After reporting growth in both annual revenues and losses in its latest results, Snowflake chairman Frank Slootman decided to replace Snowflake CEO Frank Slootman, and appointed SVP Sridhar Ramaswamy in his place.

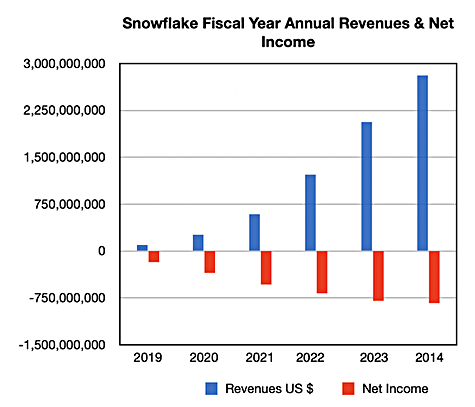

Revenues in cloud data warehouser Snowflake’s final fy2024 quarter, ended Jan 31, were $774.7 million, 31.5 percent more than a year ago, with a $170 million loss, better than the year-ago’s $207.5 million of red ink. The full year revenue number was $2.8 billion, 35.9 percent more than last year. There was a full year loss of $836.1 million, yes, $0.84 billion, contrasting with fy23’s loss of $797 billion.

Chairman Frank Slootman’s prepared statement said: “We are successfully campaigning the largest enterprises globally, as more companies and institutions make Snowflake’s Data Cloud the platform of their AI and data strategy.”

About the resignation of himself as CEO he said: “As the leading cloud data platform, Snowflake is at the epicenter of the AI revolution. There is no better person than Sridhar to lead Snowflake into this next phase of growth and deliver on the opportunity ahead in AI and machine learning. He is a visionary technologist with a proven track record of running and scaling successful businesses. I have the utmost confidence in Sridhar and look forward to working with him as he assumes this new role.”

Presumably Slootman wants Ramaswamy to “Amp it up,” that being the title of Slootman’s recent book about being a CEO and leader. In that book he writes this about a board removing a CEO: “It will treat removing the CEO as a gut-wrenching, high-risk, last-resort move, never to be done casually or for frivolous reasons.” In his view “hiring a new one is a lengthy process.”

Ramaswamy joined Snowflake in May 2023 when it acquired Neeva, the world’s first private AI powered search engine. He was a Neeva co-founder and a Google SVP before that, and led the launch of Snowflake’s Cortex. This is a fully managed service that offers access to AI models, LLMs, and vector search functionality to enable organizations to analyze data and build AI applications.

We note that Ramaswamy’s LinkedIn profile says of his first 8 months at Snowflake: “Learning Snowflake.” Our bet is that he was a CEO-elect from the start.

What Slootman said in the earnings call bears that out: “I was brought to Snowflake five years ago to help the company break out and scale. I wanted to grow the business fast, but not at all costs. It had to be efficient and establish a foundation for long-term growth.”

“I believe the company succeeded in that mission. The board has run a succession process that wasn’t based on arbitrary timeline, but instead, looked for an opportunity to advance the company’s mission, well into the future. The arrival of Sridhar Ramaswamy through the acquisition of Neeva last year represented that opportunity. Since joining us, Sridhar has been leading Snowflake’s AI strategies, bringing new products and features to market at an incredible pace.”

Snowflake hasn’t made a profit since going public, being run for growth. The company now has 9,437 customers, with 461 having trailing 12-month product revenue greater than $1 million, 39 percent more than a year ago, and 691 Forbes Global 2000 customers, representing 39% and 8% year-over-year growth, respectively. It obviously isn’t making a profit from them.

If 9,437 customers brought in an average of $82,092 each this quarter and Snowflake made a $170 million loss, then it would have needed 2,071 more customers just to break even. Put another way; on these numbers Snowflake needs a 22 percent customer count increase to start making a profit.

Quarterly financial summary

- Free cash flow: $324.5 million vs $205 million a year ago

- Cash, cash equivalents and restricted cash: $1.78 billion

- Gross product margin: 74 percent

AI is the key market driver, with Ramaswamy saying: “You heard the team say many times, “There’s no AI strategy without a data strategy.” And this has opened a massive opportunity for Snowflake to address. To deliver on the opportunity ahead, we must have clear focus and move even faster to bring innovation on the Snowflake platform to our customers and partners. This will be my focus.”

Apart from AI in the USA, Snowflake has a large revenue opportunity outside the USA, where 80 percent of its revenues are based. The EMEA region accounts for 15 percent of them and Asia Pacific a trivial 5 percent.

Snowflake is guiding next quarter’s product revenue to be $747.5 million +/- $2.5 million; a 26.5 percent increase at the midpoint year on year. Full fy2025 revenue guidance is $3.25 billion, with a lower 22 percent Y/Y growth rate. That’s slower growth than Snowflake has been used to enjoying. Perhaps competitors suchas Databricks and Dremio are finally having an impact on its growth.