ExaGrid claims it is fielding “record bookings” and revenue – although as a privately held company it provides no comparative figures for this – for the final 2024 quarter, up 20 percent annually, and full year.

The company provides target backup appliances featuring a fast restore landing zone and deduplicated retention zone. This has a Retention Time-Lock that includes a non-network-facing tier (creating a tiered air gap), delayed deletes, and immutability for ransomware recovery. ExaGrid was founded in 2002 and last raised funds in 2011, with a $10.6 million round, taking the total raised to $107 million. It says it is debt-free.

President and CEO Bill Andrews stated:”ExaGrid is continuing to grow with healthy financials, as shown by the past 16 quarters that we have maintained positive P&L, EBITDA, and free cash flow. We have sales teams in over 30 countries worldwide, and customer installations in over 80 countries. We continue to invest in our channel partnerships and worked with more reseller partners in 2024 than ever before, and we plan to expand on our partner programs in 2025.”

He added: “As we constantly innovate our Tiered Backup Storage, we look forward to announcing new updates, integrations, and product announcements throughout 2025 and expect continued growth and success.”

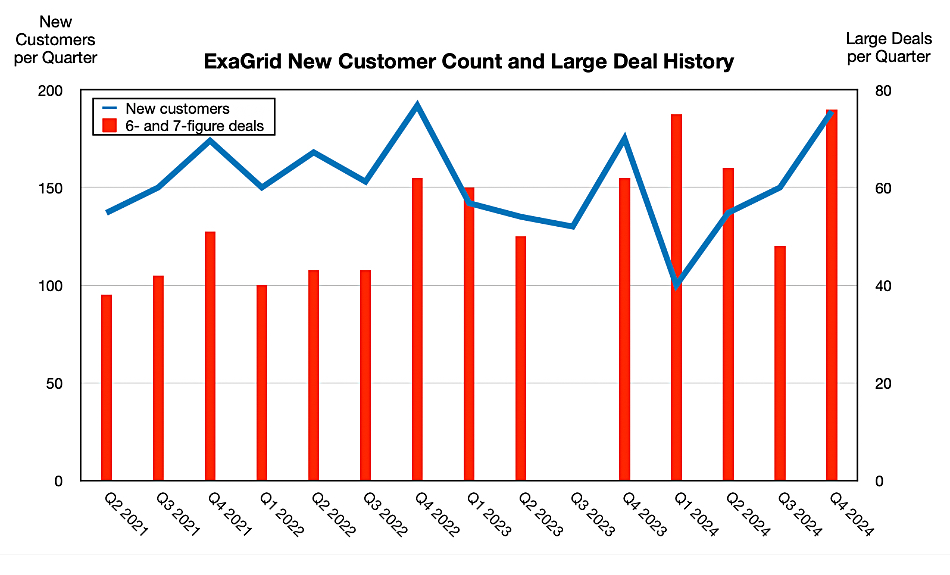

ExaGrid says it recruited 189 new customers in the quarter, of which 76 were six and seven-figure deals, taking the customer count to near 4,600. Its average customer count increase has been 150 over the past 16 quarters and its competitive win rate is 75.3 percent, it says.

Andrews claims: “There are only three solutions in the market: standard primary storage disk, which does not have dedicated features for backup and becomes expensive with retention; inline deduplication appliances … that are slow for backups and restores, use a scale-up architecture, and don’t have all the security required for today’s backup environments; and ExaGrid Tiered Backup storage, which offers many features for backup storage and many deep integrations with backup applications. When customers test ExaGrid side by side, they buy ExaGrid 83 percent of the time – the product speaks for itself.”

Andrews told B&F: “We continue to replace primary storage behind the backup application from Dell, HPE, NetApp, Hitachi, IBM, etc. We continue to replace Dell Data Domain and HPE StoreOnce inline/scale-up deduplication appliances. We continue to replace [Cohesity-Veritas] NetBackup FlexScale appliances.”

Geographically, there was “great participation from the US, Canada, Latin America, Europe, the Middle East, and Africa. We have hired ten sales teams in Asia Pacific and expect the investment to start kicking in this quarter. We continue to maintain a 95 percent customer retention rating, 99 percent of customers on maintenance, and support and an NPS score of +81.”

The company will be “adding many service provider features for the large Backup as a Service MSPs” in 2025.

Last October we learned that ExaGrid reckoned it had 3 percent of the $6 billion backup storage market, implying $180 million in annual revenues. While its Q4 2024 revenues increased 20 percent annually, we don’t know the quarter-on-quarter increase. Andrews claimed in October last year that the company was making solid progress toward achieving $1 billion in annual sales.

Andrews said at the time: “Our product roadmap throughout 2025 will be the most exciting we have ever had, especially in what we will announce and ship in the summer of 2025. We don’t see the competitors developing for backup storage. Our top competitors in order are Dell, HPE, NetApp, Veritas Flexscale Appliances, Pure, Hitachi, IBM, Huawei. Everyone else is a one-off sighting here and there.”

NetApp does not provide a deduping target backup appliance equivalent to Dell’s PowerProtect, HPE’s StoreOnce or Quantum’s DXi products. But NetApp BlueXP provides a backup and recovery control plane with the ability to back up NetApp ONTAP systems to NetApp StorageGRID object storage or AWS, Azure, and Google cloud object stores.

The big change in the target backup appliance and storage market in the last couple of years has been the emergence of object storage targets for backup software, such as Cloudian and startup Object First. ExaGrid supports the Amazon S3 object protocol.