Nutanix has reported strong revenue growth despite the gloom and doom surrounding the global economic situation. Meanwhile, according to Bloomberg, HPE has held takeover talks with the hyperconverged infrastructure supplier.

Nutanix recorded $433.6 million in revenues for its first fiscal 2023 quarter, a 15 percent annual rise. There was a loss of $99.1 million, much improved from the year-ago loss of $419.8 million.

President and CEO Rajiv Ramaswami said: “We delivered a solid first quarter financial performance against an uncertain macro backdrop.”

CFO Rukmini Sivaraman said: “We continue to see good execution on our building base of subscription renewals and remain focused on driving towards sustainable, profitable growth.”

Nutanix’s total subscription revenue was up 18 percent year-on-year at $402 million. Drilling into that number, the company reported ACV Billings of $232 million, up 27 percent year-over-year.

Financial Summary:

- Gross margin: 81 percent, up from 78.5 percent

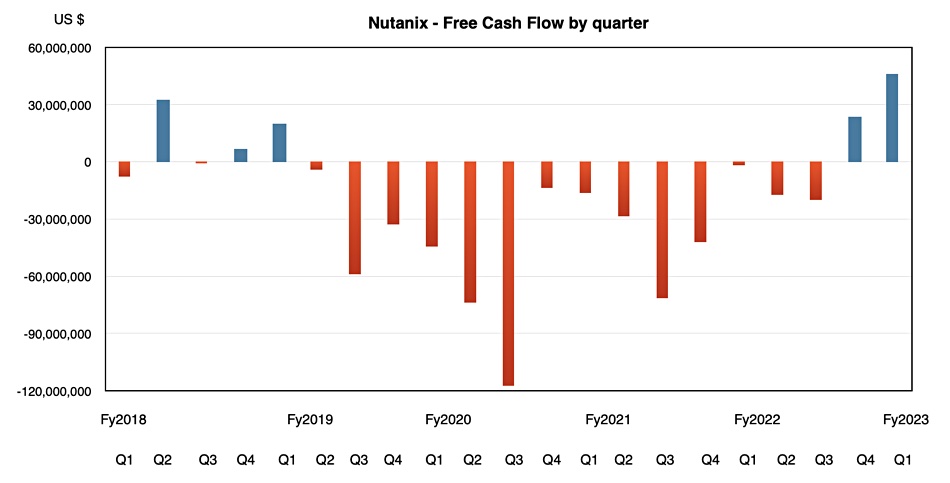

- Free cash flow: $45.8 million

- Cash & short-term investments: $1.39 billion

A look at Nutanix’s free cash flow history shows the progress it is making:

There has been a turnaround in the last two quarters, the climax of an improving trend that started in the fourth fiscal 2021 quarter.

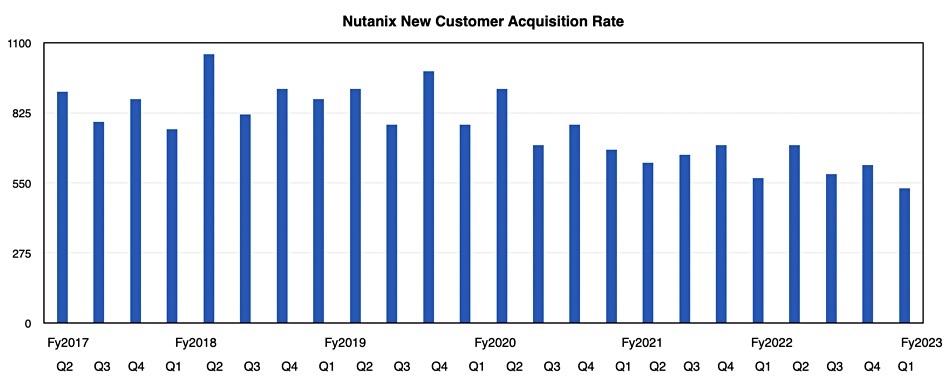

Nutanix gained 530 new customers in the latest quarter, taking its total to 23,130. There is a long-term downward trend in the customer acquisition rate:

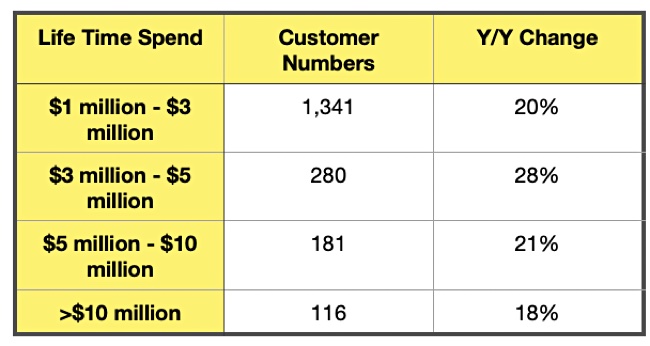

But Nutanix emphasizes that its customers steadily increased their spend with the company. A table shows this:

All the categories are showing growth and this strengthens confidence that Nutanix will become profitable.

In the earnings call Nutanix said customers were still buying IT products and services as part of digital transformation initiatives in spite of the weakening economic situation. It said it had experienced customers checking deals more closely. Supply chain issues had improved but not gone away.

Nutanix and HPE

It’s being reported that HPE has investigated a Nutanix acquisition and engaged in talks with the company in the past few months.

Nutanix was capitalized at $6.5 billion when the markets closed on November 30 with HPE valued at more than $21 billion. VMware, Nutanix’s main and larger competitor, is being acquired by Broadcom, and Nutanix may well feel safer as part of a larger entity such as HPE. HPE has two hyperconverged infrastructure (HCI) offerings; the Nimble dHCI (logically separate storage) line which has become the Alletra 6000 product family, and the SimpliVity products. The Nimble technology outsells the SimpliVity line by a wide margin.

By buying Nutanix, HPE would acquire the AHV hypervisor technology and then own hypervisor IP. Nutanix’s subscription business would be a natural fit with HPE’s GreenLake and give it an immediate revenue boost. There would be substantial cross-selling opportunities and Nutanix’s cloud business would be a good fit with HPE as well.

If the two companies can agree on a price then an HPE-Nutanix combination would be stronger competition for HCI market leader Dell (VxRail and VxFlex). HPE would have to somehow retain Nutanix appeal to, and availability on, third-party server hardware but that’s not impossible.

Outlook

The outlook for Nutanix’s next quarter is for revenues of between $460 million and $470 million, 12.6 percent more than a year ago and a tad slower growth than in the latest quarter. Nutanix is forecasting full 2023 revenues to be between $1.77 billion and $1.78 billion, which compares to the 2022 revenue total of $1.58 billion and would equate to a 10.8 percent increase at the mid-point.

This positive outlook is in line with those from HPE and Pure and contrasts with NetApp’s downbeat view of the next quarter.