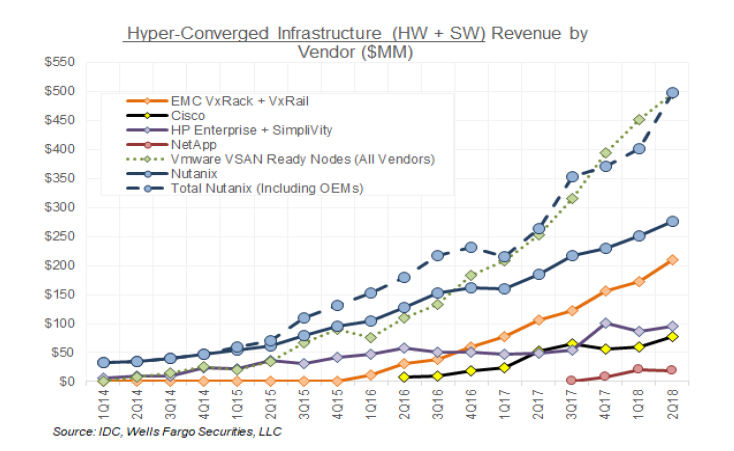

Dell Technologies and Nutanix, the leaders of the hyperconverged infrastructure (HCI) appliance market, are increasing their dominance, while their competitors in the following pack look to be fighting for market scraps.

A chart of quarterly suppler revenues since 2014’s first quarter by Wells Fargo senior analyst Aaron Rakers shows the bifurcation in the market between the leaders and the followers;

The top two curves are all VSAN Ready Nodes and all Nutanix sales (including its OEMs.) Next is Nutanix itself followed by Dell EMC’s VxRack and VxRail.

Then we have, in declining order, HPE SimpliVity, Cisco and late-entrant NetApp.

Rakers has also charted HCI software-only revenues by vendor which makes the VMware/Nutanix dominance clearer;

VMware with VSAN is the clear leader, followed by Nutanix. Then we have Cisco, HPE and Dell-EMC in a tight grouping a long way behind. Cisco’s revenue trend is positive while HPE has had two quarters of declining growth as has Dell EMC.

HPE/SimpliVity has also had six quarters of revenues lower than its highpoint in the fourth 2016 quarter and has now been overtaken by Cisco. SimpliVity was bought by HPE in January 2017 and sales have trended downwards since then. Can it recover, or will it suffer the indignity of being overtaken by NetApp as well?

Dell EMC’s trailing position in this SW-only chart doesn’t matter as owner Dell Technologies owns most of VMware whose VSAN SW powers Dell EMC’s VxRail kit.

There are a group go smaller players than the ones in these two charts; DataCore, Datrium, Huawei, Pivot3 and Scale Computing, not to mention Axellio. There’s still scope for HCI HW development with Optane persistent memory, NVMe SSDs and NVMe-oF storage access yet to appear in most products.

In another year we might find Raker’s charts look rather different, although it would be surprising if VMware and Nutanix relinquished their dominance. Those two horses are so far in front they are out of sight. B&F