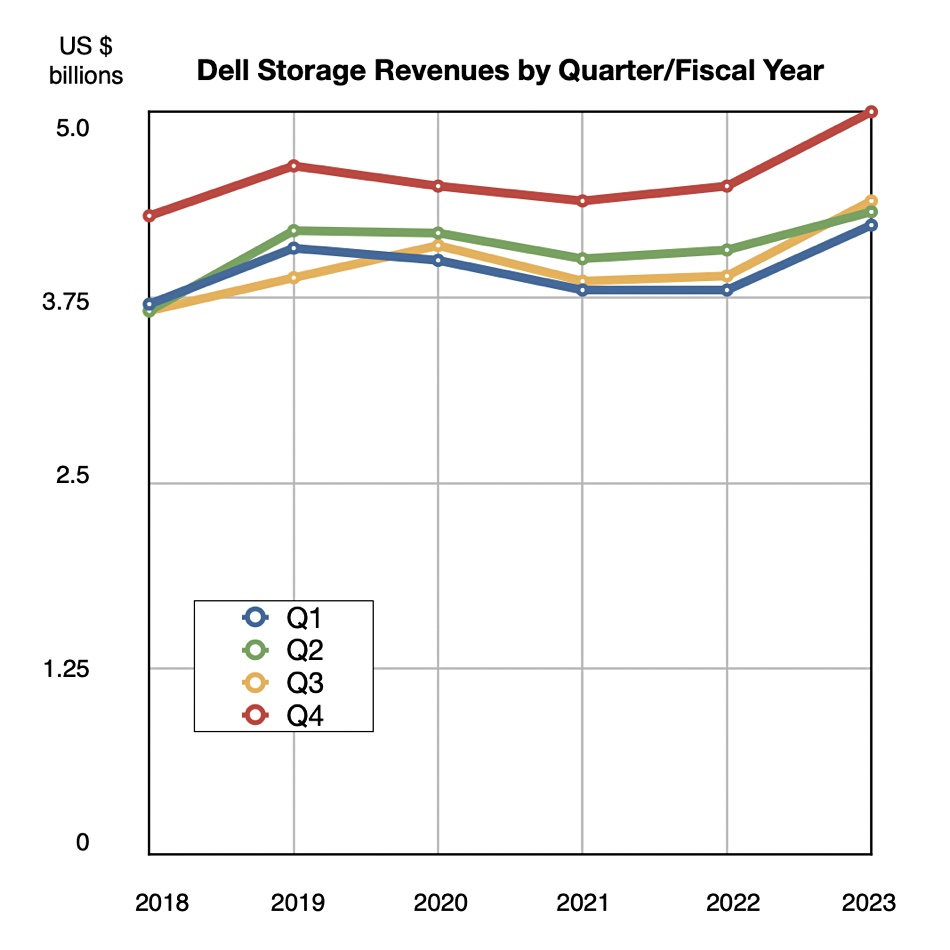

The fourth quarter is always a belter for Dell and its latest results show a record $5 billion in storage revenues.

Total revenues in the quarter ended February 3 were $25.04 billion, 11 per cent down annually due to lower PC sales, but beating Wall Street estimates and Dell’s own guidance. There was a profit of $606 million, an increase on the year-ago $1 million, which was far lower than usual due to VMware dividend and debt repayment issues. Full fiscal 2023 revenues were $102.3 billion, up just 1 percent, with a profit of $2.422 billion, down 56 percent.

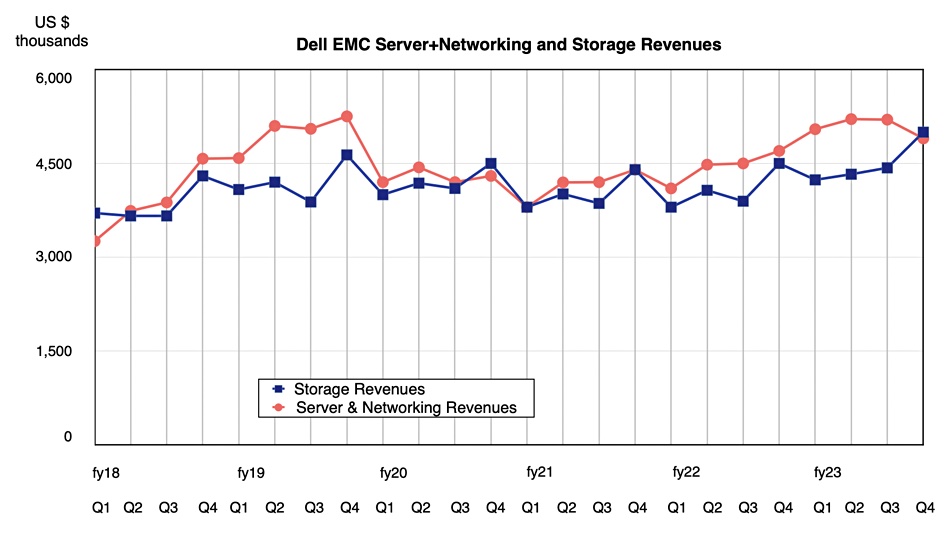

Storage is in Dell’s ISG business unit, which recorded Q4 revenues 7 percent higher than last year at $9.9 billion, its eighth consecutive growth quarter. The PC-dominated CSG unit reported in with $13.4 billion revenues, a 26 percent drop on a year ago, as the PC market slowed in June and then fell precipitously in the fourth quarter. Storage revenues, which rose 10 percent annually, pipped the $4.9 billion of server revenues in ISG, 5 percent up year-on-year.

Co-COO Chuck Whitten said in prepared remarks: “We are pleased with our FY23 execution and financial results given the macroeconomic backdrop. FY23 was ultimately a tale of two halves with 12 percent growth in the first half and revenue down 9 percent in the second half as the demand environment weakened over the course of the year.”

He added: “We delivered record FY23 revenue of $102.3B, up 1 percent on the back of 17 percent growth in FY22 … ISG in particular had a strong year with record revenue of $38.4B, including record revenue in both servers and networking and storage, and record operating income of over $5 billion … We expect to gain over a point of share in mainstream server and storage revenue when the IDC calendar results come out later this month. ”

Q4 financial summary

- Gross margin: 23 percent

- Operating cash flow: $2.7 billion

- Diluted EPS: $1.80

- Remaining performance obligations: $40 billion

- Recurring revenue: c$5.6 billion, up 12 percent year-over-year

- Cash and investments: $10.2 billion

The company more than doubled the number of active APEX subscribers over the course of the year.

Dell’s storage results, together with those of Pure Storage, up 14 percent, contrast markedly with NetApp, which has just reported a 5 percent decline in revenues.

Whitten said that in storage, Dell has “gained four points of share in the key midrange portion of the market over the last five years … [There was] demand growth in PowerFlex, VxRail, Data Protection and PowerStore. We are pleased with our momentum in storage – the investments we’ve made over the years strengthening our portfolio are paying off and have allowed us to drive growth and share gain in what was a resilient storage market in 2022.”

The ISG performance looks impressive considering that Dell reacted to the PC market downturn in Q4 with cost controls, an external hiring pause, travel restrictions, lower external spend and layoffs.

Outlook

Whitten said: “Though Q4 was a very good storage demand quarter, we saw lengthening sales cycles and more cautious storage spending with strength in very large customers offset by declines in medium and small business. Given that backdrop, we expect at least the early part of fy24 to remain challenging. In other words PC sales aren’t going to rebound soon and business is cautious about buying IT gear.”

CFO Tom Sweet added: “We expect Q1 revenue to be seasonally lower than average, down sequentially between 17 percent and 21 percent, 19 percent at the mid-point.” That would be $20.3 billion, a 27.5 percent drop on fiscal 2022’s Q1. He expects growth from that low point throughout the rest of fy24.

The full fy24 revenue amount is being guided down between 12 and 18 percent, 15 percent at the midpoint, meaning $86.96 billion.

Reuters reports this tepid outlook sent Dell shares down 3 percent in trading after the results statement was issued.

CFO Tom Sweet is retiring at the end of Q2 2024. Dell says Yvonne McGill, currently corporate controller, will be its new CFO effective the start of Q3 fiscal 2024.