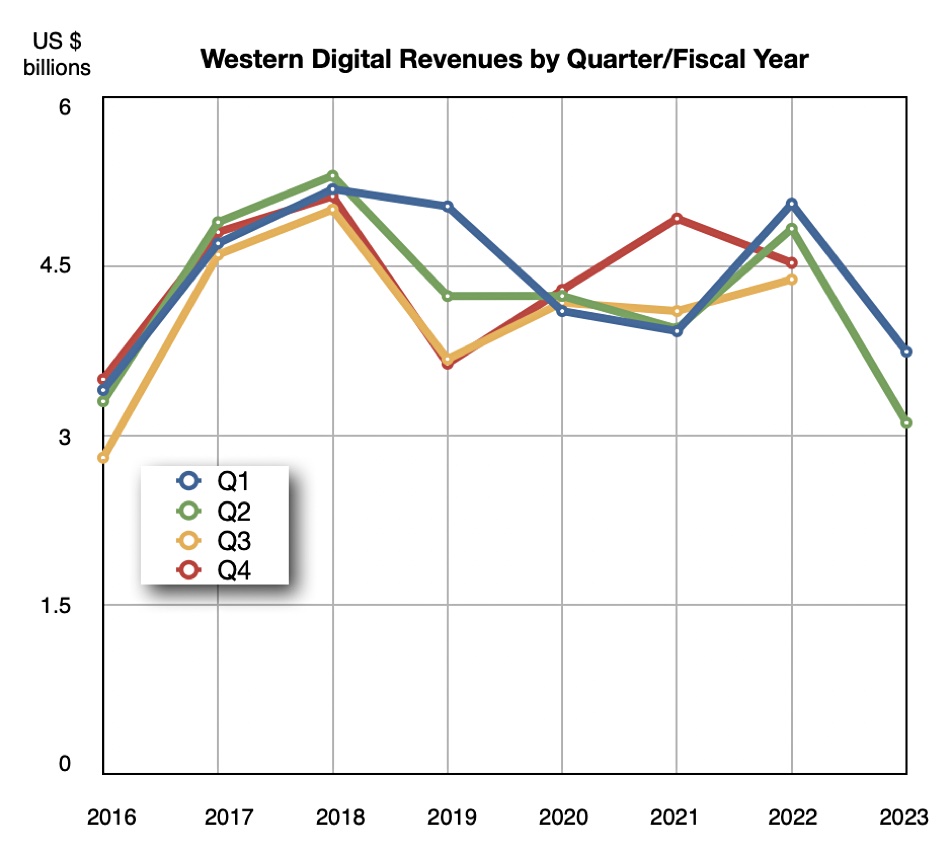

Western Digital has reported a drop in revenue of 36 percent annually for the second quarter of the dirve maker’s FY23, surpassing its Q1 fall of 26 percent. It’s also taken in a $900 million equity investment from activist investor Elliott Management and private equity business Apollo Global Management with a view to splitting the business.

Update: Analyst note section re $900 million investment added below. 1 Feb, 2023.

Revenues of $3.11 billion for the three months ended December 31 just beat WD’s $3.1 billion guidance for the quarter, and it recorded a loss of $446 million, compared to a profit of $546 million a year ago and $27 million last quarter. Both disk drive and SSD revenues were down as some public cloud and enterprise buyers paused spending, cloud customers used existing HDD inventory, and flash prices decreased. The HDD revenue fall echoes Seagate’s 39 percent revenue fall in its latest quarter.

WD CEO David Goeckeler pointed out: “The Western Digital team delivered revenue at the high end of our guidance range, despite a challenging flash price environment and continued cloud inventory digestion.”

Financial summary

- Gross margin: 17.0 percent, down from 32.8 percent a year ago

- EPS: -$1.40 compared to $1.79 last year

- Operating cash flow: $35 million; down 95 percent Y/Y

- Free cash flow: -$240 million ($631 million a year ago)

- Cash and cash equivalents: $1.87 billion

What’s Goeckeler’s company doing about this? “We continue to take action to reset the business in response to the post-pandemic environment by optimizing our cost structure and strengthening our liquidity. These actions, including strategically reducing our capital expenditures across both flash and HDD and our operating expenses, as well as amending our financial covenants and securing recent financings, will give us the financial flexibility and optionality to weather this cycle.”

Flash revenues were $1.66 billion, down 36 percent year-on-year, while HDD revenues of $1.45 billion decreased 34.5 percent annually. Bit shipments actually rose 20 percent compared to last quarter but lower prices more than compensated for that.

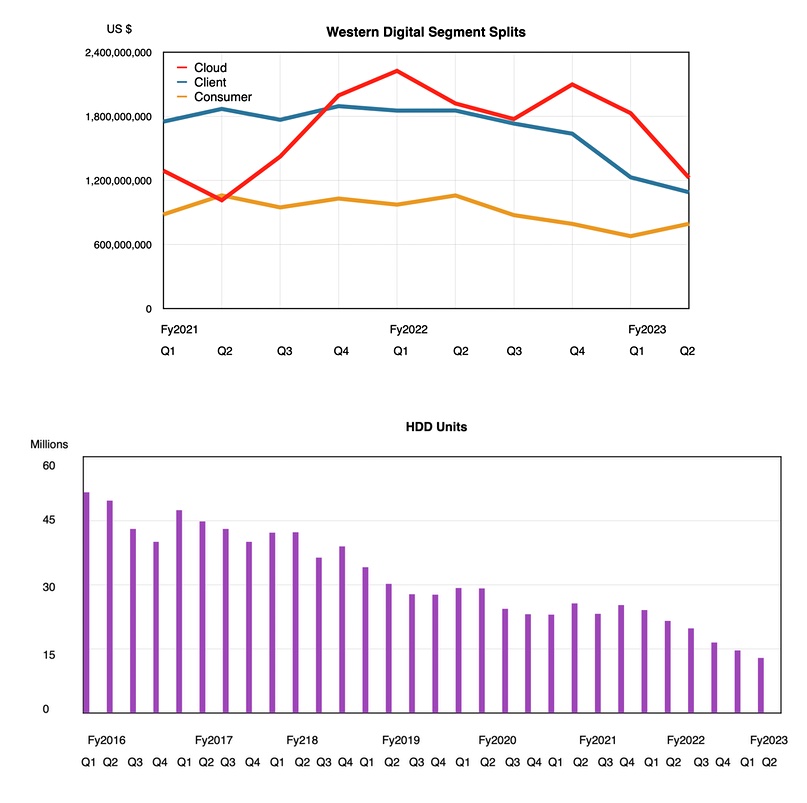

Western Digital said 12.9 million disk drives were shipped, 40 percent fewer than a year ago. Disk exabyte shipments decreased 35 percent quarter-on-quarter.

Segment summary

- Cloud was 39 percent of total revenue. Sequentially, capacity enterprise drives sold to cloud and smart video customers both declined due to lower demand in China. The year-over-year decline was primarily due to inventory digestion in hard drives.

- Client represented 35 percent of total revenue. Sequentially, the decline was driven by pricing pressure across flash products as well as lower client SSD shipments for PC applications.

- Consumer represented 26 percent of revenue. Sequentially, the increase was driven by a seasonal uptick in both retail hard drives and flash. The year-over-year decline was driven by lower retail hard drive shipments and pricing pressure in flash.

Action summary

Western Digital reduced flash wafer starts by 30 percent from January, and has lowered client hard drive capacity output by approximately 40 percent by consolidating and idling certain media production lines in Asia.

It is reducing capital expenditure across flash and HDD to lower production output. Its projected capital expenditure for fiscal 2023 has declined nearly 40 percent from six months ago to $900 million through delaying the BiCS6 transition in flash, and lowering client and nearline HDD production levels. Western Digital has also reduced operating expenses via redundancies, lower discretionary spending and variable compensation cuts.

New investment

The $900 million funding is a convertible preferred equity investment, a hybrid debt/equity security that allows its holders to convert their preferred stock into a fixed number of common shares after a certain date. If the common share price gets to be higher than the price per share rating of the CPE investment then holders can convert their preferred stock into common shares at the defined ratio (1 for 2, 3, 4, 5 or whatever) and make more money.

Elliott Management is agitating for a split between Western Digital’s HDD and SSD business units and the board is conducting a strategic review to evaluate this and other alternatives. Reed Rayman, a partner at Apollo, is joining Western Digital’s board. Goeckeler said Rayman “will provide us with additional financial and strategic expertise, which will be critical as we continue to execute on our business strategy and complete our strategic review… these financings provide valuable financial optionality and flexibility to Western Digital as we continue our strategic review.”

Analyst note

Western Digital has made an SEC 8K filing referring to the Apollo/Elliott investment. Wells Fargo analyst Aaron Rakers states: “This morning’s 8-K filing notes that the preferred stock conversion price is subject to: 1) the event that WD ‘spins-off its Flash business (SpinCo)…’, and / or 2) The event that WD enters into certain transactions to effect a ‘Spin-Off and subsequently sell, merger, or otherwise combine or transfer SpinCo with a third party…‘”

The meger statement refers to the possibility of Western Digital’s SpinCo merging with Kioxia.

Reuters reports: “The latest investment is a precursor to a potential merger between Silicon Valley-based Western Digital and Japan’s Kioxia Holdings Corp, according to people familiar with the matter. The sources, who requested anonymity as these discussions are confidential, said the talks between Western Digital and Kioxia are still active.”

SSD and HDD technology

In flash, Western Digital said 112-layer (BiCS5) accounted for 70 percent of its flash revenues while BiCS6 162-layer) should have a cost crossover in Q3 of WQD’s fiscal 2023 (April to June). It also said that BiSC8, with an unknown layer count greater than BiCS7’s 212, has entered its productization phase.

Goeckeler said in the earnings call: “BiCS8 incorporates several groundbreaking 3D NAND architectural innovations to deliver a major leap in performance and cost-effective solutions to a broad range of exciting products.

“We’ll be making choices about what we take it into or where we need BiCS6, BiCS5 will serve us well for the rest of the portfolio, and then we’ll move right into BiCS8, which quite frankly, is ahead of schedule as far as production.” That implies BiCS7 will be leapfrogged entirely with BiCS6 only used sparingly as a short-term technology.

In HDDs, Western Digital is aggressively ramping 22TB CMR product and expects this drive along with its SMR variants to be a growth engine going forward.

Outlook

Western Digital is guiding Q3 revenue to be in the range of $2.6 billion to $2.80 billion. That represents a 35.8 percent fall from a year ago. Gross margin is expected to fall to between 8.4 and 10.5 percent.

However Goeckeler said: “We expect sequential growth in [HDD] revenue and margin into our fiscal third quarter and continued recovery as we move through calendar year 2023.”

Flash shipments will recover more slowly, Goeckeler said. “We expect enterprise SSD product demand for the fiscal third quarter to be sharply reduced as certain large cloud customers have entered a digestion period.” Lower PC demand will reduce client SDD shipments. WD expects flash bit shipments to return to growth in its fourth FY23 quarter (July-September 2023).

To sum up, Q3 will be dire but Q4 might show a recovery.