Analysts have ranked Pure Storage third in revenue share in the all-flash external storage market in a placement that shows its sales just under those of storage giant NetApp.

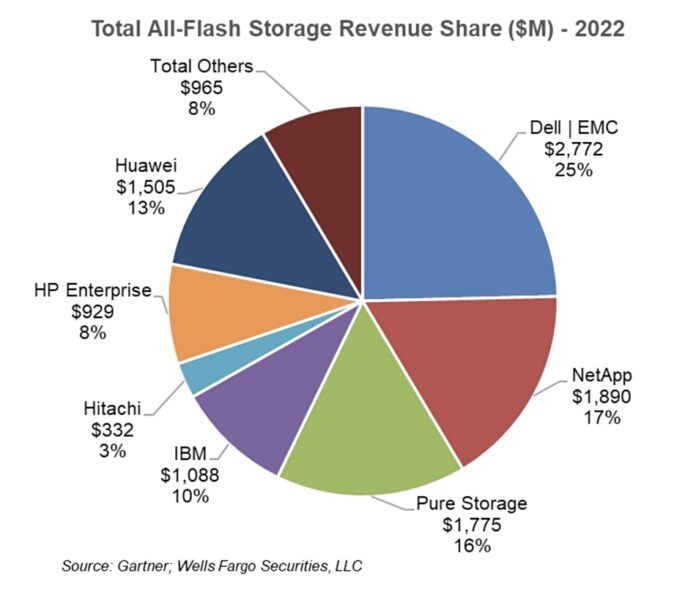

The revenue share numbers were calculated by Gartner and Wells Fargo Securities and presented to subscribers by analyst Aaron Rakers. The total all-flash array (AFA) market was sized at $11.1 billion and a pie chart showed how the various players ranked:

Dell EMC was first with a quarter share, followed by NetApp with a 17 percent share. Pure’s 16 percent puts it close behind NetApp, with fourth-placed Huawei having 13 percent. Then we have, in declining order, IBM, HPE and Hitachi with Others making up 8 percent.

This group will include relative newcomer VAST Data, which said in March this year it “went from $1 million in annual recurring revenue (ARR) to $100 million in ARR within three years of selling.”

Rakers says that Pure’s revenue share in all-flash primary storage stood at ~15.8 percent in 2022, according to Gartner estimates. This is a good amount of growth when you compare to Pure’s revenue showing in 2020 and 2021: ~12 percent and ~14 percent respectively.

Pure’s fiscal year starts in early February so its fiscal 2023 revenues, $2.75 billion, approximate calendar 2022 revenues. Gartner and Wells Fargo say $1.775 billion of that was all-flash storage revenues, with about $1 billion coming from elsewhere, subscription services for example.

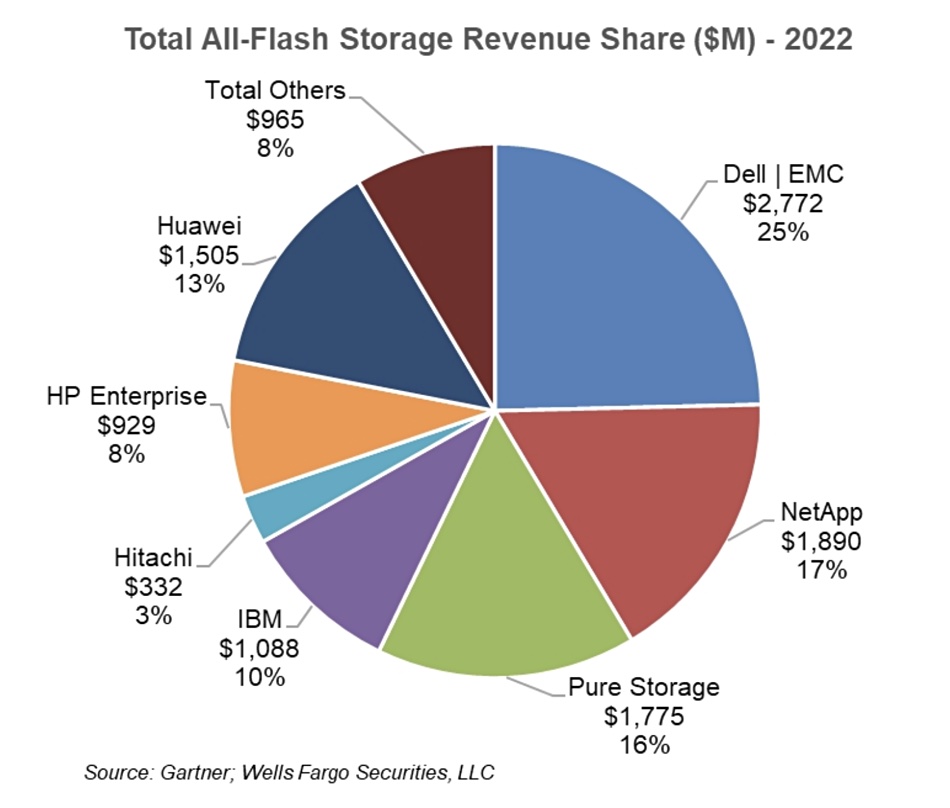

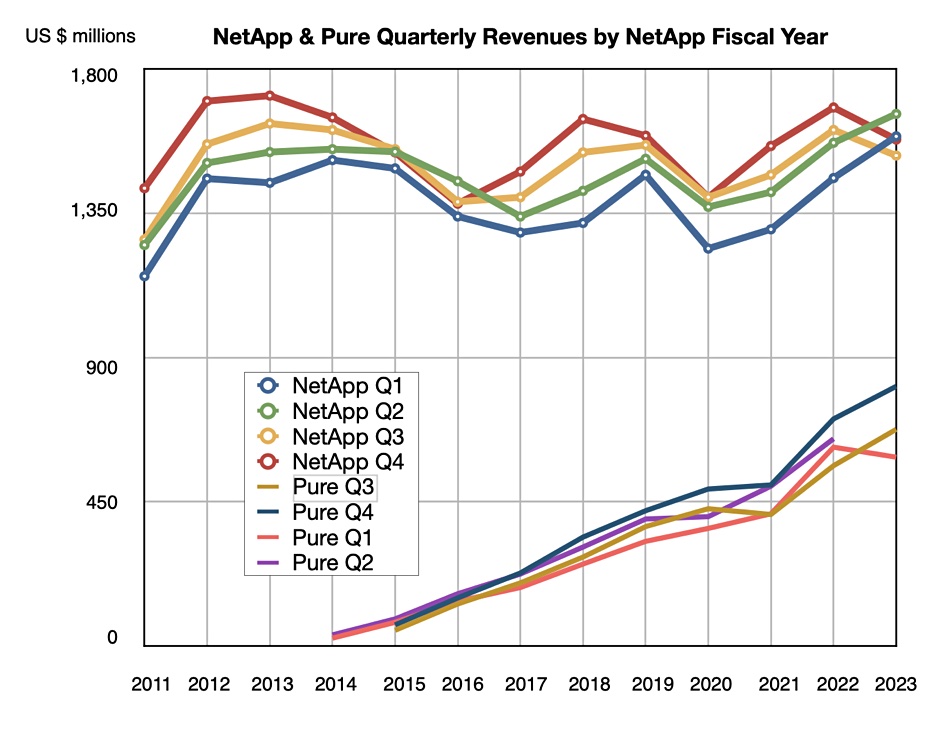

We can compare NetApp and Pure’s quarterly revenue histories to compare their growth rates:

The chart is normalized to NetApp’s fiscal quarters. We can see that Pure Storage’s revenues have been growing quite consistently while NetApp’s have been trending flat, allowing Pure Storage to outgrow NetApp. On this basis Pure’s all-flash revenues may overtake NetApp’s equivalent number by 2025, putting it in second place in the AFA market by revenue share, behind leader Dell EMC.

But, as NetApp has recently upgraded its all-flash array products, its current lead may well be maintained.