GigaOm has has added separate SMB and Enterprise hybrid cloud data protection supplier evaluation docs in its Radar series as the fast-developing market splits into two groups of products.

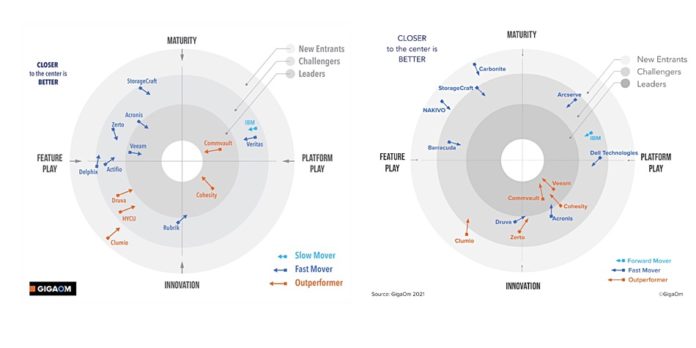

This separation follows on from the February 2020 unified hybrid cloud data protection Radar document, which evaluated 14 vendors: Actifio, Acronis, Clumio, Cohesity, Commvault, Delphix, Druva, HYCU, IBM, Rubrik, StorageCraft, Veeam, Veritas, and Zerto.

The GigaOM analysts have split the original document in two because the two markets have different characteristics. The enterprise market “is trending toward additional services built on top of data protection, and these services are becoming instrumental in collecting and consolidating data across the entire organisation.”

The SMB (Small and Medium Business) market, on the other hand, “is trending toward solutions with a broad feature set that can address the data protection requirements of hybrid and cloud workloads as well as SaaS applications.”

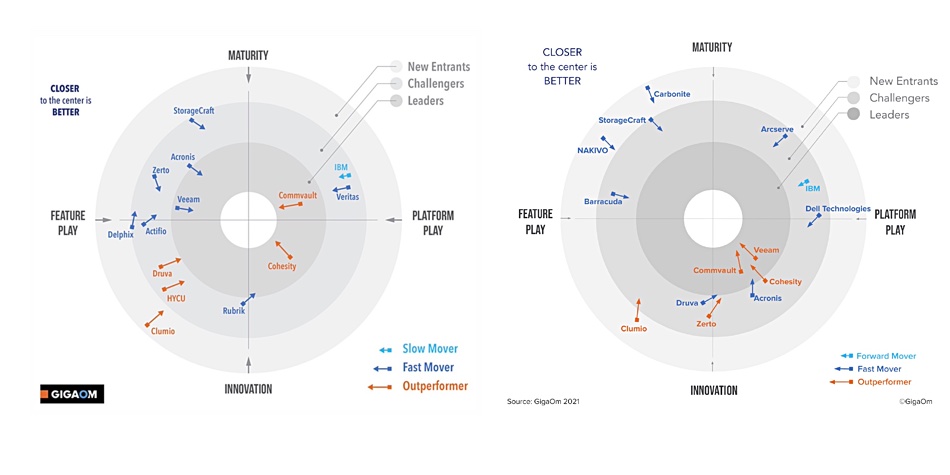

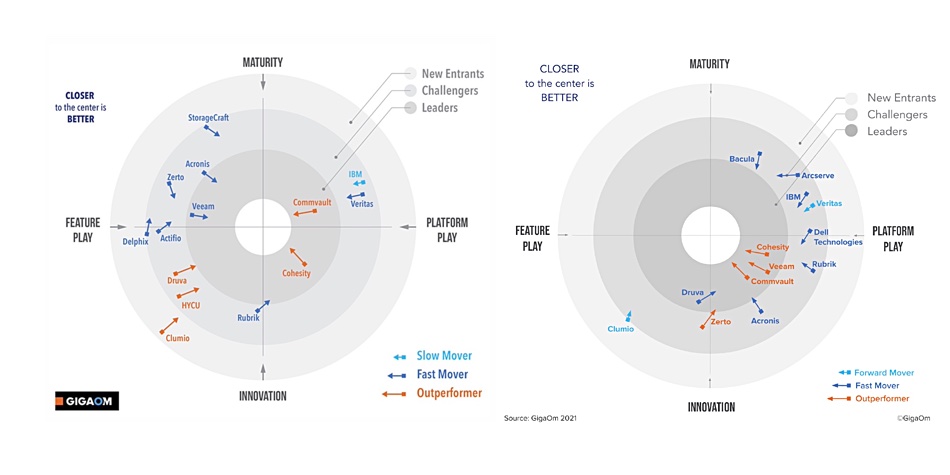

These Radar documents evaluate suppliers on a range of characteristics and then diagrammatically position them on a quasi-radar screen with two axes: feature vs platform play, and maturity vs innovation. The screen is separated into three concentric circles around a bullseye. These circles, from the outside in, represent positions for new entrants, challengers and then leaders.

Vendors are located with square dots and an arrow showing their direction and speed of progress. The nearer they are to the middle of the diagram the better as far as the analysts are concerned.

SMB Radar

Here is the 2020 unified radar diagram and, for comparison, the updated 2021 SMB diagram;

There are 14 vendors in the 2021 SMB radar: Acronis, Arcserve, Barracuda, Carbonite, Clumio, Cohesity, Commvault, Dell, Druva, IBM, NAKIVO, StorageCraft, Veeam and Zerto. It’s the same number as before but Actifio, Delphix, HYCU, Rubrik and Veritas are no longer included while Arcserve, Barracuda, Carbonite, Dell, and NAKIVO have been added. The included vendors are quite spread around the rings with just Veeam and Commvault identified as leaders. Cohesity was a leader but is now a challenger and moving into the inner leaders’ ring.

Carbonite, Clumio and StorageCraft are classed as new entrants. The remaining companies are all challengers, with Acronis set to enter the leaders’ ring.

The market is said to be in active development with all suppliers “looking at ways to disrupt traditional backup models and differentiate, while ensuring they can cover most data protection use cases.”

Enterprise

In the 2021 enterprise radar diagram we see a reduced list of 13 vendors: Acronis, Arcserve, Bacula, Clumio, Cohesity, Commvault, Dell, Druva, IBM, Rubrik, Veeam, Veritas and Zerto. Vendors that have been withdrawn from the original list are Actifio, Delphix, HYCU and StorageCraft. Arcserve, Bacula and Dell have been added.

There is a noticeable concentration of vendors on the right-hand side of the diagram, favouring platform plays rather than features. There are three outside this semi-circle: Clumio, Druva and Zerto — with Druva and Zerto set to move across into the platform play section, leaving Clumio as the sole feature player.

The four fastest-moving suppliers; Cohesity, Commvault, Veeam and Zerto, are all in the innovation semi-circle.

The analysts summarise the enterprise market as being active “with both startups and incumbents looking at ways to disrupt traditional backup models, as well as increase the value of the protected data by adding data management and data reuse capabilities to their solutions.”

Overall, the enterprise market suppliers tend to be classed more as innovative platform players while the SMB suppliers are more spread between feature and platform plays on the one hand, and mature and innovative vendors on the other. All the fastest-moving SMB-focussed vendors are innovative though.

GigaOM subscribers can read a separate “Key Criteria for Evaluating Hybrid Cloud Data Protection v 2.0” document to gain more insight into the analysts’ thinking.