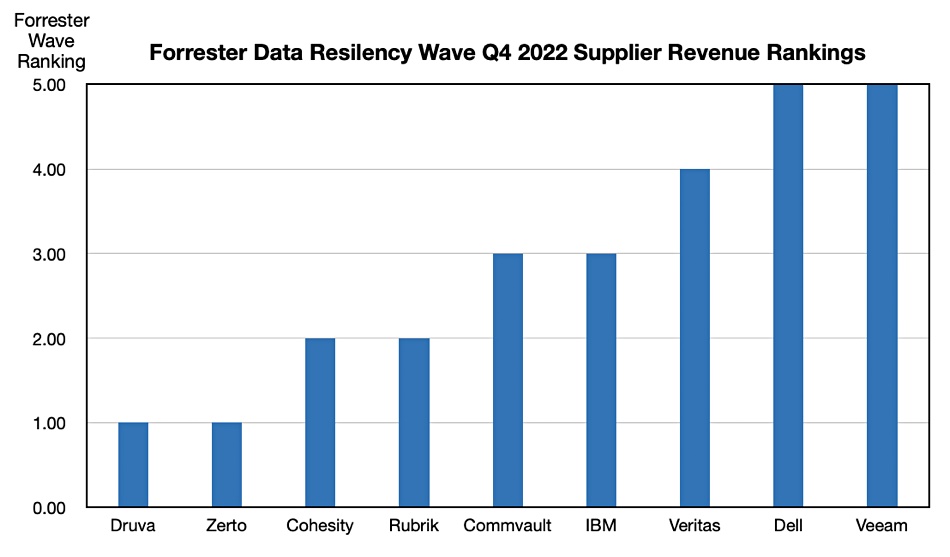

The market presence is formed from three components: revenue, number of customers and average deal size. Each of these are rated from 0 to 5. A minimum revenue requirement for being in this Wave report is $100 million revenues in the latest financial year. In that case what do the 0, 1, 2, 3, 4 and 5 ratings represent for the revenue number? Presumably a rating of 0 is the minimum amount, $100 million, and 1 is a higher amount, 2 a higher amount still, and so on.

Dell and Veeam received 5s on this revenue rating. IDC said Veeam’s first half 2021 revenues were $647.17 million, giving it a $1.29 billion annual run rate. CTO Danny Allen told us in July this year that Veeam revenues were growing 20 percent year-on-year. That gives us a $1.55 billion run rate for Veeam’s fiscal 2022 and could mean a Forrester Wave 5 ranking on revenue means numbers in that arena.

We don’t know if the revenue rating scale is linear from the starting $100 million point, i.e., adding $200 million per step, but we can now chart the supplier’s revenue rankings, knowing roughly what the high end point value is:

This is comparative data we simply have not seen before, and indicates that Cohesity and Rubrik revenues in their latest fiscal year could be above $100 million but less than Commvault’s $769.6 million in its fiscal 2022. The Forrester “3” revenue rating has Commvault and IBM at the same level, indicating IBM pulled in around $750 milion for its Spectrum Protect revenues in its last fiscal year. As IBM no longer releases storage software revenues in its financial reports, this is informative.

Similarly private equity-owned Veritas doesn’t release its financial numbers but we now know its revenues were greater than Commvault’s $769.6 million in its latest fiscal year but less than Veeam’s and revenues, also Dell’s PowerProtect-based revenues.

You can download a copy of the Forrester Wave report courtesy of Cohesity here.