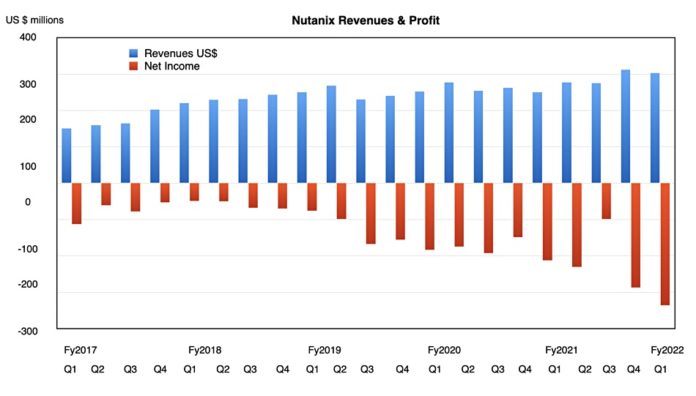

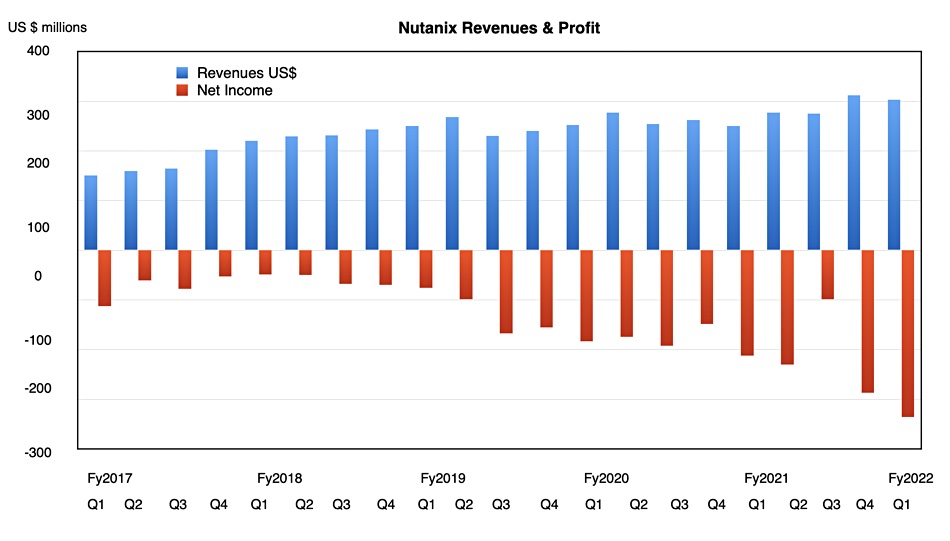

Nutanix reached a negative landmark, with losses exceeding revenues in its latest quarter, but financial analysts are happy with its progress.

Revenues were $378.52 million in its first fiscal 2022 quarter, which ended October 31, up 21 per cent annually, for a loss of $419.8 million. For every dollar it earned Nutanix spent $1.11 — it bought its growth. The year-ago quarter’s loss was $265 million. In the previous quarter it dropped 92 cents in costs for every dollar of revenue. Things have got worse.

President and CEO Rajiv Ramaswami’s results statement read: “Our first quarter was a good start to our fiscal year, demonstrating strong year-over-year top and bottom line improvement.” The “bottom line” term certainly did not refer to GAAP net income.

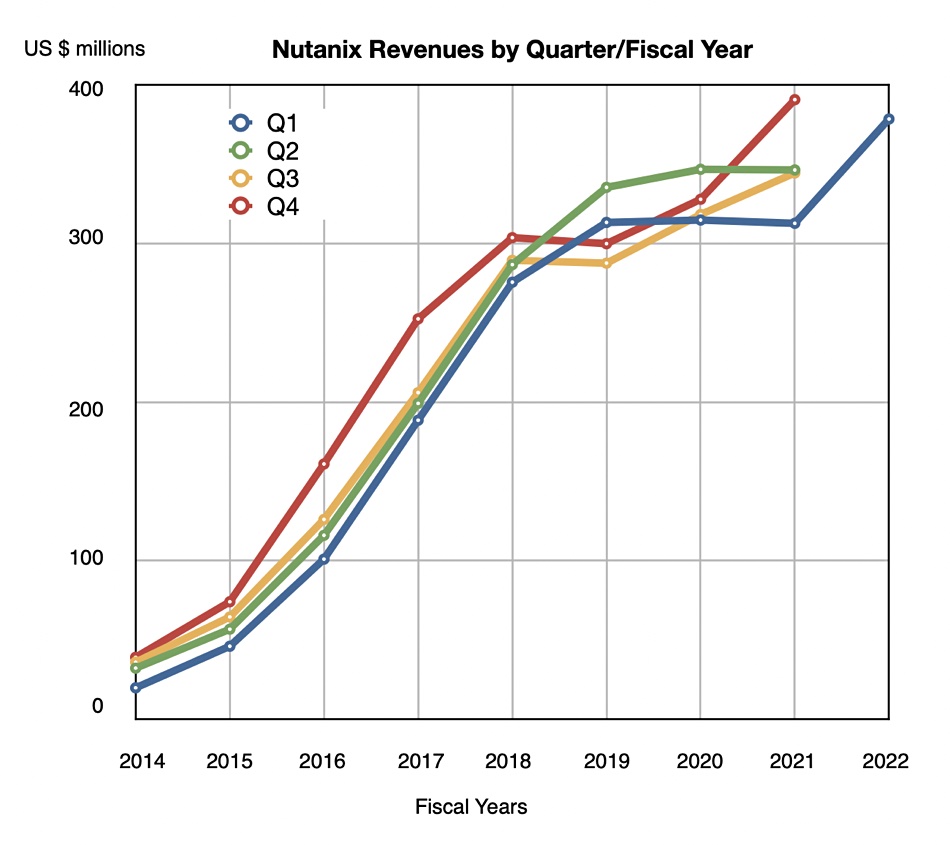

CFO Duston Williams said: “We achieved record ACV billings, which grew 33 per cent year-over-year, and saw 21 per cent year-over-year revenue growth, our highest growth in over three years.”

Financial summary

- Free cash flow — improved to -$1.9M from -$16.3M a year ago;

- Gross margin — 78.5 per cent compared to 78.3 per cent a year ago;

- Annual Contract Value (ACV) — $183.3M vs last year’s $137.8M, up 33 per cent;

- Annual Recurring Revenue (ARR) — $952.6M vs $569.5M a year ago;

- Cash and cash equivalents at end of period — $350.99M compared to $504.5M last year.

The quarter was the third in a row showing annual growth and one with a steep rise:

Nutanix announced a strategic partnership with Citrix in the quarter which was unfortunately followed by Citrix announcing a restructuring and layoff program and the departure of CEO David Henshall. That’s unfortunate timing.

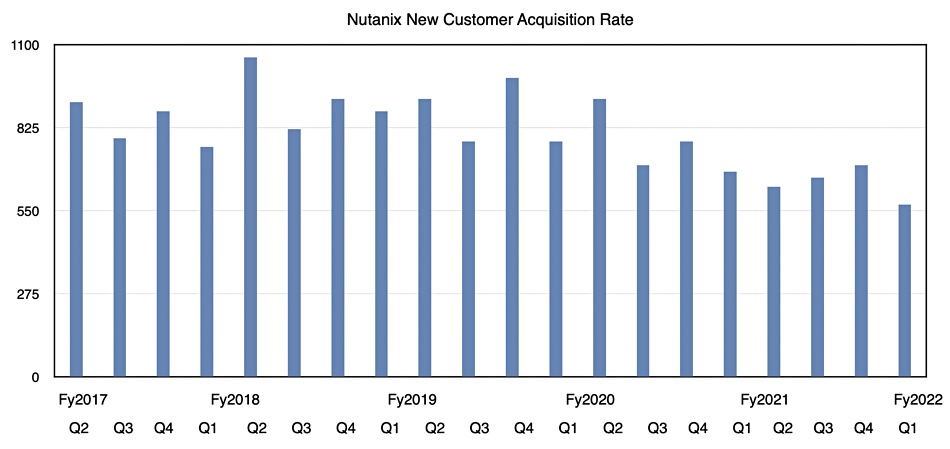

Nutanix grew its customer count by 570 in the quarter to a total of 20,700 but the increase was the lowest for five years or more. The customer acquisition rate trend is downwards. We might say Nutanix is spending more, as shown by deepening losses, to gain fewer new customers.

But customer spend increased and analysts were not concerned, as we shall see.

There was a minimal impact of Nutanix’s business from the COVID resurgence, as customer businesses have learnt how to do remote working. There was little to no supply chain impact as Nutanix has multiple hardware partners.

Nutanix saw more customers buying more products — 42 per cent of customer deals involved at least one so-called emerging product, which includes all add-ons beyond the basic HCI offering. This was up slightly, 7 points Nutanix said, year-on-year. A basis point is equal to 1/100th of one per cent, which is why we said it was up slightly.

Analyst views

Wells Fargo’s Aaron Rakers told subscribers: “[Nutanix] delivered positive F1Q22 results (and forward guide) driven by a seasonally strong federal business, significant upselling, and continued execution on subscription renewals.” He said Nutanix “provided investors with increased confidence in the company’s path to profitability,” and “Nutanix expects significant growth in emerging products and new ACV bookings in F2Q22.”

Rakers commented on the customer acquisition rate: “While new logo additions decelerated, Nutanix’s ASP per new logo was up year over year and quarter over quarter as it focuses on quality/efficiency of new logos. [Nutanix] now has 1,580 customers that have purchased >$1 million, up 68 quarter over quarter.”

Williams said in the earnings call: “We are generating more new logo ACV bookings with less new logos,” which explain’s Rakers’ view.

William Blair’s Jason Ader said: “Nutanix reported another solid beat-and-raise in its fiscal first-quarter print as the company benefited from improving hybrid cloud infrastructure demand, returns on its solution selling investments (including higher win rates, healthy renewals, and a strong attach rate for add-on products), and enhanced partner leverage.”

Ader also sees a “significant renewal opportunity ahead”. He pointed out that: “Management continues to view its rapidly approaching renewal opportunity as the key to unlocking operating leverage and achieving its target of free cash flow break-even in the next 12–18 months (as well as operating profit in calendar 2023).”

This means analysts were not concerned over the big loss, with Ader saying: “The company gained operating leverage from the higher revenue and spent less than expected.” But he did point out: “Risks to the Nutanix story include competition from Dell/VMware and cloud titans, a high cash burn and deep level of operating losses.”

Guidance

The guidance for the next quarter is for revenues between $400 million and $410 million — an annual increase of 16.9 per cent at the $405 million mid-point. Growth is slowing. Revenue guidance for the whole fiscal 2022 year is $1.615 to $1.630 billion — a 16.7 per cent increase on FY2021 at the mid-point.