Tech analysis house Omdia sees the datacenter external storage market growing again after a 2023 dip with Dell, Huawei, NetApp, and Lenovo the top named vendors.

The Cloud Storage and Data Intelligence Service report reviewed storage system supplier revenues for external storage in datacenters in 2023 for both arrays and server expansion. Full year revenues of $53 billion were down 16 percent from 2022. In particular, “original design manufacturers (ODMs) revenue decreased by over 30 percent in 2023, as DC equipment spending temporarily shifted away from storage.” Original equipment manufacturer (OEM) vendors overall had a single digit percentage decline.

Omdia found that “cloud storage shipments faced constraints as cloud service providers allocated significant portions of their budgets to the purchase of costly GPUs.”

That spending slowdown is set to reverse, the analyst forecasts, driven by digital transformation projects within enterprises, data volume growth, AI advances pulling storage in their wake, and a general need for storage modernization. Omdia says: “These factors will collectively revitalize the storage market, ensuring a return to a growth trajectory.”

It believes “storage and data management are strategic components of modern digital enterprises, which will ensure continued long-term investments in storage.”

The Omdia chart shows that it expects growth to be the strongest in low-end hybrid arrays, followed by server expansion and NVMe SSD arrays.

Dennis Hahn, Omdia Principal Analyst for Data Storage, stated: “Storage vendors have been adjusting their acquisition models to be more cloud-like adopting a pay-per-use approach and focusing on overall data needs rather than just storage. Ransomware protection and AI-driven data set creation are becoming essential features in storage solutions.”

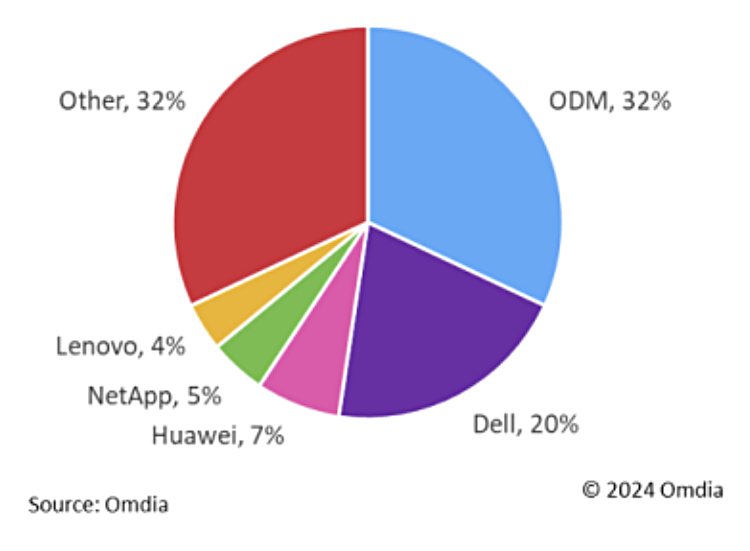

ODMs had a 32 percent revenue share of the 2023 datacenter external storage market, with Dell having the largest vendor-specific share at 20 percent. Huawei was in second place with a 7 percent share, followed by NetApp (5 percent), and Lenovo (4 percent). The remaining 32 percent is attributed by Omdia to “Other” suppliers. That means HPE, IBM, Pure Storage, VAST Data etc.

We asked Omdia: “Since Lenovo largely OEMs NetApp storage, wouldn’t that make NetApp’s total share equal 9 percent and thus place it third behind Dell and ahead of Huawei?”

Hahn replied: “The analysis treats the enterprise storage sold as Lenovo’s with their salespeople/brand/support/demand generation, etc. and with NetApp as the supplier. We don’t try to track suppliers’ inputs. Co-sold generated revenue is divided according to the JV agreement and reported to me quarterly.

“A very large portion of the Lenovo share is from their ODM+ biz model, not derived from NetApp gear, so you can’t add Lenovo and NetApp together like you suggest. As you might have noticed, Omdia includes ODM storage (storage-servers, JBOF, etc.) in the storage analysis.”