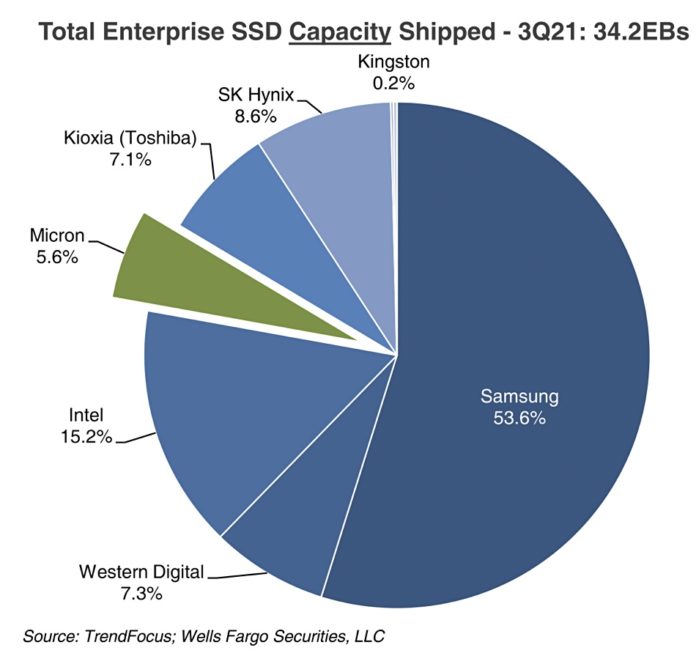

Intel and Samsung each accounted for about 35 per cent of enterprise SSD capacity shipped in 2019’s third quarter – but now Samsung has a market-dominating 53.6 per cent share while Intel’s has dropped to 15.2 per cent.

Update: contribution from industry analyst Mark Webb added. Jan 11, 2022.

These numbers come from analysts at TrendFocus ands Wells Fargo, and were revealed to subscribers by Wells Fargo analyst Aaron Rakers in an article about Micron’s prospects with its current 5.6 per cent share. We see that Samsung ships more enterprise SSD capacity than all the other suppliers combined, and a pie chart shows Samsung and the six dwarfs in this market:

Western Digital and joint-venture partner Kioxia have a combined 14.4 per cent share, placing them third in the market after Samsung and Intel. SK hynix with its 8.6 per cent share is in fifth place, with a proviso. As it now owns Intel’s SSD business, renamed to Solidigm, the combined SK hynix-Solidigm enterprise SSD ship share is 23.8 per cent, putting it in second place behind Samsung. That puts the WD-Kioxia combo in third place.

Micron is in sixth place in Raker’s chart with a share near enough 10 per cent of Samsung.

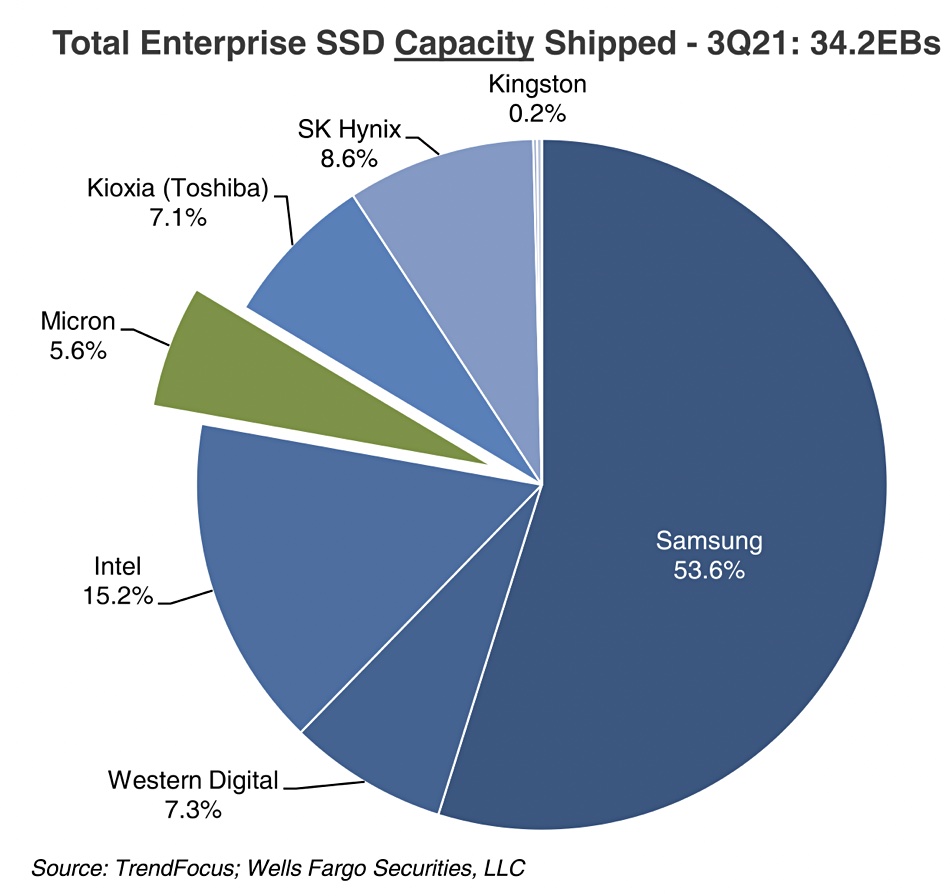

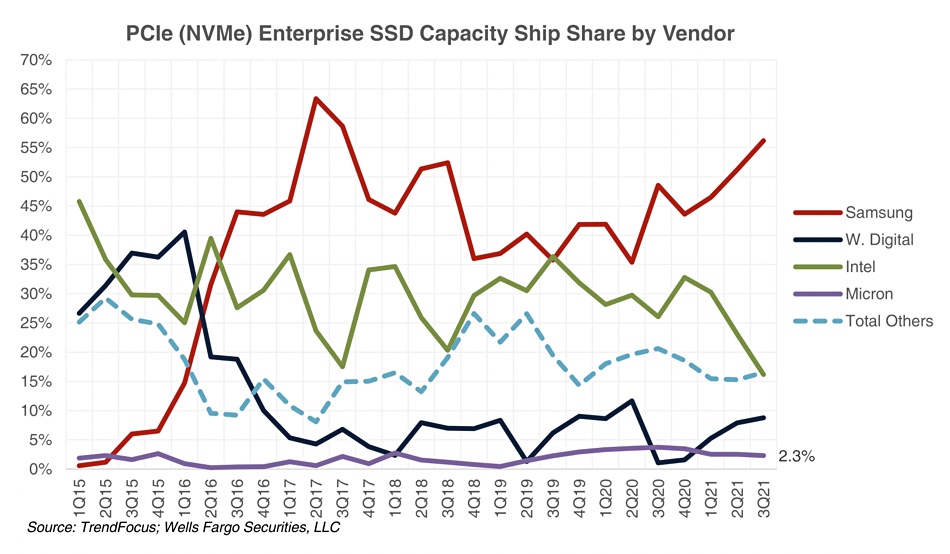

A look at vendor shipment share numbers since the start of 2015 shows Intel originally leading the market and then throwing its first place away, first to Western Digital and then to Samsung. WD’s decline has been even more dramatic than Intel’s.

SK Hynix’s share is included in the “Others” category along with Kioxia. Micron’s share is visible and shows it never has been a leading player in this market.

Industry analysts Mark Webb tells us: “WDC dropped when Samsung got into the game. Prior to this WDC and Intel had a partnership on SAS drives and Samsung jumped in and disrupted everything. Intel/Solidigm will be interesting. the Challenge is that Intel is a great brand name in data centre (enterprise is a different, more narrow definition in my book). Will that brand keep up with the same people but a different parent company? Will Intel Datacenter group promote Solidigm or WDC, Samsung, etc?

“Should be interesting but Samsung clearly has the dominant position and doesn’t look to give it up anytime soon. In my opinion, WDC and Kioxia are both in a position to gain market share…. They have expertise and scale and [the] ecosystem allows large increases in data centre SSD business.”

Watching suppliers’ progress in this market is like watching oil tankers race each other – ship share changes are made at slow rates.

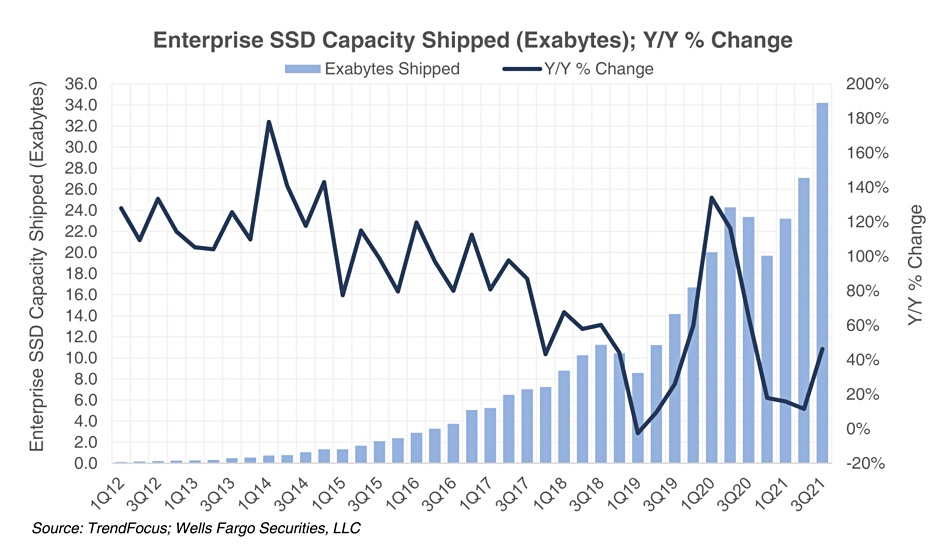

Overall the growth in shipped enterprise SSD capacity has been impressive:

The COVID pandemic appears to have caused a slump in the year-on-year growth rate, from the first 2020 quarter to 2021’s second quarter, but growth has always been positive apart from the zero growth registered at the start of 2019.

The obvious question to ask is: can SK Hynix get the acquired Intel enterprise SSD business growing again? Over to you Rob Crooke, Solidigm CEO.