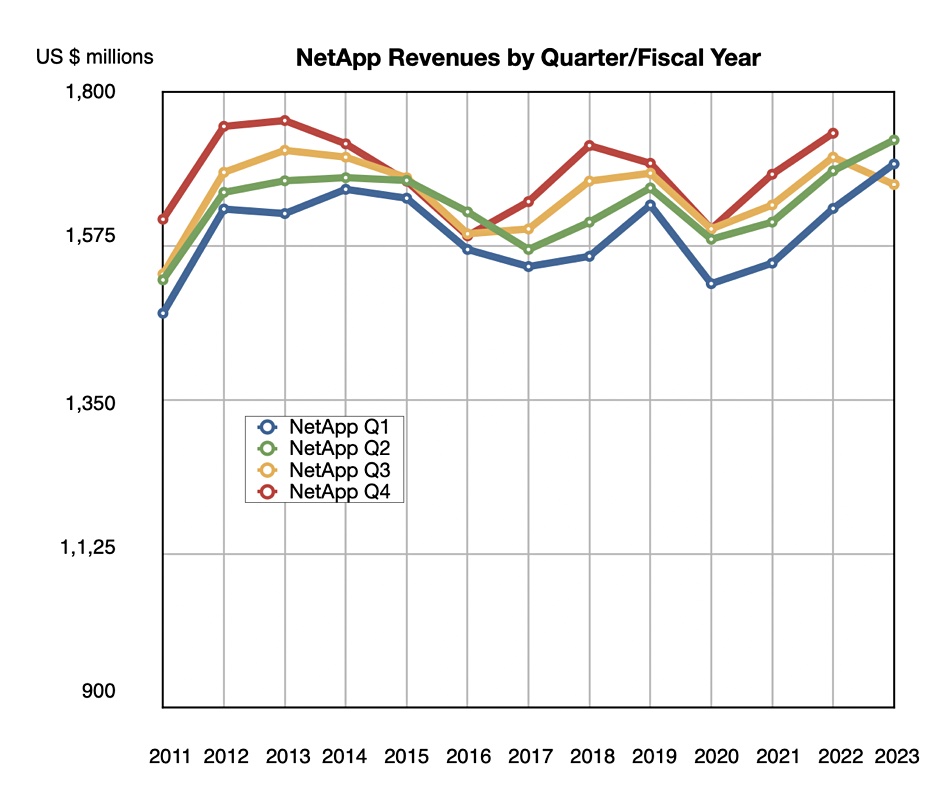

Now we know why NetApp implemented a hiring freeze, spending cuts at the end of last quarter and an 8 percent job cut in January; it has just confirmed a 5 percent dip in its latest quarter revenue report, and next quarter’s outlook expects a deeper decline.

Revenues were $1.53 billion in its third fiscal 2023 quarter ended January 27, compared to $1.61 billion a year ago, with the fall terminating 10 successive growth quarters. There was a profit of just $65 million, compared to $252 million a year ago, a 74 percent drop, but a profit nonetheless, helped by the overheads reductions.

CEO George Kurian said in a statement: “In Q3, we executed well on the elements under our control in the face of a weakening IT spending environment and continued cloud cost optimization. … Building on that solid foundation, we are sharpening our execution to accelerate near-term results while strengthening our position when the spending environment rebounds.”

Financial summary

- Gross margin: 65.6 percent; 66.5 percent a year ago

- Return to shareholders (dividends + share repurchases): $308 million

- Billings: $1.57 billion, down 10.5 percent y/y

- Operating cash flow: $377 million; $260 million a year ago

- Deferred revenue: $4.2 billion; up 6 percent y/y

- EPS: $0.30 compared to $1.10 a year ago

- Cash, cash equivalents and investments: $3.1 billion

The company is still paying a dividend to stockholders on April 26 of $0.50 per share.

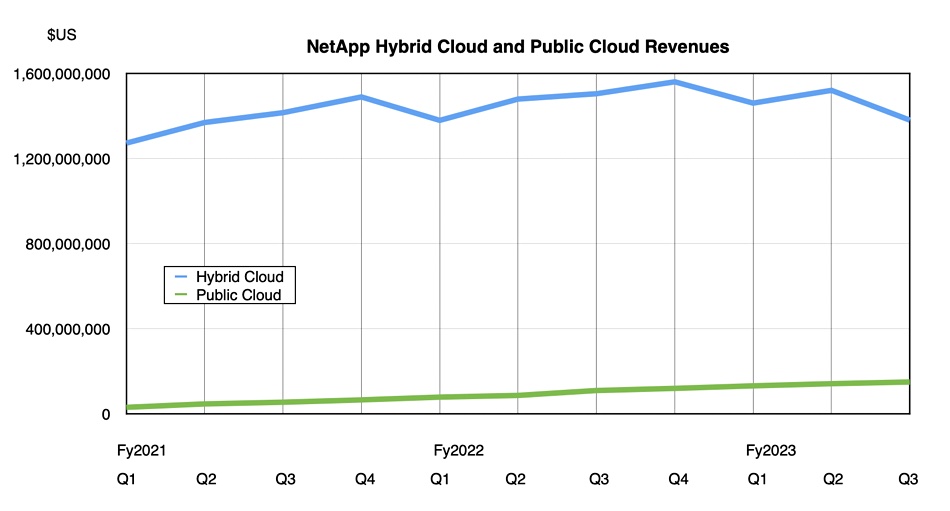

Public cloud revenues grew 36 percent to $150 million but that total and its growth rate were eclipsed by hybrid cloud revenues of $1.38 billion, down 8.3 percent year-on-year. NetApp’s annual run rate for all-flash arrays dropped 12 percent to $2.8 billion from the year-ago $3.2 billion as customers bought less on-premises kit.

That’s the problem in a nut shell; customers are spending less. Product revenues in the quarter were $682 million, down 19.4 percent.

Kurian said: “We continued to see increased budget scrutiny, requiring higher level approvals, which resulted in smaller deal sizes, longer selling cycles, and some deals pushing out. We are feeling this most acutely in large enterprise and the Americas tech and service provider sectors.

“Customers are looking to stretch their budget dollars, sweating assets, shifting spend to hybrid flash and capacity flash arrays from higher-cost performance flash arrays and, as our cloud partners have described, optimizing cloud spending.”

The flash array business was hit, with Kurian saying: “Our hybrid flash and QLC-based All-flash arrays continue to perform well, benefiting from customers’ price sensitivity in this challenging macro. The shift from high-performance All-flash arrays to lower cost solutions, coupled with the lower spending environment, especially among large enterprise, and US tech and service provider customers who are large consumers of flash, created headwinds to our product and All-flash array revenues.”

The cloud cost factor affected NetApp, despite its Spot optimization capability. Kurian said: “Public Cloud ARR of $605 million did not meet our expectations, driven by a shortfall in cloud storage as a result of the same factors we experienced last quarter. Spending optimization and the winding down of project-based workloads like chip design, EDA, and HPC were headwinds again in Q3. We have a sizable base of public cloud customers, with a number of large customers who have grown rapidly over the past year and are now optimizing.

“Overall, the Cloud Ops portfolio performed to plan. Cloud Insights has stabilized, and Spot continues to grow nicely, benefiting from the cost optimization trend. Our dollar-based net revenue retention rate decreased to 120 percent but is still within healthy industry norms.”

NetApp has three measures to deal with these problems: tightly manage the business’s spend, reinvigoratie efforts to support the storage business, and build a more focused Public Cloud business.

The cost control side is reflected in its decisions to reduce investment in smaller revenue potential products like Astra Data Store and SolidFire. Storage reinvigoration is a result of NetApp, as it moved rapidly to embrace cloud, losing momentum in its Hybrid Cloud business.

Kurian admitted: “We were slow to fully embrace the customer desire for lower-cost, capacity-oriented All-flash systems. At the start of Q4, we rectified that situation with the introduction of the AFF C-series,” with its lower cost quad-level cell (QLC) flash.

NetApp lost AFA market share, and Kurian said: “We are rebalancing our sales and marketing efforts to better address the significant storage market opportunity, including aligning compensation plans to drive sales of our reinvigorated storage portfolio. We believe that these actions will enable us to drive product revenue growth and regain share in the all-flash array market.”

CFO Mike Berry added: “Our large enterprise and US tech and service provider customers have continued to reduce capex spend as they right-size their spending envelopes. These customers are the most forward leaning technology adopters and the biggest consumers of All-flash systems in the economy, and their pause in capex spending has had a material impact on our total revenue, All-flash mix and product margins.”

The public cloud business needs to grow. Kurian commented: “We believe strongly that Public Cloud services can be a multibillion-dollar ARR business for us. However, achieving that target will take longer than we initially planned due to the industry-wide slowdown in cloud spending and our recent performance.”

All in all there are quite a few mea culpa comments by NetApp. It took its eye off the QLC AFA ball, letting competitors like Pure Storage and VAST Data have more of a free run. William Blair analyst Jason Ader told his subscribers: “NetApp was negatively impacted by three main factors: 1) concentration among large enterprise customers (particularly in the technology and service provider verticals), which have substantially slowed down their spending due to the macro backdrop – this impacted both the cloud and hybrid cloud segments; 2) NetApp’s lack of a low-end, capacity-optimized all flash array product, which led to underperformance (and share loss) in traditional storage; and 3) poor sales execution (GTM misalignment), which stemmed from an overemphasis on cloud products in sales comp plans in fiscal 2023.”

It’s going to get worse as fourth quarter revenues are being guided to $1.475 billion to $1.625 billion. The $1.5 billion midpoint will be a 10.7 percent decline on a year ago. This would mean a $6.28 billion full year, 0.6 percent less than fiscal 2022’s $6.32 billion.

That means 2024’s first fiscal quarter is the first one that could show an upturn and return to growth. NetApp execs had better show some positive results by then or analysts may be calling for management changes.