A sequential rise in nearline disk units and capacity shipped signals a market recovery, according to Wells Fargo analyst Aaron Rakers.

Analyst Trendfocus issued preliminary shipment numbers for 2023’s fourth quarter with between 27.6 million and 29.7 million HDDs delivered, flat sequentially and down 21 percent year-on-year. Total capacity shipped declined 6 percent year-over-year to 212 EB but increased 8 percent quarter-on-quarter.

That increase did not come from the desktop and consumer electronics (CE) sector, where unit shipments of 17-18 million slumped 28 percent from 24.1 million a year ago and declined 6 percent from the 18.5 million shipped in the third 2023 quarter. The fourth quarter total was divided between 3.5-inch desktop and CE drives, with around 10 million units, and approximately 8 million 2.5-inch mobile and CE drives.

Trendfocus estimates that there were almost 10 million nearline drives – 3.5-inch mass capacity devices – shipped in the quarter. Rakers calculated this to mean a 6 percent year-on-year decrease but a 12 percent quarter-on-quarter increase. Trendfocus’s nearline capacity shipped estimate for the quarter was around 159 EB, up 19 percent sequentially and down only 2 percent year-on-year.

Nearline capacity shipped declined 51 percent year-over-year in the second quarter and 41 percent in the third quarter, so a mere 2 percent decline in the fourth quarter is a significant change. It looks like nearline capacity shipped is going to start rising more strongly, with unit shipments following in its wake.

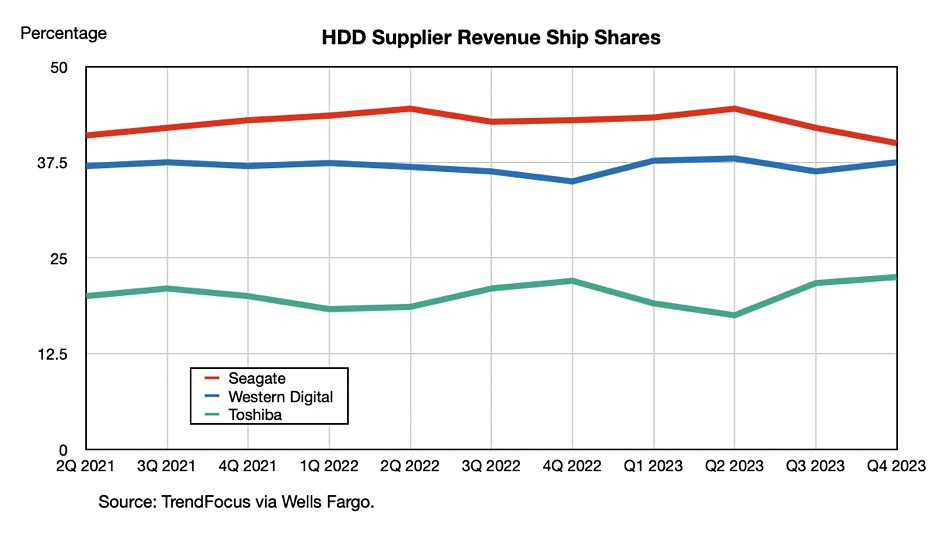

The unit shipment shares between the three HDD suppliers in the fourth quarter were:

- Seagate: 40 percent, down 2 percent Q/Q

- Western Digital: 37.5 percent, up 1.2 percent Q/Q

- Toshiba: 22.5 percent, up 0.8 percent Q/Q

A unit shipment share chart shows leader Seagate slipping in the past two quarters: