File management and tape system vendor Quantum recorded its second consecutive growth quarter with $93.2 million revenues for Q2 2022 ended September 30. Revenues would have been higher but for supply chain issues and having to pay more to get materials delivered.

Revenues were 8.6 per cent more than a year ago, but came with a $9.6 million loss — worse than the year-ago $4.6 million loss. That was partially attributed to charges from extinguishing debt.

Chairman and CEO Jamie Lerner’s results quote explained: “Our second quarter results exceeded the high-end of our guidance range across all key metrics, supported by strong customer demand while increasing backlog to over $50 million. Orders from our hyperscale customers grew sequentially for the third consecutive quarter, and while not all orders will ship in the subsequent quarter, visibility into revenue contribution from this growing base has improved dramatically relative to a year ago.”

Supply chain problems affected the numbers, with Lerner arguing “The ongoing industry supply constraints improved during the quarter, but still restricted our ability to meet all end customer demand. We anticipate supply chain constraints will see further improvement in our third fiscal quarter, which should allow the company to see a sequential reduction in current backlog levels.”

CFO James Dodson added numbers to this: “The second fiscal quarter revenue doesn’t include just over $15 million of orders that were requested by customers in the quarter, but could not be fulfilled due to supply constraints.”

Dodson explained: “Just over 85 per cent of the backlog was related to tape products, with just over 70 per cent of the backlog specifically related to hyperscaler customers. Approximately 2/3 of the backlog is expected to be shipped in the second half of fiscal 2022, and the remaining 1/3 of the backlog … early in fiscal year 2023.”

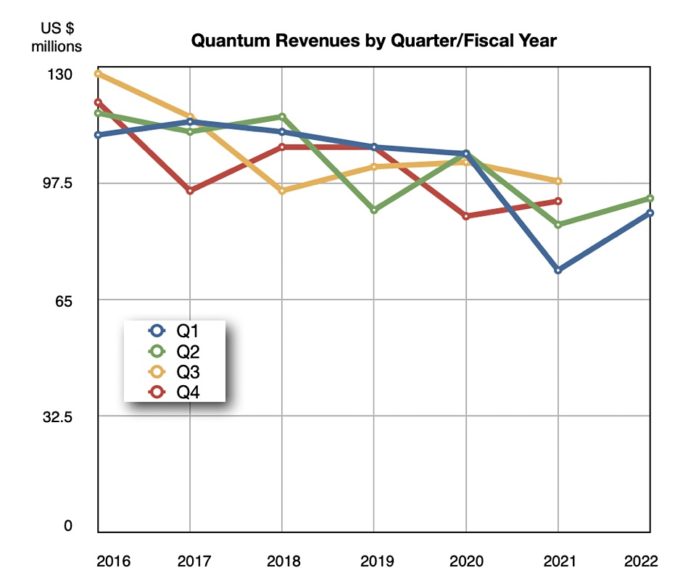

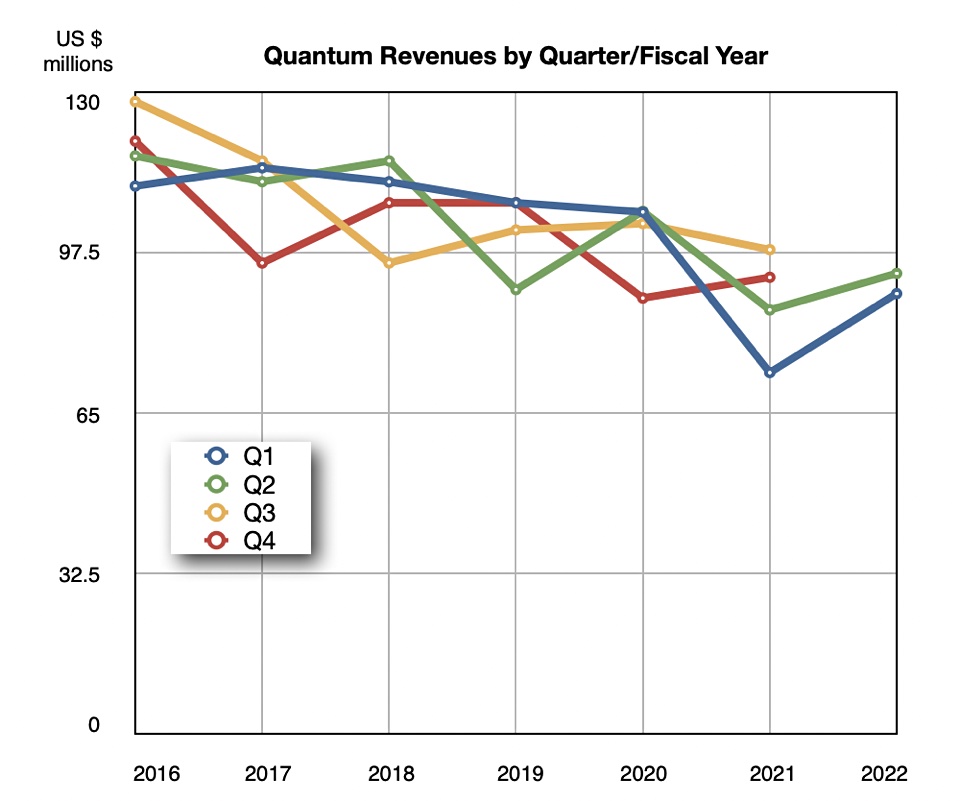

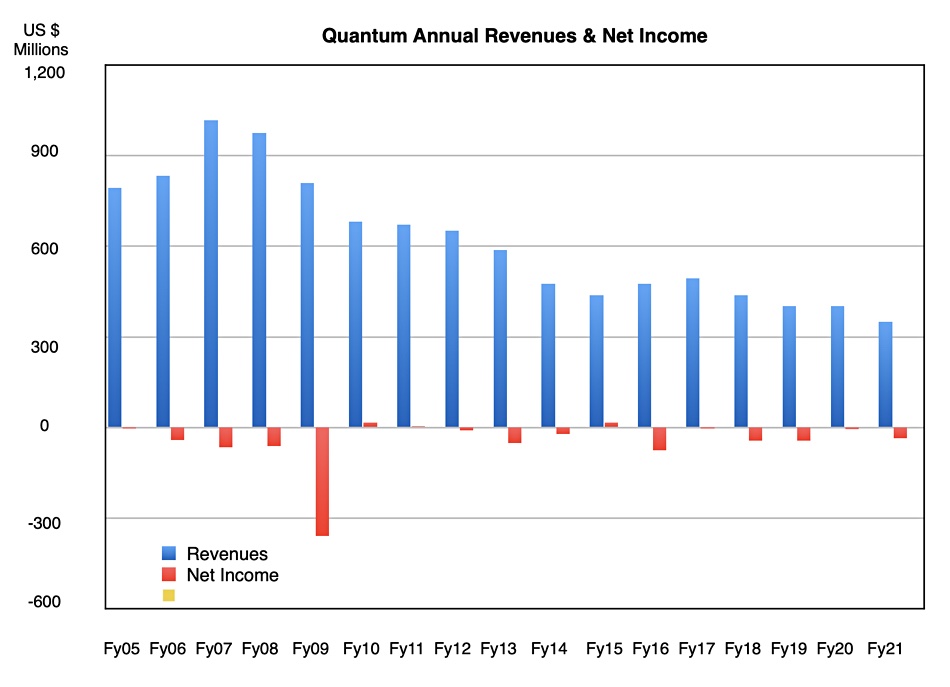

Quantum’s multi-year revenue decline, which started in its fiscal 2008, could have reached its low point in FY21.

However, as the chart above indicates, there was an earlier attempt to climb out of this trough — in fiscal years 2016 and 2017 — which fizzled out. We better hold our excitement until the end of FY2023 before concluding that Quantum is well and truly back as a growth company.

Highlights

- The CatDV asset management software recorded a second consecutive quarter of increased bookings.

- Cash and cash equivalents including restricted cash was $23.2 million at quarter end, compared to $24.6 million at the end of the previous quarter.

- More than 70 per cent sequential growth in recurring revenue.

- More than 30 per cent sequential growth in the recurring revenue customer count to about 200.

- $22 million reduction in annual interest payments.

During the earnings call we learnt from Lerner that: “Today, surveillance cameras are the number-one generator of data on the planet, and the total number of cameras as well as the resolution required of the cameras is continually increasing. Overall required retention times of video surveillance data is increasing as well. Combined, all these trends lead to a need for more storage capacity, more infrastructure, more software and more video analytics.”

This is very good news for Quantum, and it has finished integrating the acquired Pivot3 video surveillance HCI business into its own operations.

The supply chain situation has improved during the quarter, with Lerner saying: “We are receiving much larger shipments of the tape component that we lacked … overall, the situation has improved dramatically.”

He also said the business coming in from Pivot3 should increase as: “Our entire sales team is now compensated to cross-sell surveillance into our large and loyal installed base, and we’re starting to see quite a bit of traction from that in the pipeline as well as in quarter. So we are, right now, for last quarter and for the quarter in front of us, we’re beating our internal objectives with our surveillance business.”

Supply chain price increases

Quantum has added price increases because of the supply chain issues and, separately, it’s moved products to subscription pricing. Lerner explained: “We actually have instituted a series of those programs. We first instituted a 1.75 per cent across the board surcharge to deal with predominantly the increase in transportation fees and shipping fees. We moved the StorNext product to subscription. And as we’re moving DXi to subscription in that, we’re instituting price increases in the eight per cent to 15 per cent range based on various products.

“Same thing with ActiveScale cold storage. With the introduction of that product, we’ve added price increases. We introduced the 84000, and we’ll be introducing the 84,000 Essentials. And those are both at premium pricing as well. So we are doing a combination of surcharges across the board and then product-specific price increases as well.”

He pointed out: “We’re paying extra to get drivers, quite frankly, to get trucks to show up on time. We’re paying a premium for that.” Quantum doesn’t expect such surcharges to last though.

It’s also asking for deposits from large customers which require Quantum to buy a lot of component material up front and hold it on its books for months — six, nine and even twelve months.

Guidance

Quantum’s guidance for the next quarter sets expectations at $104 million revenues plus/minus $5 million. The $104 million would be a 6.1 per cent increase on the year-ago Q3.

The guidance for the fiscal year is for revenues between $380 million and $420 million — $400 at the mid-point which would be a 14. 4 per cent increase on FY2021 revenues.

Quantum will hold a virtual analyst day event on November 9 and outline its change to an annual recurring revenue business model. Lerner did say: “The only thing at this stage that is not on subscription is our surveillance business and our tape hardware business.” We expect that to change in Quantum’s FY2023.