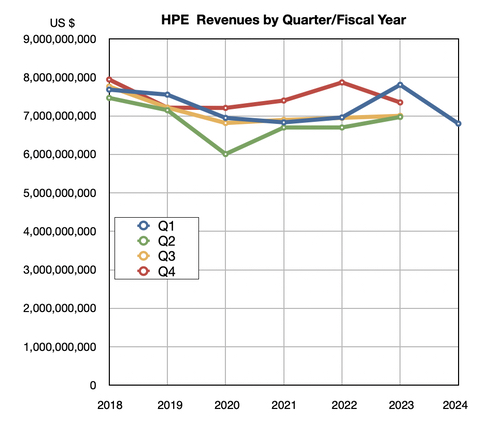

HPE has changed its quarterly financial reporting structure with storage results disappearing into a hybrid cloud category.

Revenues in its first fiscal 2024 quarter ended January 31 were $6.8 billion, 14 percent lower than the year-ago quarter and also below its guided estimate for $6.9 billion to $7.3 billion. There was a $387 million profit, 23 percent less than last year. The move to GreenLake is causing overall revenue declines as subscription revenue is recognized over time whereas straightforward product sales are recognized when the product ships.

Antonio Neri, HPE president and CEO, said in prepared remarks: “HPE exceeded our profitability expectations and drove near-record year-over-year growth in our recurring revenue in the face of market headwinds, demonstrating the relevance of our strategy.” HPE did not exceed its revenue expectations, however. The annual revenue run rate was $1.4 billion, 42 percent more than a year ago, and primarily due to the GreenLake portfolio of services.

HPE’s new organizational structure consists of the following segments: Server; Hybrid Cloud; Intelligent Edge; Financial Services; and Corporate Investments and Other. It has amalgamated previously separate Compute and HPC & AI reporting lines into a single Server category. The new Hybrid Cloud reporting line includes three elements:

- The historical Storage segment

- HPE GreenLake Flex Solutions (which provides flexible as-a-service IT infrastructure through the HPE GreenLake edge-to-cloud platform and was previously reported under the Compute and the High Performance Computing & Artificial Intelligence (“HPC & AI”) segments)

- Private Cloud, and Software (previously reported under the Corporate Investments and Other segment)

This means we no longer have a direct insight into the business health of its storage portfolio. HPE says it’s doing this to better reflect the way it operates and measures its business units’ performance. This new hybrid cloud segment is meant to accelerate customer adoption of HPE’s GreenLake hybrid cloud platform.

Financial summary

- Gross margin: 36.4 percent, up 2.4 percent year-over-year

- Operating cash flow: $64 million

- Free cash flow: -$482 million

- Cash, cash equivalents, and restricted cash: $3.9 billion vs $2.8 billion last year

- Diluted earnings per share: $0.29, 24 percent lower than last year

- Capital returns to shareholders: $172 million in dividends and share buybacks

Server segment revenues were $3.4 billion, down 23 percent year-over-year. Hybrid Cloud pulled in $1.3 billion, down 10 percent, with Intelligent Edge reporting $1.2 billion, up 2 percent. Financial services did $873 million, down 2 percent, while Corporate Investments and Other was responsible for $238 million, up just 1 percent.

CFO Marie Myers said on the earnings call: “Demand in Intelligent Edge did soften due to customer digestion of strong product shipments in fiscal year ’23, which is lasting longer than we initially anticipated and is the primary reason Q1 revenue came in below our expectations.” Specifically, “campus switching and Wi-Fi products eased materially, particularly in Europe and Asia.”

Neri’s top-down view was that “overall, Q1 revenue performance did not meet our expectations.” It was “lower than expected in large part because networking demand softened industry-wide and because the timing of several large GPU acceptances shifted. Additionally, we did not have the GPU supply we wanted, curtailing our revenue upside.”

”This quarter is a moment in time and does not at all dampen our confidence in the future ahead of us.”

Myers commented: ”Demand for our traditional server and storage products has stabilized,” although “our traditional storage business was down year-over-year on difficult compares, given backlog consumption in Q1 ’23. Total Alletra subscription revenue grew over 100 percent year-over-year and is an illustration of our long-term transition to an as-a-service model across our businesses. We are starting to see AI server demand pull through interest in our file storage portfolio. We are also already seeing some cross-selling benefits of integrating the majority of our HPE GreenLake offering into a single business unit.”

Neri said HPE was “capturing the explosion in demand for AI systems” with GPU-enhanced servers, called Accelerator Processing (AP) units, orders rising. AP orders now represent nearly a quarter of HPE’s entire server orders since fiscal 2023’s Q1. Neri said: ”Our pipeline is large and growing across the entire AI life cycle from training to tuning to inferencing.”

Server revenues should grow due to AI demand and better GPU availability, and “hybrid cloud will benefit from continued HPE GreenLake storage demand and the rising productivity of our specialized sales force.”

HPE’s next quarter outlook is $6.8 billion in revenues up or down $0.2 billion, a 2.5 percent annual decrease at the midpoint. Myers said: ”For hybrid cloud, we expect sequential increases through the year as our traditional storage business improves and HPE GreenLake momentum continues. We expect meaningful progress through the year.”