IT research house IDC says public cloud spending by end user businesses outpaced private cloud in the first 2023 quarter and will do so for the rest of the year and out to 2027.

IDC’s Worldwide Quarterly Enterprise Infrastructure Tracker: Buyer and Cloud Deployment tracks spending in multiple market segments including compute and storage infrastructure non-cloud, shared cloud, and dedicated cloud infrastructure. Shared cloud is its term for the public cloud while dedicated cloud is private cloud IT, which can be on-premises or in a colo-type setup, with management by the enterprise direct or a contracted third party.

Kuba Stolarski, research VP for IDC’s Infrastructure Systems, Platforms, and Technologies Group, said: “Cloud infrastructure spending remains resilient in the face of macroeconomic challenges. However, the segment is grappling with substantial price hikes and Q1 marked the second consecutive quarter of declining system unit demand.”

The cloud infrastructure segment saw unit demand slide 11.4 percent year-on-year in the quarter, but average selling prices grew 29.7 percent, “driven by inflationary pressure as well as a higher concentration of GPU-accelerated systems being deployed by cloud service providers”.

Spending in the three categories in 1Q23 was:

- Non-cloud: $13.8 billion – down 0.9 percent Y/Y

- Shared cloud: $15.7 billion – up 22.5 percent

- Dedicated Cloud: $5.8 billion – down 1.5 percent

On a geographic basis, year-over-year spending on cloud infrastructure in 1Q23 increased in all regions except Central and Eastern Europe (due to the Russia-Ukraine war), China, and Canada.

In Stolarski’s view: “Although the overall outlook for the year remains positive, its growth hinges on the expectation that volume will drive it. Prolonged stagnation in demand could pose a significant obstacle to growth for the remainder of this year.”

Nevertheless IDC is forecasting a cloud spend increase for the year as its forecast spending in the three categories in 2023 is:

- Non-cloud: $60.4 billion – down 6.3 percent Y/Y

- Shared cloud: $68.0 billion – up 8.4 percent Y/Y

- Dedicated Cloud: $28.4 billion – up 4.8 percent Y/Y

Cloud spending will stay positive, despite macroeconomic headwinds, due to the drive for modernization, opex focus, and continued growth in digital consumer services demand, while non-cloud contracts as enterprise customers shift towards capital preservation.

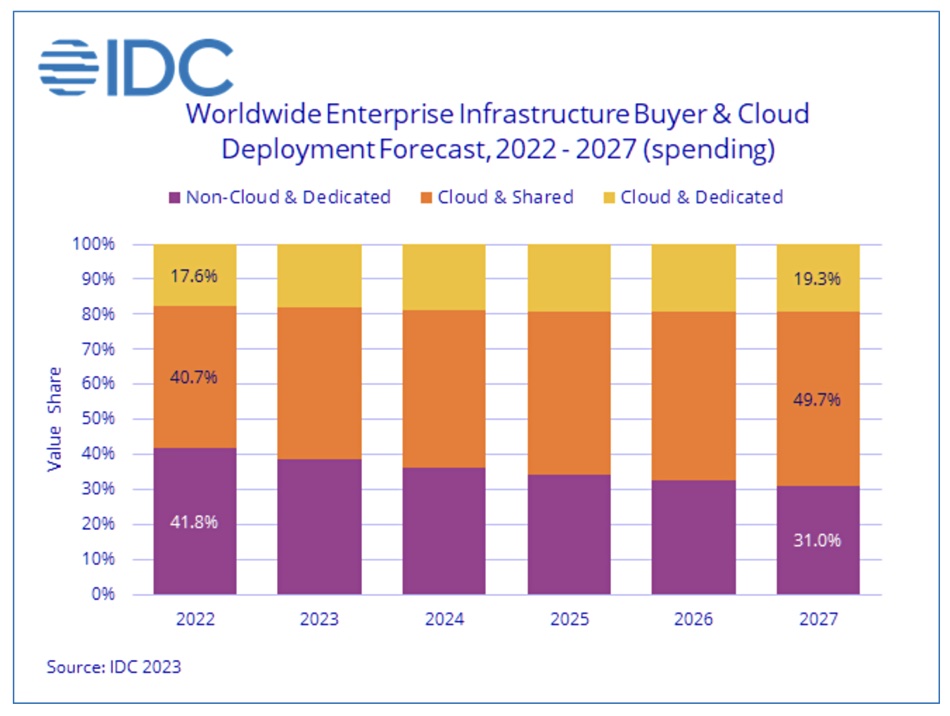

In the 2022-2027 period, IDC expects cloud infrastructure spend to have an 11.2 percent CAGR, reaching $153.0 billion in 2027 and accounting for 69.0 percent of total compute and storage infrastructure spend.

Forecast spending in the three categories in 2027 is:

- Non-cloud: $68.6 billion – up 1.3 percent Y/Y

- Shared cloud: $110.1 billion – up 11.9 percent Y/Y

- Dedicated Cloud: $42.9 billion – up 9.6 percent Y/Y

The shared (public) cloud spend of $110.1 billion is slightly less than the non-shared cloud (meaning dedicated cloud and non-cloud) spend of $111.5 million. The two might be equal or cross over in 2028 if the IDC forecast growth trends continue.

Spending by cloud and non-cloud service providers on compute and storage infrastructure is expected to grow at a 10.6 percent CAGR, reaching $148.2 billion in 2027.