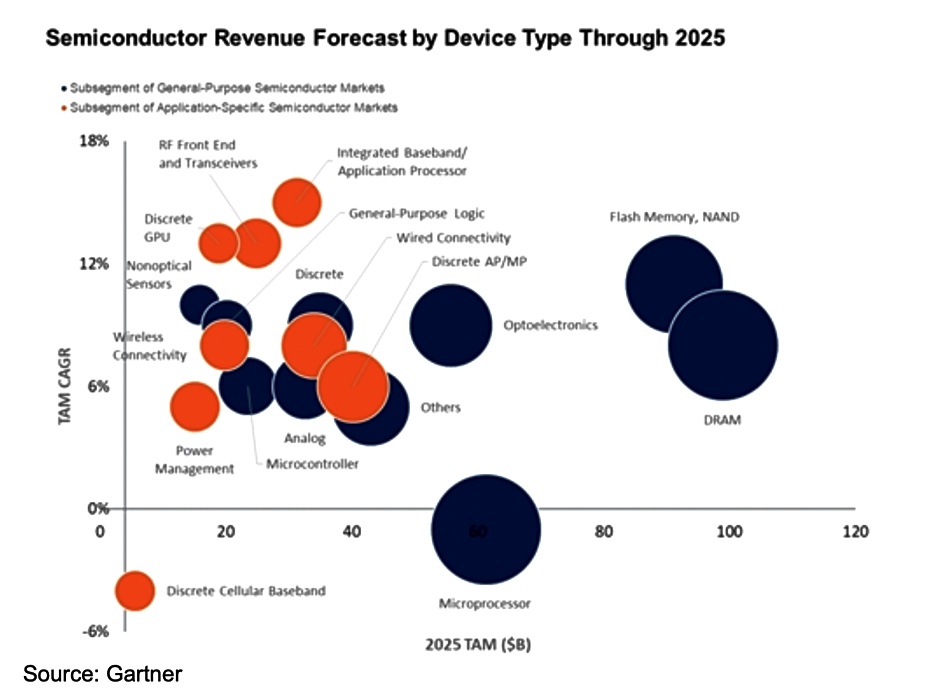

A Gartner semiconductor revenue forecast out to 2025 shows that DRAM has the largest total addressable market (TAM), followed by NAND and then microprocessors.

Wells Fargo analyst Aaron Rakers told subscribers about Gartner’s second 2021 quarter global semiconductor revenue forecast out to 2025, which has bigger numbers from the first 2021 quarter forecast document. This was due to Gartner increasing its calendar 2021 and 2022 forecast by $25.7 billion (+4.7 per cent vs prior) and $25.3 billion (+4.2 per cent) respectively.

The prime driver is a larger forecast for DRAM and NAND revenues due to DRAM under-supply and NAND price rises. A chart showing semiconductor revenue by device type caught our eye as it showed that microprocessor, DRAM and NAND revenues were the three largest categories.

Judging by the chart circle positions the microprocessor total addressable market TAM) will be about $60 billion, NAND $90 billion and DRAM $100 billion. The microprocessor TAM growth out to 2025 is negative. DRAM has a >6 per cent TAM CAGR with NAND’s CAGR being more than ten per cent.

Yangtze Memory Technologies Co

Separately, Rakers told subscribers that Chinese media outlet Global Times reports China’s state NAND champion, Yangtze Memory Technologies Co (YMTC) is now mass-producing its 128-layer, 3D NAND. Shenzhen-based Powev Electronic Technology has Asgard-brand SSDs on sale using the YMTC flash.

Intel, Kioxia, Micron, Samsung, SK hynix and Western Digital account for 98 per cent of NAND market markets according to TrendForce, so YMTC has a mountain to climb to reach a significant presence in the global NAND market.

YMTC’s product development may be affected by parent Tsinghua Unigroup’s bankruptcy problems.