Startups that are over ten years old often disappoint their early venture capitalists (VCs) due to prolonged timelines in yielding returns. This locks up their invested cash, making it unavailable for other ventures, like startups with quicker exit potentials.

Silicon Valley VCs are taking a leaf out of the private equity playbook by setting up continuation or secondary funds. These funds purchase investments in mature startups that have not yet exited through acquisition or IPO. The cash is used by the VC to return money to its investment partners, the LPs (Limited Partners), while the continuation fund retains the VC’s holdings in the startup.

According to the UK’s Financial Times, a VC startup investment can have a ten-year run time with a possible two-year extension. After that, and if there is no return prospect, they can shut the startup down or sell their holding at a discount.

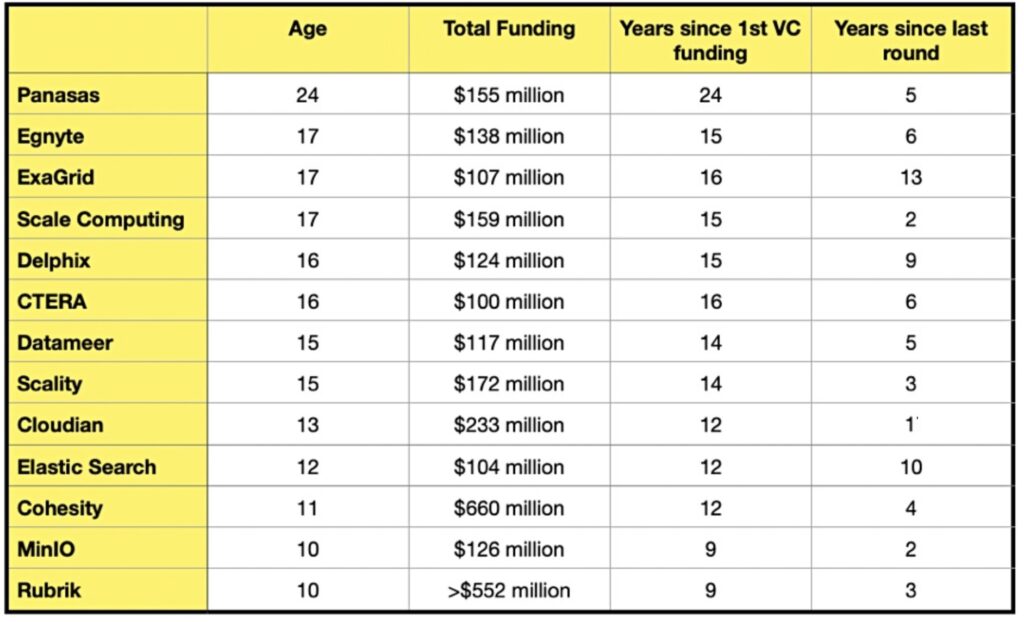

Here is a table, not an exhaustive one, listing some long-life storage startups:

Many appear to be growing, such as ExaGrid, which claims to achieve record revenues virtually every quarter, and yet do not IPO.

Ditto the two object storage suppliers, Cloudian and Scality. They’re growing, but competing with ten-year-old MinIO and its $126 million in funding. Meanwhile, all the main IT storage suppliers, except HPE, have their own object storage tech, meaning an acquisition looks unlikely.

Many storage startups are thus delaying an IPO. Some, due to high valuations, face problematic acquisition exits – as in, who can afford them? Others face an unattractive IPO landscape as investor interests have shifted from the areas popular during their founding days to newer fields like big data analytics and AI. The same can be true of acquisitive businesses that may, these days, also want to invest in generative AI technology businesses and not technology that was a good idea ten years ago.

The continuation fund concept provides a way for worn-out VC investors to get some money back from their holdings in these companies, and thus provide liquidity for new investments.

Insight Partners has set up a continuation fund and moved 32 of the companies in which it had investments into the new fund. Insight’s LPs received $1.3 billion as a result. Potential LPs for a VC will look at the capital it has distributed to LPs in the past and, if this has shrunk, they’ll look elsewhere to for a dependable return on their cash.

In effect, the continuation fund is a way for VCs to transition towards becoming private equity players.

The FT also reports that Lightspeed Venture Partners is talking to investors about setting up a $1 billion continuation fund for ten of its holdings. It has $25 billion in invested assets, including holdings in Nest, Snap, and, of particular relevance to our storage focus, Rubrik. We are not saying that any one of these is heading for continuation fund status. Rubrik seems more likely to IPO than not.

The continuation fund notion raises two questions in our mind. First, will the valuation of VC-held companies change if they are moved into continuation funds?

Secondly, will the continuation fund VCs, adopting more of a private equity mindset, start involving themselves assertively in the management of such startups, and restructure them to become profitable and acquisition-ready? Long-life startups cannot be VC-funded businesses forever. It’s an IPO, acquisition exit, or private equity management via the halfway continuation fund house for them.

Bootnote

The Institutional Limited Partners Association has various continuation fund resources for investors, both limited and general partners in VC funds.