A IT Press Tour briefing by Lightbits Labs in San Jose told us good things about Lightbits’s technology but a great unseen presence started becoming more visible throughout the pitch as it progressed. Several clues, when combined, indicate Intel is going to make a strong push for its partners to sell Lightbits software-powered NVMe/TCP-accessed storage servers full of Intel hardware.

Let’s itemise the various clues and then spin up the coherent picture we see being made from these pointers.

First, Intel is funding Lightbits. Intel Capital was the sole contributor to a September 2020 funding round according to Crunchbase, with the amount kept secret. At the time we wrote: “Lightbits Labs is working with Intel to make its NVMe/TCP all-flash arrays almost as fast as RoCE and InfiniBand options, which require much more expensive cabling.”

Lightbits supplies software-defined multi-tenant block storage from clusters of x86 servers fitted with NVMe SSDs and accessed across standard Ethernet using the NVMe/TCP protocol. This has a longer latency than NVMe over RoCE which needs more costly lossless Ethernet. Its software can extend QLC SSD endurance up to 20x which helps make flash data storage more affordable compared to disk.

Second, an Intel exec, Gary McCulley presented at our briefing. He is the director of the Data Platform Group, in Intel’s Data Storage Technology Business. It was nice to hear from him, but Lightbits execs could have told us about Intel and Lightbits working together.

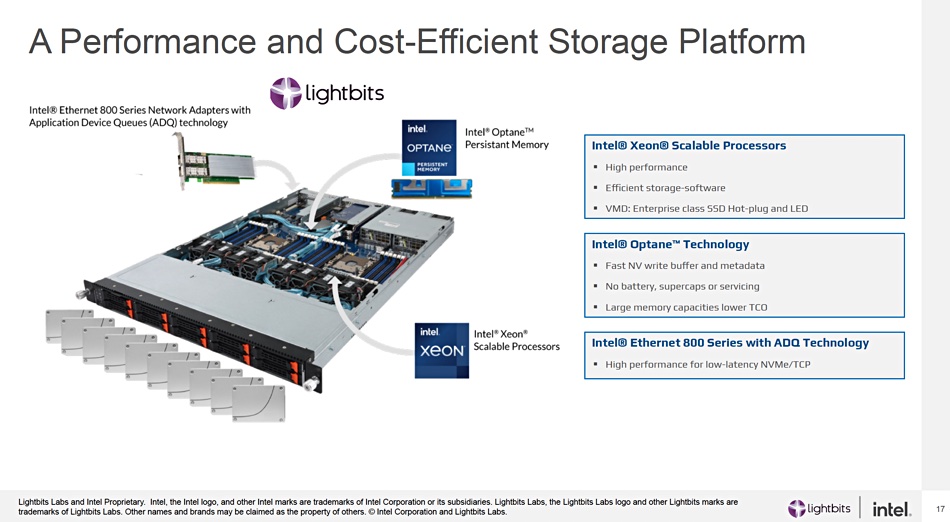

McCulley showed a picture of a server with Lightbits’s software utilising various Intel componentry:

- Gen 2 Xeon SP processors (IceLake);

- Optane Pmem 200 memory cards;

- 800 Series Ethernet NIC.

There was a slide for each of these followed by a summary slide saying Lightbits with Intel technology delivers “Hyperscale Storage for all.” It’s certainly good for Intel to be supporting a startup using its kit, but why go this extra mile?

Kam Eshghi, Lightbits; Chief Strategy Officer told me that Intel has 50 employees, many of them engineers, working full time on the Lightbits partnership. That made me sit up. It’s a lot of people, working on what exactly? Making sure Intel components and Lightbits software work well together, we suppose. But again, why the extra mile for this particular Intel partner?

Third, Intel’s IPU (data processing unit to accelerate east-west traffic in a datacenter) can be used by clients accessing a Lightbits storage cluster. They use an extended CSI plug-in.

Fourth, Lightbits has announced TCO Calculator and Configurator tools developed in collaboration with Intel. They provide Cloud Service Providers (CSPs), Financial Services, and Telco organizations with an intuitive way of determining the value of the Lightbits Cloud Data Platform. The tools highlight the TCO savings that can be made by using Lightbits software with Intel hardware.

Fifth, Lightbits has recruited two channel sales execs. In April it appointed Charla Bunton-Johnson as VP of Global Alliances and Channel. We were then told a key focus would be collaboration with Intel with reference to Xeon scalable processors, Optane Persistent memory (PMem), and Ethernet 800 Series Network Adapters.

Andrew Engledow joined Lightbits in May as EMEA sales director. He said Intel had been instrumental in helping UK telco BT buy a Lightbits storage system.

Sixth, we also learnt that the Lightbits partnership with intel included Intel’s sales organisation.

These six pointers are enough to get us asking: Why is Intel making such a big deal of this Lightbits technology? Is it planning on building and selling (storage) servers to large scale buyers, like telcos such as BT – or enabling server and storage hardware vendors to do this?

We think it’s the latter. Intel will use its hardware partners in the server and storage area to sell Lightbits storage clusters using Intel Xeon, Optane and Ethernet NICs, with, possibly, Solidigm SSDs, and also Intel’s IPU, to large-scale buyers (but not necessarily hyperscale) in the CSP, financial services and telco markets.

That’s our prediction. It gives intel an answer to Fungible (DPUs, NVMe/TCP, storage servers), and to other DPU vendors. And it could enable Intel’s partners to shift a lit of Intel-powered boxes, netting Lightbits substantial revenue growth.