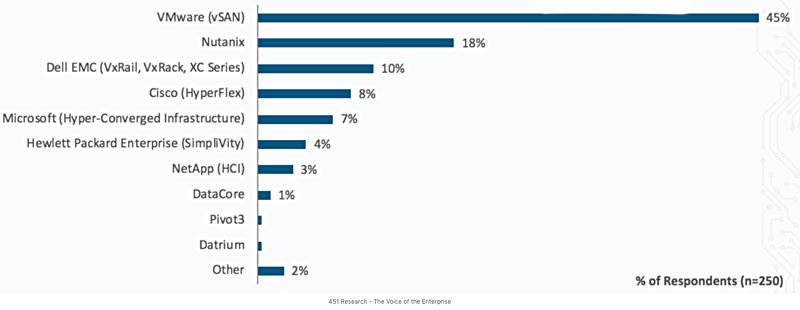

Our thanks to VMware VP Lee Caswell who has published some extracts of a recent 451 Research survey of hyperconverged system vendor installed system market share. Look at the chart below and you can see why.

The 451 researchers asked 256 enterprise and small/medium business respondents: “Which of the following vendors is your organization currently using for hyperconverged infrastructure?”

VMware is racing ahead of the pack and, together with hyperconverged arch-rival Nutanix, accounts for almost two-thirds of HCI installations. This confirms other surveys and market analysis from Gartner and IDC.

The second division comprises three big names: Dell EMC, Cisco and Microsoft. We are unable to assess how Microsoft is progressing as this is the first 451 HCI survey we have seen – and Microsoft does not appear in Gartner and IDC analyses.

Dell EMC’s hyperconverged business is growing and, after a slow start, Cisco is showing momentum. It recently joined the leaders in Gartner’s HCI Magic Quadrant.

The third division has just two names, but they are both biggies: HPE and NetApp.

Left at the starting gate?

451’s HCI chart seems to demonstrate the characteristics of a mature market. As you can see, there are few dominant suppliers followed by tail enders with small market shares.

For instance, DataCore, lauded in a recent What Matrix HCI report, is in eighth position with one per cent share.

Below DataCore is Pivot3 with a sub-1 per cent share and Datrium with a lower sub-1 per cent share. Maxta and Scale Computing are in the Other category.

Vendors with less than five per cent share – and this includes HPE and NetApp – may be right to be optimistic if the HCI market is in its early stages and has five years or more growth ahead. No-one knows what the future holds here. All the players are convinced that HCI is an immature growth – so they have a real chance of gaining market share from the dominant players at the top of the 451 chart.

But they will have to work hard and some might not make it even if they have great technology. Acquisition by a bigger vendor is, of course, a realistic option for many.