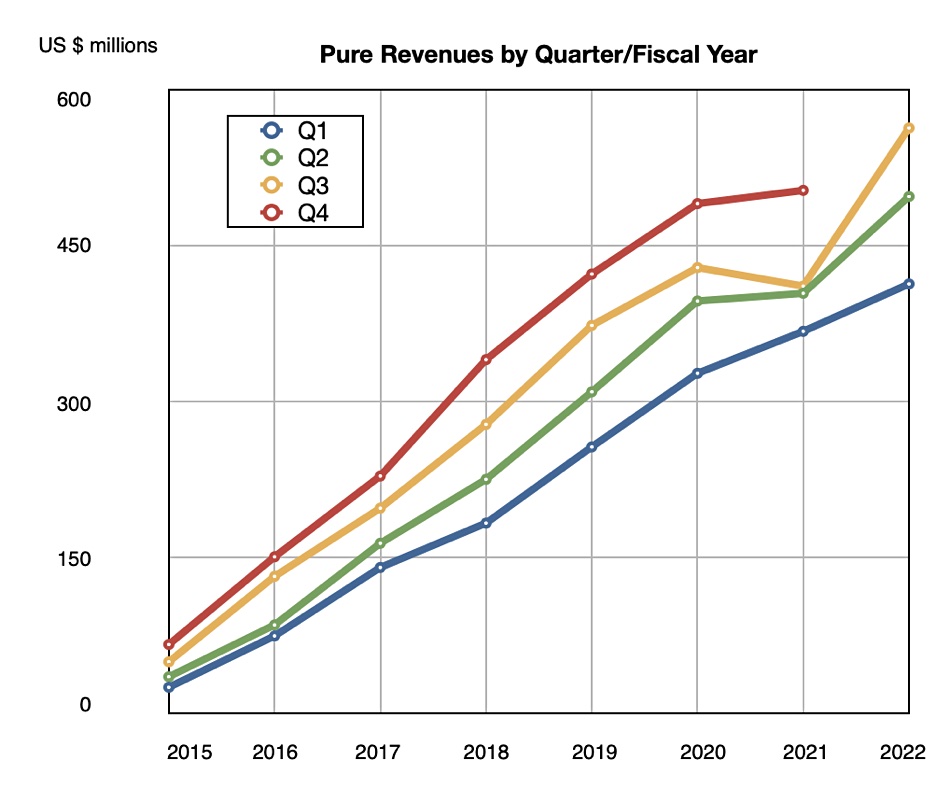

Pure has grown third quarter revenues a whopping 37 per cent year-on-year, surging back after last year’s third quarter 4 per cent revenue fall. That was its first negative growth quarter since we started reporting its results more than five years ago.

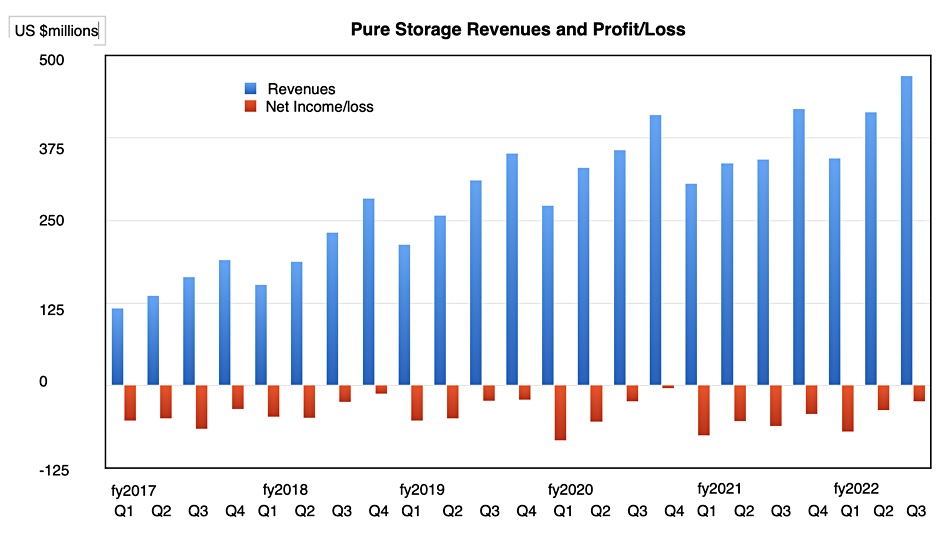

Revenues in the quarter ended October 31, 2021, were $562.7 million. They were $410.6 million a year ago, with a loss of $28.7 million — less than half the year-ago $74 million loss. But look at the quarterly trends so far this fiscal year. The chart below shows a declining loss trend throughout this fiscal year and if the fourth quarter comes in at the predicted $630 million then Pure could turn a profit — a GAAP profit — its first ever. That would be a landmark event in its history.

Chairman and CEO Charlie Giancarlo said in his results statement: “With Q3 revenue up 37 per cent year-over-year and with increasing profitability, it’s clear that Pure continues to set the pace for the industry.”

CFO Kevan Krysler said: “Our strong Q3 performance was fueled by increased customer demand and execution across the entire business. We are in a great innovation cycle with our portfolio.”

Giancarlo’s prepared remarks reflected this, as he predicted: “Our next announcement, on December 8th, will … extend the breadth of our FlashArray platform.”

Financial summary:

- Subscription services revenue — up 38 per cent year-on-year;

- Subscription Annual Recurring Revenue (ARR) — $788.3M, up 30 per cent year-over-year;

- Gross margin — 66.6 per cent;

- Operating cash flow — $127.0M;

- Free cash flow — $101.3M;

- Total cash and investments — $1.4B.

Pure gained 345 new customers in the quarter — 12 per cent year-over-year growth — taking its total to, we calculate, just shy of 10,000 (actually 9,992 give or take).

The Q3 revenue bounce back is seen clearly in a chart of revenues by quarter by fiscal year — see the yellow line’s dip and steep ascent.

The trends are good and Pure has uplifted its full year forecast to $2.1 billion — a 25 per cent increase on FY2021. This, with its Q4 $630 million contribution, rebuts any ideas that the Pure would be hit hard by the departure of sales chief Dominic Delfino earlier this month. He was replaced by Dan FitzSimons, who got a “special shout-out” from Giancarlo.

Earnings call

Giancarlo said in the earnings call that Pure had: “double-digit quarter-over-quarter growth across all product lines and across both US and the international markets” and “Pure continues to take share.”

He made a remark that strengthens our belief that Pure could make a profit in the next quarter: “We are also pleased with our strong profitability trend continuing through this fiscal year.” Krysler said he saw no sign of demand relaxing in his initial look at the next fiscal year.

Giancarlo acknowledged supply chain problems but said they had been largely overcome. “This past quarter, global semiconductor availability was more challenging than last quarter, and we expect this environment to continue into next year. However, our operations team and the strong partnerships we’ve built with our suppliers have continued to work well, minimising impacts to our customers and our business.”

Pure will publish its first environmental, social and governance report early next calendar year, with Giancarlo saying: “Pure’s products use dramatically less energy and create far less waste than competitive offerings.”

Hyperscaler FlashArray//C sale

Krysler dropped this gem about a product sale: “Our sales growth this quarter also includes sales of FlashArray//C to one of the top 10 hyperscalers.” A $10 million-plus FlashArray//C sale to a hyperscaler was predicted back in August. Without that sale the quarter’s growth “would more likely be in the high 20s,” rather than the reported 37 per cent. This particular sale could be repeatable with Krysler saying: “No reason for us not to believe that it’s repeatable and conversations continue.”

Giancarlo said that: “It’s also worth noting that the overall footprint savings was a key part of winning the initial deal,” referring to a disk-based alternative.

He talked about a disk-to-flash crossover, saying: “We believe very strongly that as flash continues to decline relatively to the declines in magnetic disk, that there’s inevitably going to be a crossover point where every player everywhere including the hyperscalers will start switching from disk to flash. And it’s just a matter of time and their particular use case or instance before that happens. … before flash is used in a more … mainstream way in the hyperscale environment.”