HDD vendor Seagate recorded a 39 percent drop in revenues for its second fiscal 2023 quarter, chalking it up to an adverse economic environment.

For the quarter ended December 30, the storage company generated revenues of $1.89 billion compared to $3.12 billion a year ago. There was a loss of $33 million – the first loss in many years – down from a profit of $501 million. This follows a dire first quarter of fiscal 2023 when revenue plunged 35 percent and profit dived 94 percent. Some 3,000 layoffs were announced.

On the latest earnings call, CEO Dave Mosley said: “Seagate delivered on what we set out to do in the December quarter, and I’m proud of our team’s accomplishments amid this tough business environment.”

Seagate’s revenue was slightly above its guidance midpoint and Mosley said this “extended a decade-long trend of generating positive free cash flow.”

Mosley listed the main factors that pulled revenues down, weighing heavily on the mass capacity markets: “The COVID-related economic slowdown in China, the work down of nearline HDD inventories among US cloud and global enterprise customers under a more cautious demand environment, and macro-related disruptions primarily impacting our consumer-facing markets.”

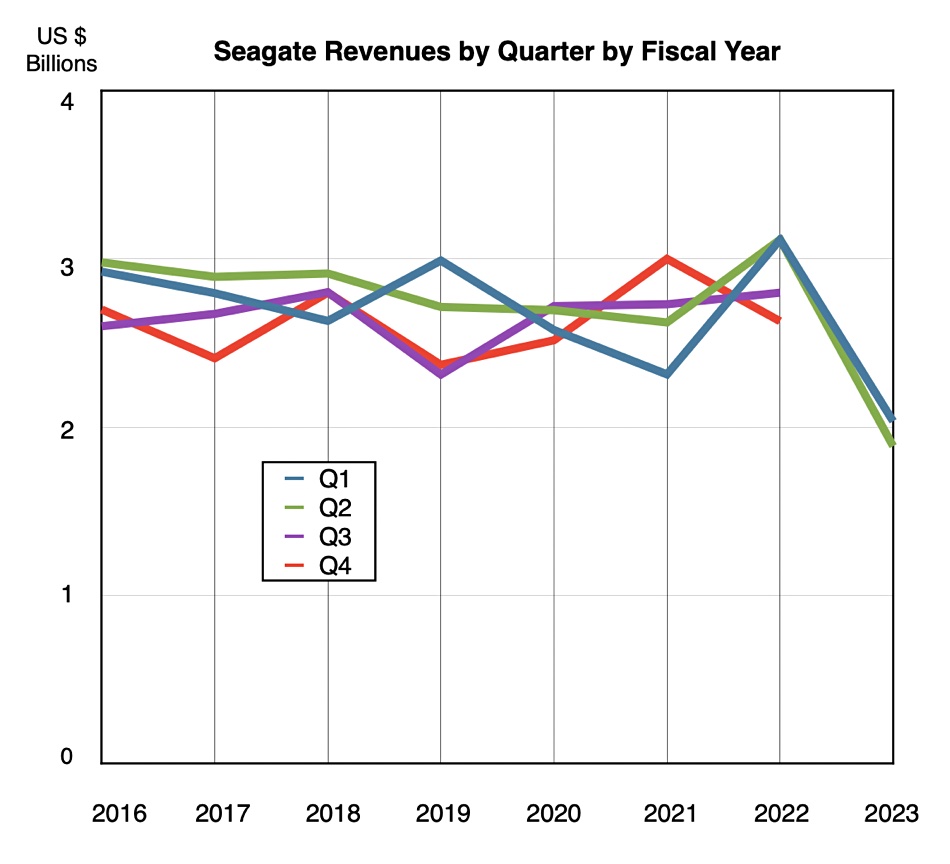

A chart of revenues by quarter by fiscal year shows the dramatic revenue fall in the past two quarters:

Financial summary

The main disk drive business pulled in $1.66 billion, down 41 percent; while enterprise, flash systems and other products generated $224 million – a 24 percent fall. Seagate shipped 113EB of disk drive capacity, down 31 percent, and the average capacity per drive was 7.3TB, lower than the previous quarter’s 7.5TB.

Seagate reduced its total debt in the quarter by $220 million and reduced its capital expenditures by more than 40 percent sequentially. It recognized charges related to last quarter’s layoffs, the October 2022 Restructuring Plan, plus various gains and charges associated with other cost-saving measures.

Despite these charges and the lower revenues, investors still made out: it nonetheless declared a dividend of $0.70 per share, which will be payable on April 6, 2023.

Seagate said there was ongoing adoption of its 20+TB platform, representing nearly 60 percent of nearline EB shipped in Q2 FY23. It shipped 79.7 nearline exabytes; about 35 percent of which as shingled magnetic media (SMR) drives in the quarter.

High customer inventory levels affected nearline drive demand, but Seagate thinks customers are getting inventory levels down. The VIA (Video and Image Apps) market was depressed by the prolonged economic slowdown in China, following recent China government policy changes to reverse Covid lockdowns. Seagate anticipates demand will improve as the year progresses.

Demand for other drives, its legacy group, were seasonally up 8 percent due to a consumer demand rise compared to the prior quarter.

Seagate has lowered production output to help progress customer inventory correction and support supply discipline as demand recovers. It is already seeing encouraging signs in China, and Mosley expects “nearline sales will improve slightly in the current quarter, particularly for our high-capacity drives.” Overall there are signs that conditions will generally improve as the calendar year progresses.

Seagate will add another 10 percent to SMR drive capacity and launch 25TB plus drives this quarter. It says it will be launching its 30+TB HAMR-based product family in the June quarter, Q4 FY23, slightly ahead of schedule. This will be preceded by it shipping pre-qualification units to key cloud customers in the coming weeks.

Mosley believes Seagate has a HAMR technology advantage that is measured in years, with “strong and consistent cost reductions at the highest drive capacities and enable future cost-efficient refreshes of our midrange capacity drives.” That means they’ll need fewer platters and heads and cost less to produce because they change from 2 or 2.2TB/platter to 3+TB/platter.

The outlook for the next quarter is for revenues of $2 billion, plus or minus $150 million. This compares to the year-ago $2.8 billion, a 26.8 percent fall. Look out to the quarter after that for signs of an upturn in Seagate’s revenues.