Gartner analysis of third 2023 quarter all-flash array (AFA) sales show Huawei has leapfroggerd Dell EMC to become the world’s biggest producer of this type of storage infrastructure.

The AFA market totalled $2.658 billion in the quarter, down four percent year-on-year. All-flash storage represented 53.9 percent of the $4.98 billion external storage market, which declined 13 percent annually. Within that primary storage declined 15 percent annually, secondary storage was up 2 percent, while backup and recovery went down 27 percent.

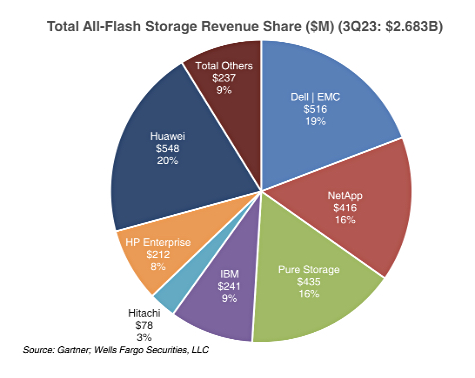

As reported by Wells Fargo analyst Aaron Rakers, Huawei, with $548 million in revenues, had a 20 percent AFA share while Dell EMC’s $516 million revenues gave it a 19 percent share. A pie chart from Rakers shows market share among the top seven suppliers:

Dell’s AFA revenue was down 23 percent year-on-year, with HPE’s AFA revenue decreasing 20 percent over the same period. NetApp’s AFA revenue went down 9 percent year-on-year, but Pure Storage did much better than these three competitors as its AFA revenue grew 2 percent year-on-year. Huawei’s AFA market share obviously rose year-on-year but we don’t have access to Gartner’s exact figures. We suspect it was close to a 25 percent gain.

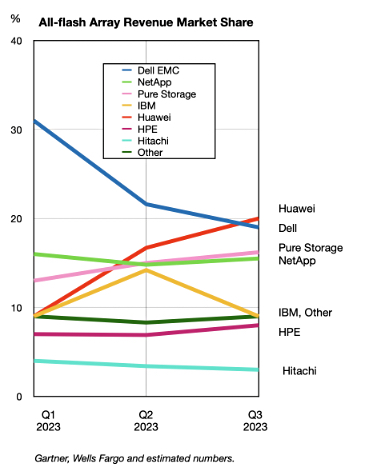

In the second quarter of 2023, Huawei’s share was 16.3 percent giving it second place, with Dell EMC leading at 21.6 percent. NetApp was third with 14.8 percent. Rakers does not report all of Gartner’s numbers and we have calculated IBM’s share to be 14.2 percent. Pure Storage was fifth at 14 percent. HPE had a 6.9 percent share with Hitachi tail-ending at 3.4 percent.

We have charted the last three quarters of AFA supplier market share percentages to show the changes visually:

Huawei’s rise in Q3 was as sudden – particularly as it is not selling its products in North America – as Dell EMC’s fall. Dell must be seeing strong competition from Huawei in the Asia Pacific territory, as well as the Middle East and Africa regions as well.

Pure Storage has shown a steady increase in market share – given the overall sales climate – by overtaking NetApp, with HPE also showing a rise over the period, unlike Hitachi with its 3 percent share at $78 million. At this rate we expect Hitachi to decline into the Others category in a quarter or two, with VAST Data or Lenovo emerging to take its place in the rankings.

The total external storage capacity shipped in the quarter went down 7 percent annually. Primary storage capacity declined 4 percent, secondary storage capacity decreased 7 percent with backup storage slumping 26 percent. Flash storage represented 21.5 percent of all storage capacity shipped, up strongly from the year-ago 15.6 percent.

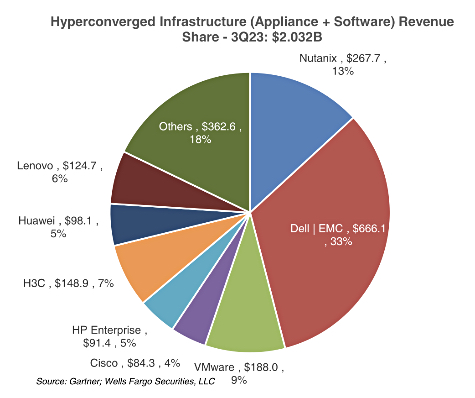

Gartner said the hyperconverged infrastructure (HCI) market totaled $2.03 billion, 2 percent lower than a year ago. Rakers produced an HCI supplier market share pie chart based on the Gartner numbers:

Dell EMC was well in front, with a 33 percent share ($666.1 million), Nutanix second with 13 percent ($267.7 million), and VMware (now part of Broadcom) pulling in $188 million to get third place.