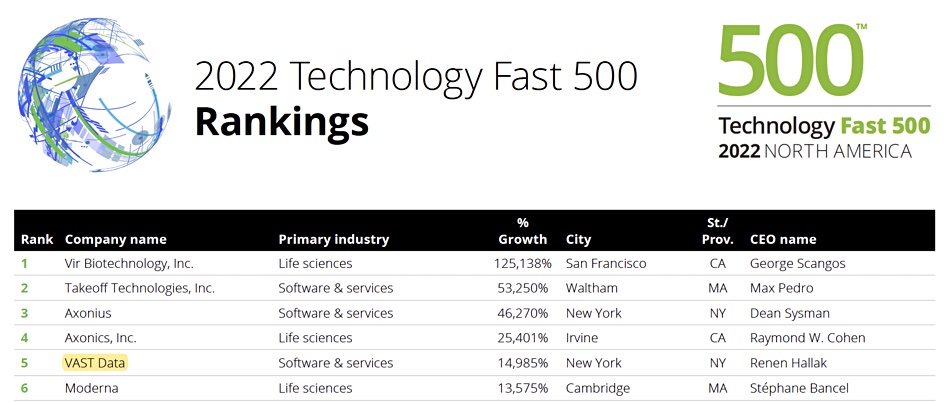

VAST Data has been named the fifth fastest growing US technology company in the 2022 Deloitte Technology Fast 500 listing.

This is based on revenue growth from 2018 to 2021 in which period VAST notched up 14,985 percent growth from its all-flash disaggregated and scale out Universal Storage filer product launched in 2019.

VAST founder and CEO Renen Hallak said: “VAST Data is the fastest selling enterprise infrastructure software company in history and this recognition by Deloitte further validates our unprecedented growth.”

The fastest growing company of all was Vir Biotechnology with 125,138 percent growth. Vir develops infectious disease treatments based on stimulating the body’s immunity processes. VAST came in above COVID vaccine developer Moderna, which was ranked number six with 13,575 percent growth.

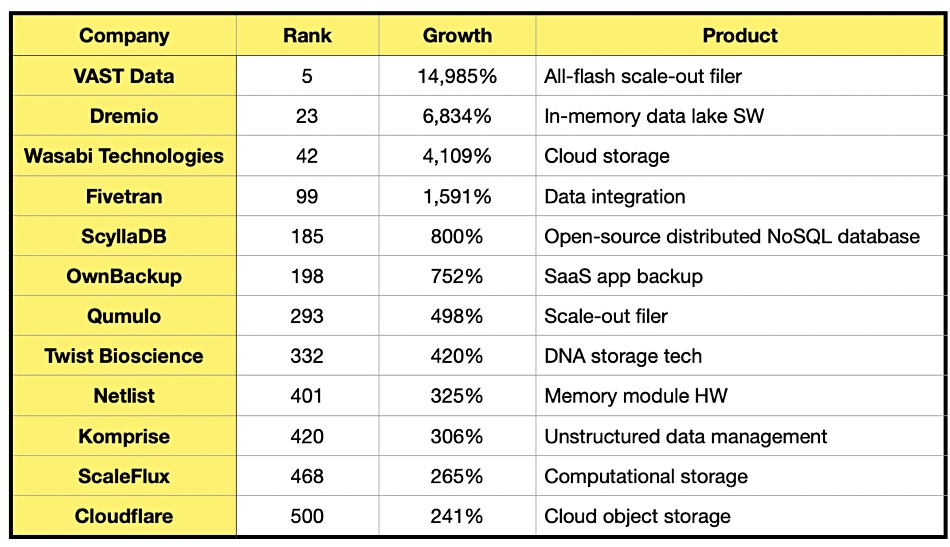

There were 12 storage companies in Deloitte’s list:

Their inclusion is both surprising and pleasing.

In August several storage companies were present in the Inc. 5000 list which ranked businesses by growth from 2018 to 2021:

- Backup services supplier OwnBackup was ranked number 839 with 752 percent growth.

- Cloud file sync-and-sharer Panzura at 1,343 with 485 percent ARR growth.

- Unstructured data manager Komprise came in at number 1,971 with 306 percent growth.

- Database supplier SingleStore achieved the 3,819 rank with 130 percent growth.

- Storage hardware supplier OpenDrives came in at number 4,652 with 92 percent growth.

The growth percentage numbers for OwnBackup and Komprise are identical on the two lists. This suggests that Panzura could have been in the Deloitte list, had it applied.

Technology companies apply for inclusion in Deloitte’s list and must satisfy certain criteria:

- Be in business for at least four years

- Be headquartered in North America

- Have fiscal year 2018 operating revenues of at least US$50,000

- Have fiscal year 2021 operating revenues of at least US$5 million

- Have a growth rate of at least 75 percent

- Own proprietary intellectual property or proprietary technology, which must be sold to customers in products or services that contribute to a majority of the company’s operating revenues.

Assuming VAST’s 2018 revenues were at least $50,000, and applying a 14,985 percent uplift, we get a minimum of $7,492,500 revenue in 2021. This is a long way short of Soothsawyer’s calculation of $84 million revenues for VAST in that year. If the 2018 revenue number were $500,000 then the 2021 result of a 14,985 percent increase would be $74.925 million which is in the Soothsawyer calculation area. This is no help in trying to work out VAST’s actual revenues for 2021. Only privately-owned VAST and the bean counters at Deloitte know that number.

Bootnote

Coldago analyst Philippe Nicolas wrote in his SC22 event summary that VAST confirmed it had “generated $1 billion in revenue in 4 years of sales.”