The world’s three major disk drive vendors delivered less capacity to customers in the third 2022 quarter than a year ago, and lower revenues from those shipments as the market reacted to the global economic downturn.

Wells Fargo analyst Aaron Rakers has taken shipment numbers from Seagate, Toshiba, and Western Digital, and research data from TrendFocus, to present a picture of an industry that’s had to apply the brakes. This is due to the Russia-Ukraine war, inflation, and recession fears all encouraging customers to spend less on spinning drives.

Total capacity shipped in the quarter was 292.7 EB, which is 19 percent less than a year ago. The total revenue derived from this was $4.42 billion, down 29 percent year-on-year.

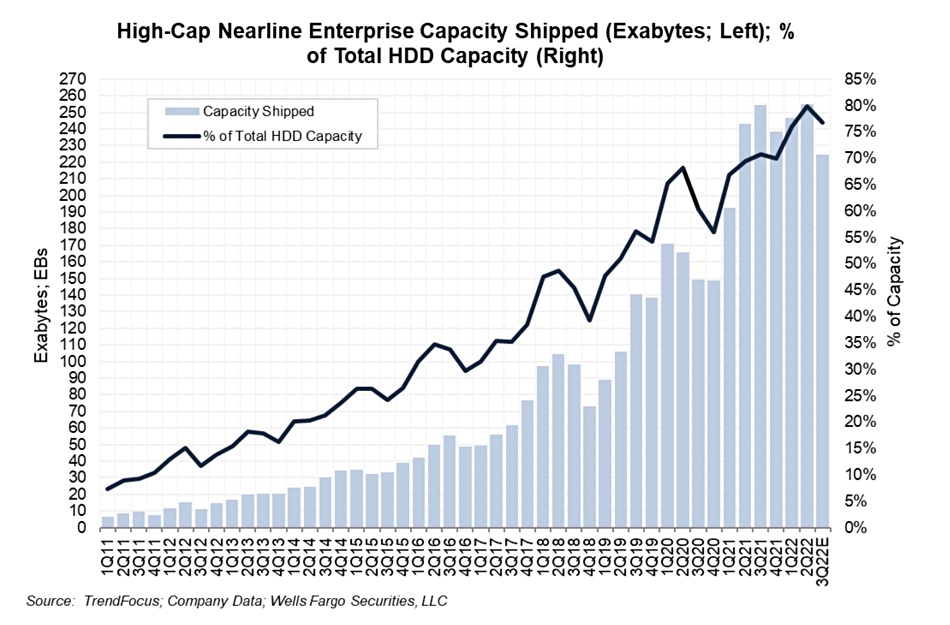

Nearline drives account for the bulk of disk drive shipments these days:

Such drives represent 77 percent of the total disk drive capacity shipped in the quarter, around 224.7EB. That’s down from the previous quarter’s 80 percent but well up on the year-ago’s 70 percent. As the world’s data is increasing, so too will nearline drive shipments – there is no cost-effective alternative to spinning disk.

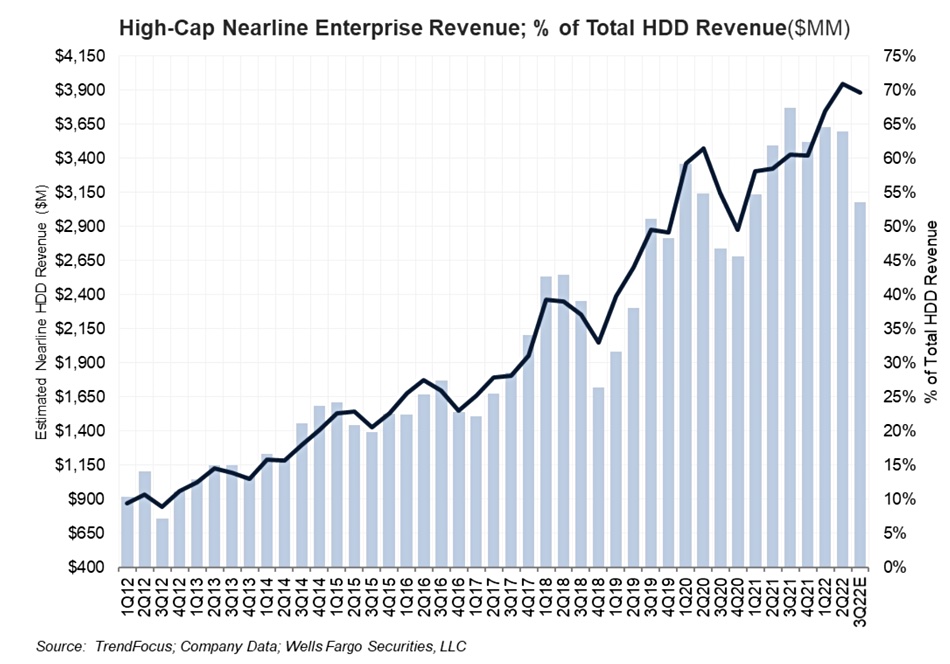

The nearline drive revenue chart closely matches the capacity chart:

Disk drive capacity shipped outside the nearline drive market fell 35 percent year-on-year to 68.0EB. That covers mission-critical, notebook, and desktop PC internal and external drives. Seagate shipped 49 percent of this total, Western Digital 38 percent, and Toshiba 14 percent. Seagate is dominating a shrinking market.

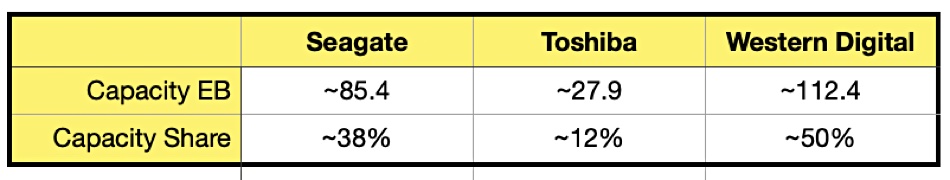

The vendors’ nearline capacity shares in the quarter were:

The winner in market share terms is Western Digital, accounting for around half of all nearline (high-capacity) 3.5-inch drive capacity shipped, compared to 44 percent a year ago. That was marginally higher than Seagate’s 43 percent, with Toshiba experiencing a year-on-year decline from Q3 2021’s 13 percent to this latest quarter’s 12 percent.

The capacity share value movements by Seagate and Western Digital are getting wilder, with Seagate having a steep fall in the latest quarter. Seagate is paying for its late introduction of its capacity-increasing HAMR (Heat-Assisted Magnetic Recording) technology while the other two vendors are benefiting from their use of MAMR (Microwave-Assisted Magnetic Recording) to increase capacity before they migrate to HAMR. Seagate believes it can catch up by shipping 30+TB HAMR drives by the middle of next year.

Meeting that schedule looks to be crucial for Seagate regaining lost ground.