Pure Storage has ended its fiscal year as it started – with a drop in revenues. This time it’s due to subscriptions becoming more popular than anticipated, but the company says it expects to resume double-digit growth from the next financial quarter.

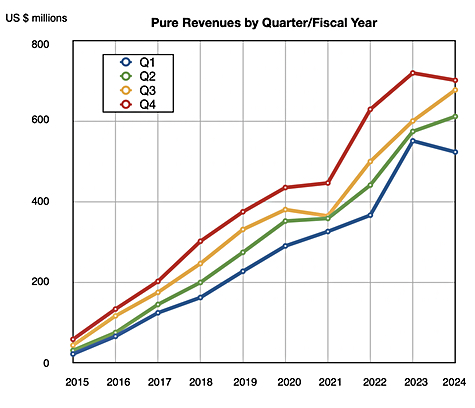

Revenues in Pure’s Q4 of fiscal 2024, ended February 4, declined three percent year-on-year to $789.8 million yet beat its own guidance. Net profit dropped 12 percent to $65.4 million. Full year revenues were $2.8 billion, up 3 percent to surpass guidance, and net earnings fell 16 percent annually to $61.3 million profit.

Charles Giancarlo, Chairman and CEO at Pure Storage, said on the earnings call: “We had a solid Q4 performance and ended the year with increasing sales momentum and balanced performance across our theaters and product portfolio. This momentum and growing customer interest in our platform strategy provides us with increased confidence for the coming year.”

Pure noted that subscription revenue of $329 million was up 24 percent while turnover from product sales was down 15 percent to $460.9 million. Giancarlo said: ”We certainly see our way clear to a majority of revenue over time being in the subscription category.”

Quarterly financial summary

- Gross margin: 72 percent

- Free cash flow: $200.9 million

- Operating cash flow: $244.4 million

- Total cash, cash equivalents and marketable securities: $1.5 billion

What was responsible for the revenue decline? Pure had better than expected sales of Evergreen//One storage-as-a-service (STaaS) and Evergreen//Flex pay-for-what-you-use storage deals at the expense of perpetual license sales. The latter’s revenues are recognized on shipment while the former’s are recognized over the life of the services contract.

During the conference call, Pure’s confirmed its file and object FlashBlade array has brought in more than $2 billion in total sales since launch. Pure has won an eight-figure Evergreen//One FlashBlade deal with one of the largest GPU cloud providers for arrays to be used in AI processing and training stages, it said. Pure, however, is not the only storage supplier to this unnamed customer.

Giancarlo said Pure’s Portworx container storage product “had a record year and accelerated growth based on customers increasingly graduating their container-based development projects to production scale.” The financial sector was highlighted as adopting Portworx in this way.

Answering an analyst’s question, Giancarlo said there were three aspects to AI for Pure: modeling (training) needing lots of GPUs, inference with fewer GPUs, and storage. Storage for AI needs to be in a single fast-access data environment, one that is not spread across silos. He reckons the training market is the smallest one of the three in terms of total market size.

Pure also thinks that the market researchers including Gartner underplay Pure’s market share because they are biased towards perpetual license (capex) sales. Giancarlo said: “They do not incorporate our Evergreen//Forever subscription, which, as you know, means that we don’t resell the same storage when an array becomes obsolete because in our case, arrays don’t become obsolete.”

He said that an analyst’s “basic premise that the market is under accounting, what we believe would be our growth if our Evergreen//One sales were actually in standard product sales, is absolutely correct.”

Pure did not see more sales into Meta’s Research Super Cluster (RSC) this quarter, which meshes with what Hammerspace is claiming, but Pure CTO Rob Lee said: “Our relationship with Meta is stronger than ever. We’re working with them on almost a continuous basis.”

Inevitably Pure was asked about flash replacing disk, and Giancarlo stepped up to that with no hesitation: “I started saying last year that I expected the last disk storage array to be sold in about five years’ time. We’re now four years in front of that. I’m going to stick with that timetable … I am very bullish on this, and I’ll stick with it, that I think the next three to four years, we’re going to see the decline of disk systems.”

Turning to the future, Giancarlo said: “We are beginning to see some encouraging signs of improvement in the macro environment.” CFO Kevan Krysler said in a prepared statement: “We expect double-digit revenue growth and strong growth of RPO, fueled by our highly differentiated data storage platform, and strength of our Evergreen and Portworx consumption and subscription offerings.”

With this in mind, next quarter’s revenues are expected to be $680 million, 15.4 percent up on the year-ago quarter. Pure is looking for 2025 revenues to be around $3.1 billion, meaning a 10.7 percent rise on 2024.