File and object lifecycle management software suites like that supplied by Data Dynamics will become essential and virtually irreplaceable as the only way of making unceasing unstructured data sprawl manageable.

Data Dynamics’s software moves, manages, analyzes and secures data. Founder and CEO Piyush Mehta said his New Jersey-based company is 10 years old. It was started to build software to move files from one supplier’s filer to another. The company has evolved this migration capability to move files to lower-cost cloud and on-premises object storage.

And it has evolved its original file-scanning capability into a file and object scanning capability, leading to policy-directed user-managed file and object actions. Data retention rates and locations can be varied and manipulated based on access activity for example.

Mehta said that, as customers’ unstructured data has grown in amount, from terabytes to petabytes, and spread across hybrid-multi-cloud location then its management has become increasingly burdensome. His company lessens this burden and saves its customers time and money.

For example, an F200 bank enjoyed a 78.7 percent lower TCO with Data Dynamics’ data storage lifecycle management by moving little-used files to cheaper object storage. It had a total cost of ownership of $80.72 million for 57.67PB of data on file storage and $13.46 million for 26.39PB of object storage data. The bank used only 53 percent of its total usable file storage and paid a surplus of $26.38 million yearly for the unused storage capacity. The average cost of file storage per TB was $1,333, whereas it was $475 for object storage, ie 64 percent lower than file storage.

Business background

Data Dynamics is privately-owned and not VC-funded. It is profitable and so not being pushed towards an exit (IPO or acquisition) by VC backers wanting to get a return on their investment. However it did take in $9 million in July 2020 from investment banker DH Capital to expand its sales and marketing teams and grow its product portfolio.

The company has 145 employees – 119 in India focusing on R&D, 23 in the USA and three in Europe. It says it has analyzed and migrated more than 468PB of data in its existence to date and has a net customer retention rate of 160 percent.

Data Dynamics has more than 350 customers for its offerings, 28 of whom are in the Fortune 100. These buy from Data Dynamics and also from system integrators such as Capgemini, HCL, Infosys. Kyndryl and Tata Consultancy Services. Data Dynamics is resold by NetApp (migrate files to StorageGRID) and Lenovo, and has a go-to-market deal with Microsoft (free migration of data into Azure). It has relationships with Dell EMC and VAST Data to help their customers with file migrations.

Products

It presents itself as having three products and also four modules in a Unified Unstructured Data Management Platform, classified as solutions, and based on the three products:

- StorageX unstructured data migration software;

- Insight AnalytiX analytics software to discover, scan and tag unstructured data;

- ControlX to manage sensitive data and limit its exposure, decreasing risk and increasing compliance and governance, and based on acquired Infinitus Innovations content analytics software.

“Sensitive” means data containing personally identifiable information (PII) such as social security, credit card and passport numbers, etc. StorageX v9 came along in August and implemented Share and DFS analytics, NFSv4 and NFSv3 POSIX security translation, and support for versioned object mobility. InsightAnalytiX v1.4 was announced in March and added the ability to generate a Data Insight report on a dataset by building advanced multi-level logical expressions and a combination of logical operators.

The four UUDMP modules are Data Analytics, Mobility, Security and Compliance, Data Analytics relates to the Insight AnalytiX product. The ControlX product relates to the Security and Compliance Modules while Mobility relies on the StorageX product.

Competition and roadmap

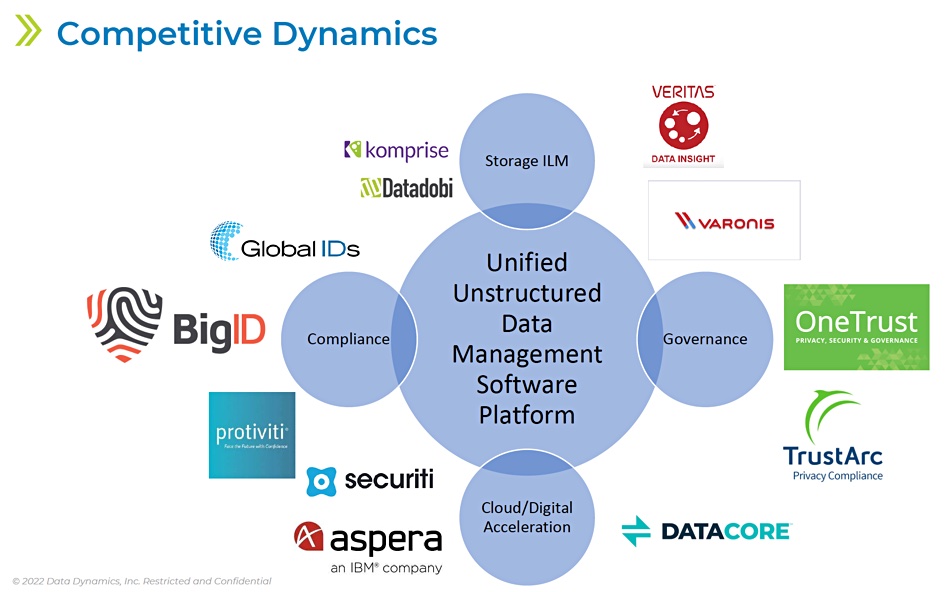

Mehta presented Data Dynamics’ competitive positioning to briefing attendees, using this slide:

It positions the company’s competition as providing point product capabilities around the edge of a unified unstructured data management platform area. The subtext is for customers to use Data Dynamics software instead of multiple products from competing suppliers. The competing suppliers may well provide a different view.

Datadobi, for example, says it is a data management supplier, with its StorageMap product scanning entire file and object storage estates and identifying non-active and little used data. ESG supported this and said the StorageMap product can reduce data storage cost, carbon footprint, and risk.

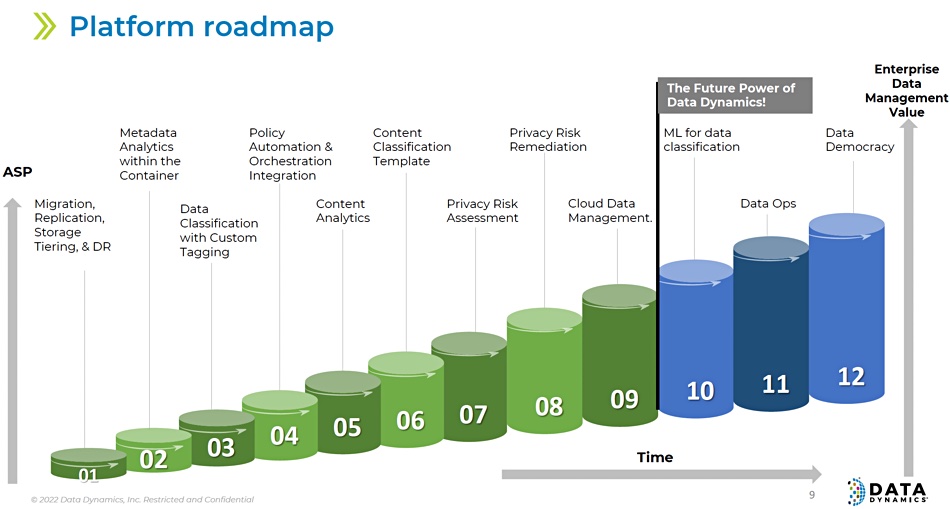

Mehta presented a roadmap slide:

We can see that using machine learning for data classification is the next item followed by DataOps and then increasing the ability of ordinary users to run data management and analytics functions on data without having to go through data scientist intermediaries (data democratization). Competitor Komprise is adding similar functionality to its Intelligent Data Management product.

We understand Data Dynamics is looking at bring structured data into its grasp as well.

Comment

Although Data Dynamics is a SaaS business and so customers can, in theory, switch to an alternative supplier easily, the products are sticky and have more and more utility as a customer’s unstructured data grows and grows, making its management a growing burden. This writer finds managing thousands of user files on one PC and a notebook takes an hour or so a week. A business with millions of files and objects spread across multiple servers, filers and object stores located in various datacenters and cloud locations faces gigantic task in comparison.

And then it becomes tens of million and hundreds of millions. File and object lifecycle management software suites like Data Dynamics will become essential and virtually irreplaceable. It’s a great niche business.

Boot Note

Net revenue retention rate is percentage of recurring revenue retained from existing customers over a given time period. A greater than 100 percent score means customers spend more with a supplier over time and the business can grow without having to acquire new customers.

DataOps refers to processes, workflows and automation to bring data to the people that needed it.