It was a roller coaster year for NAND flash storage as shipments sank then recovered as a cyclical downturn reversed. Suppliers increased cost effectiveness by extending 3D layer counts and using QLC flash, but looking at PLC and other extreme bits-per-cell counts proved disappointing.

The year started with NAND fabricators experiencing depressed revenues as a supply glut met muted demand. They cut production then saw demand start rising again as customers used up their existing inventory.

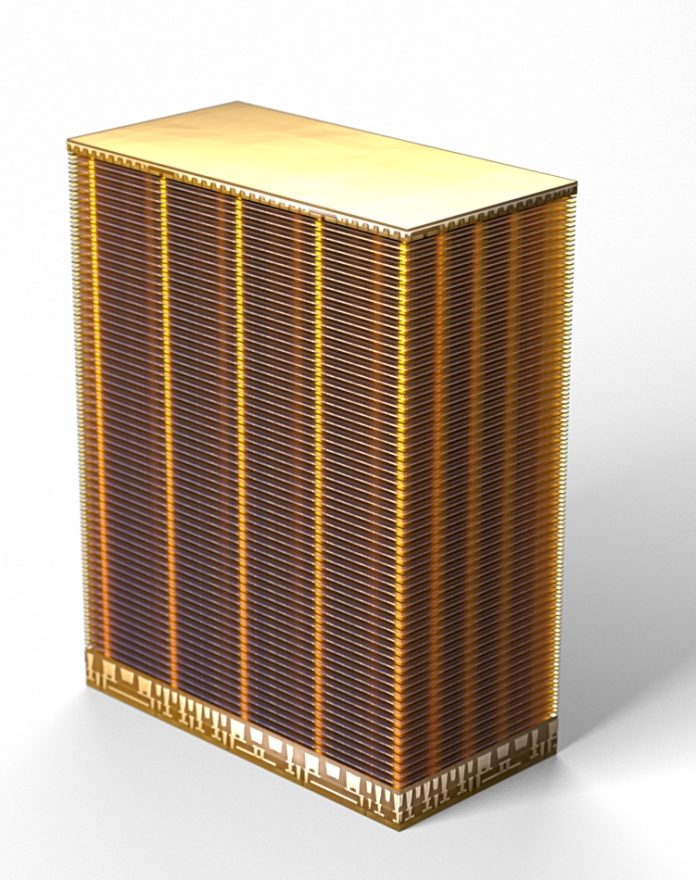

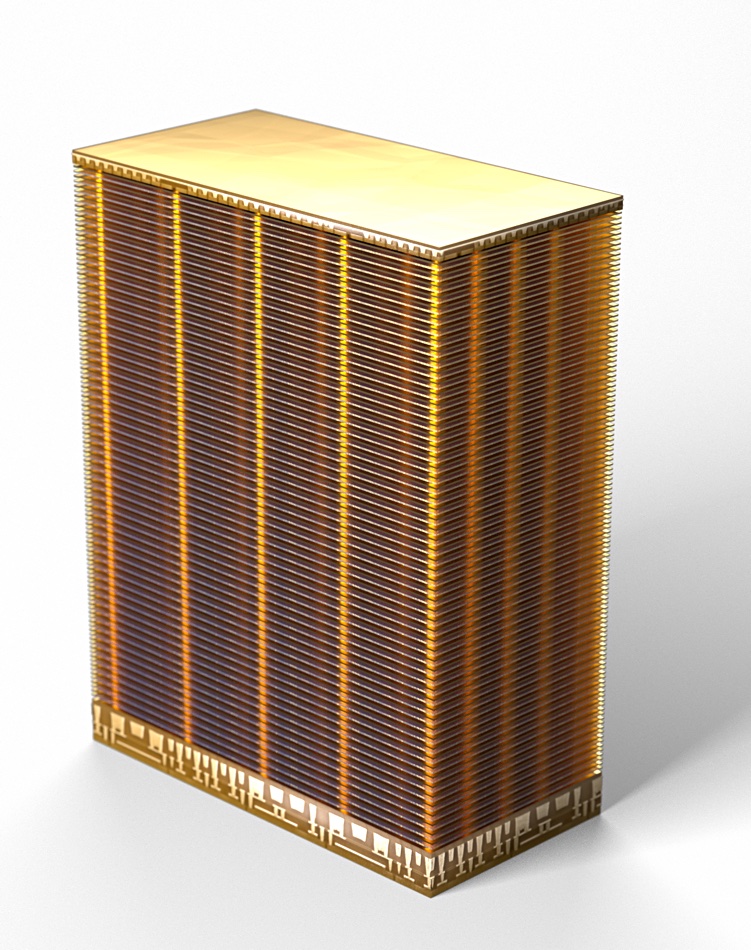

NAND foundry operators cut $/GB production costs by using more layers in their 3D NAND to build higher capacity dies. We saw a steady flow of layer count increases during the year, starting at the 218-layer level.

- March: SK hynix presented a >300-layer NAND paper at a conference, Kioxia and Western Digital have 218-layer NAND

- May: Micron builds 232-layer QLC SSD

- August: SK hynix introduces 321-layer NAND, Samsung has 300-layer NAND coming with 430 layers after that

- November: YMTC first to ship 232-layer QLC NAND

- December: Micron debuts 232-layer workstation SSD

All the suppliers moved to have the NAND control logic fabricated separately and added to the bottom or top of the die.

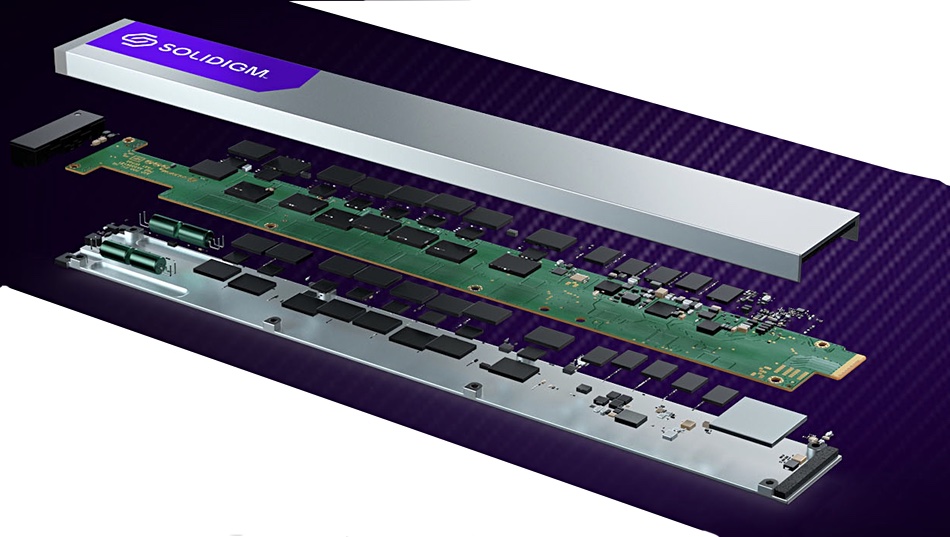

The standard SSD used TLC (3 bits/cell) flash but suppliers such as SK hynix subsidiary Solidigm and YMTC focused on providing QLC (4 bits/cell) NAND, and compensating for its lower write cycle endurance with over-provisioning and better write cycle management.

Storage array suppliers such as DDN, NetApp, and VAST Data took advantage of QLC flash to offer higher all-flash array capacities at a lower cost/TB and so were better able to compete with disk drive arrays.

There were no supplier announcements about penta-level cell (5 bits/cell) and beyond this year following 2022 forays. These layer counts seem utterly impractical as cryogenic cooling is needed for the 6 and 7-layer tech, and write endurance and read speed would both be increasingly low.

SSD capacities rose in the year, exceeding disk drive capacities, with Solidigm leading the way. It introduced a 61.44 TB capacity SSD, the D5-P5336, using QLC flash. Other SSD suppliers are shipping drives with maximum capacities around 30 TB. These are still larger than disk drives, which reached 24 TB with conventional recording and 28 TB with slower write shingled recording technology by year end, courtesy of Western Digital. This year we’ll probably see 60+ TB SSDs from other suppliers as well as Solidigm.

The EDSFF form factors started to make an appearance but not to the extent of killing off the classic M.2 (gumstick) and U.2 (2.5-inch bay) ones.

One piece of flash industry news that did not happen was Western Digital buying or merging with its NAND joint venture partner Kioxia. SK hynix, a Kioxia investor via Bain Consortium, killed that idea off by objecting to it.

Western Digital is now going to separate its disk drive and NAND fab/SSD businesses this year.

China’s YMTC managed to overcome US technology export obstacles and produce 232-layer NAND in the year. It would not be surprising if it announced 300+ layer technology this year, along with Kioxia and Western Digital, which are both currently at the 218-layer level with their BiCS 8 technology. These three suppliers lag Micron, Samsung, and SK hynix. We also expect Kioxia and Western Digital to announce a BiCS 9 NAND initiative this year and reach the 300-layer level.