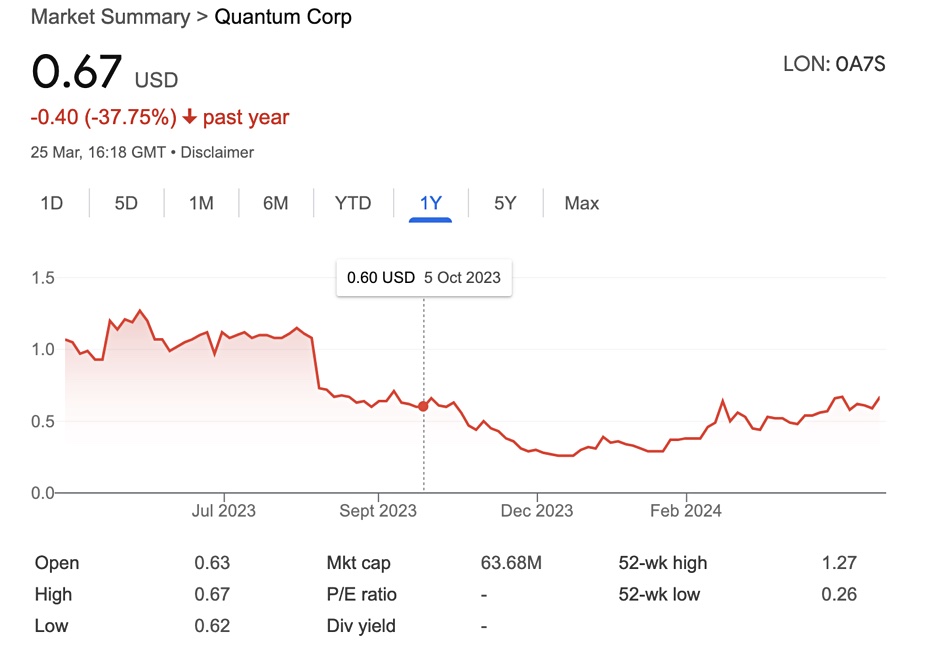

Quantum stock price has been below the $1 mark on Nasdaq for more than 30 days and, as such, it was sent a letter by Nasdaq requesting it regain compliance.

The data manager has been dealing with an accounting issue regarding component pricing in product bundles that has affected its ability to file SEC reports for its second and third quarters of fiscal 2024. This issue has caused it to request a reporting date extension from Nasdaq to avoid delisting for not issuing financial reports. Now it has fallen foul of a second Nasdaq rule that threatens its listing status as well.

The $1 stock price non-compliance letter arrived on March 19 and Quantum has asked for a hearing to present its plans to regain compliance plus a 180-day extension in which to do so.

CEO Jamie Lerner was appointed by Quantum in June 2018 following an October 2016 NYSE delisting threat for its stock price dipping below the $1 mark for 30 days. That delisting was avoided in April 2017 by a reverse stock split. Seven and a half years later, and following a June 2020 move to the Nasdaq stock market, it now faces a second delisting threat.

We may see a second reverse stock split to drive up the share price and regain Nasdaq listing compliance.

Separately, Quantum filed an SEC 8-K report detailing changes to its term loan credit and security agreement. This states that any financial proceeds from asset sales, aka “disposition of assets,” be prioritized to pay down existing debt. Quantum says this is consistent with its “broader efforts to prioritize certain financial and business projects targeting improvements to working capital, acceleration of new products and a more focused business.”

The recent i7 Raptor tape library product plan announcement is part of the “new products” aspect of this.