NetApp has been downgraded by a financial analyst for what it claimed was underpar cloud business growth and falling on-prem storage product sales.

The company sells ONTAP file and block all-flash and hybrid arrays, StorageGRID object storage, BlueXP cloud operations services (Spot by NetApp and others) and has its ONTAP software OEM’ed by Lenovo and the big three public cloud suppliers as first party managed services: Azure NetApp Files (ANF), Amazon FSx for NetApp ONTAP, and Cloud Volumes Service for Google Cloud, which all “took years to build and integrate and are unique in the storage industry.”

Customers can also use a self-managed instance of ONTAP in the big three clouds.

William Blair analyst Jason Ader said he saw problems in the core business: on-premises hardware and software, and in NetApp’s cloud business. He said he believed NetApp had neglected to keep its on-prem offerings competitive: “We worry that NetApp lacks competitive differentiation in the space, especially compared to all-flash specialists like Pure Storage and upstarts like VAST Data and Qumulo.”

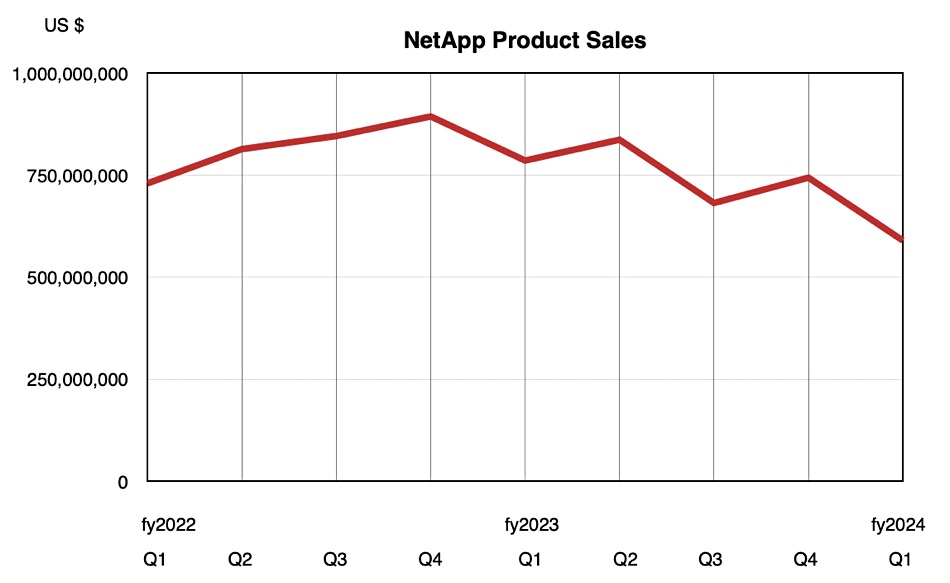

Ader writes: “Over the last four quarters, the company’s product sales in aggregate are down 15 percent year-over-year, implying material loss in market share. … We believe NetApp’s … slowdown is due mainly to an over-rotation of investment to the cloud business, which has left the company flat-footed and poorly positioned in the core storage systems market.”

Recent new products have filled gaps in NetApp’s portfolio: SAN-specific ASA A-Series, lower-cost capacity-optimized AFF C-Series, and the entry-level AFF 150 all-flash array.

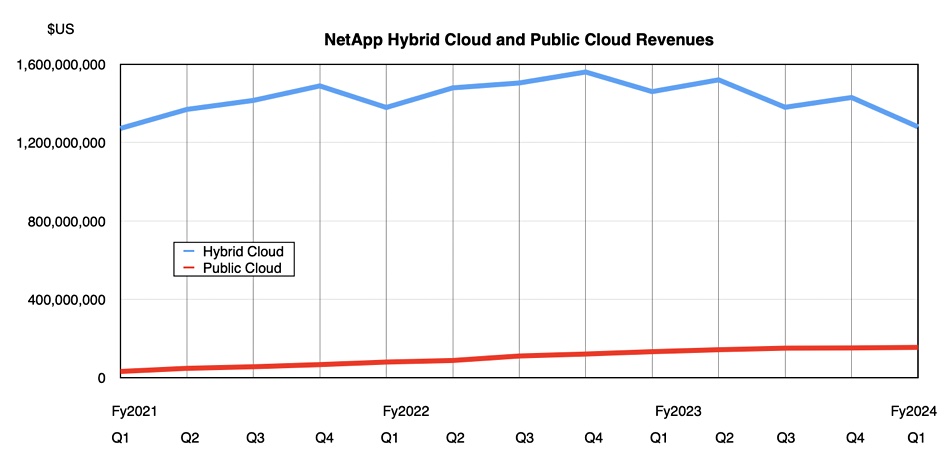

Ader tells subscribers: “Growth in NetApp’s cloud business has hit a wall in recent quarters (cloud annual recurring revenue (ARR) flat sequentially and up only 6 percent year-over-year in the most recent quarter.” Public cloud revenue of $154 million in the most recent quarter made up 8 percent of total NetApp revenue, broadly in line with its showing last year, when it made up $132 million over the $1.59 billion in net revenues in Q1 fiscal ’23, an 8.3 percent slice.”

Ader identifies what he sees as four cloud business issues. The first was execution following the acquisition of seven CloudOps companies when the cloud business was led by Anthony Lye: Spot, CloudHawk, CloudJumper, Data Mechanics, CloudCheckr, Fylamynt and Instaclustr. Lye subsequently left in July 2022, with Ader opining that the Cloud BU lacked direction and the acquisitions weren’t well-integrated onto NetApp’s overall business. VDI business CloudJumpr was shut down earlier this year.

He says: “With enterprise customers intensely focused on cloud cost optimization over the last year, Spot should have been an ideal solution, but growth has fallen sort of expectations likely due to a misaligned go-to-market strategy.”

Ader says he believes there were unrealistic cloud total addressable market ideas: “Beyond established ANF use cases like SAP Migration and EDA chip design, we believe the opportunity could be more limited than we originally thought.” Also, the ANF “service is extremely expensive and … Microsoft itself has been one of NetApp’s largest customers,” he claims, adding: “The traction for Amazon FSx for NetApp has been underwhelming.”

He reckons there has been conflict in NetApp’s sales organization between on-premises and cloud sales: “A core NetApp sales rep has little incentive to push an existing hardware customer to migrate to the cloud, where the rep is likely to loser a major upgrade sale.”

Because of these issues, he says, Ader is downgrading NetApp’s stock from OutPerform to Market Perform rating.

NetApp response

A NetApp spokesperson gave us a statement which we reproduce verbatim:

“NetApp has taken a number of steps to address challenges and drive growth. Our strategic initiatives, including new product launches and GTM (Go-to-market) optimizations, demonstrate our determination to navigate the evolving market successfully. We remain confident in our ability to leverage our competitive advantages and drive growth across our diverse product portfolio.”

Public cloud storage:

“Overall, we remain confident in our cloud storage services and their potential to drive growth for NetApp. We are committed to delivering value to our customers and shareholders and believe that our strategic actions will position us for success in the evolving cloud landscape. Some of those actions include:

- At the beginning of this year, we strategically aligned our cloud sales specialists with our hyperscaler partners’ go-to-market structures, which we believe will further enhance the performance of our first-party services.

- Our first-party cloud storage services, those integrated natively into the public clouds, set us apart in the market. It’s worth noting that all three major cloud providers have chosen to integrate our technology into their offerings, demonstrating the value that ONTAP brings to customers. This endorsement by major cloud players reflects the strength and relevance of our product portfolio in today’s dynamic technology landscape.

- As workloads migrate from on-prem to the cloud, we have the opportunity to displace legacy on-prem competitors as data that resides on their on-prem systems move to NetApp-based cloud services.

- We’re pleased to report that we are successfully attracting new customers who are adopting our cloud storage solutions, including Azure NetApp Files, FSx for NetApp ONTAP, and Google Cloud NetApp Volumes. These services cater to a wide range of use cases, from enterprise workloads like SAP to cloud-native and AI workloads.”

All-flash arrays:

“We have initiated a series of strategic actions aimed at enhancing our Flash portfolio. These actions include:

- The introduction of innovative new products such as the AFF A150 entry A-series product, the AFF C-series family of capacity flash products, and our new All-Flash San Array (ASA) family. Additionally, we’ve made crucial adjustments in our Go-To-Market (GTM) approach to reaccelerate the growth of our All-Flash Array (AFA) business.

- Notably, the positive impact of these changes is already evident in the growth of our sales pipeline. This early success reinforces our belief in the effectiveness of our strategy and the resilience of our market positioning.

- NetApp continues to provide all-flash systems at every price point and configuration based on a customer’s performance and budget needs.

- We have unified data storage, where any workload, any data, anywhere (on-prem, MSP/Hosting, Public Cloud) can be serviced; interconnected and managed by BlueXP.

- We have the leading multi-protocol systems (e.g., File/Block/Object with full support for NVMe/FC and NVMe/TCP) for customers who want industry-leading consolidated storage.

- Dedicated purpose systems (e.g., ASA for block storage, StorageGRID for object storage) for customers with specific needs.”

“Only NetApp can provide this full, comprehensive portfolio of solutions at any performance point, price point and/or any environment, all managed by ONTAP and BlueXP.”