NetApp’s latest results were higher than expected, “capping off a solid year of growth” in CEO George Kurian’s view, as NetApp gained storage market share against flat storage revenues from Dell and lower growth from HPE.

NetApp revenues in its fourth fiscal 2021 quarter ended April 30 were $1.56bn, up 11.4 per cent Y/Y, with profits up 70.4 per cent to $334m. This was NetApp’s fourth successive quarter of revenue and profit growth.

Revenues in its full fiscal 2021 were $5.74bn, up 6.1 per cent, but below fy2018 ($5.92bn) and fy2019 ($6.15bn). Full year profits were $730m, down 10.9 per cent year on year.

Kurian said in his prepared remarks: “We delivered strong fourth quarter results, capping off a solid year of growth. Our results were all above our Q4 guidance ranges. I am most excited by the return of product revenue to growth, the strength of our public cloud ARR, and an all-time high free cash flow.”

In the earnings call CFO Mike Berry mentioned: “accelerating enterprise demand throughout the quarter.”

Financial summary:

- Gross margin – 67.3 per cent,down from the year-ago 68 per cent.

- Operating expenses – 44.2 per cent, down from year-ago 44.9 per cent.

- Cash provided by operations – $559m vs $383m a year ago.

- Deferred revenue – $4.0bn, up 8 per cent Y/Y

- Free cash flow – $521m – an all-time record.

- Cash, cash equivalents and investments – $4.60bn at quarter end.

- EPS – $1.46 vs $0.88 a year ago.

Business segment summary for quarter:

- Product revenues – grew 6 per cent Y/Y to $840m

- Product hardware – $360m, down 6.7 per cent Y/Y

- Product software – $480m up 18 per cent Y/Y

- Cloud services annual recurring revenue (ARR) – $310m, up 171 per cent Y/Y.

In the all-flash arrays area revenues grew 11 per cent Y/Y with a $2.9bn run rate. Some 28 per cent of its installed base is now running all-flash arrays, compared to 27 per cent last quarter. That leaves lots of headroom for growth.

Specific revenues for product segments such as ONTAP, E-Series, SolidFire and StorageGRID were not provided.

NetApp said it had continued share gains in hybrid and all-flash arrays. Regarding cloud-based revenues Kurian said: “Cloud Volumes for storage; Cloud Insights for monitoring; Spot for compute management, all had really strong Q4s.” He said these were “really strong innovation engines” and NetApp had seen “really good success with Microsoft (Azure) in terms of their route to market. We’re working with the other hyperscalers to also train and expand the range of ways we take our products to market with them.”

Wells Fargo analyst Aaron Rakers told subscribers: “NetApp’s commentary points to notable momentum at Microsoft Azure – e.g., noting that Microsoft is asking NetApp to deploy more of the NetApp systems in the Azure cloud.”

NetApp now describes itself as a cloud world software company, and has a $1bn ARR target for fiscal 2025. Getting, for example, AWS and the Google Cloud to provide as much revenue as Azure would help achieve that target.

He also said: ”We saw good expansion in the number of customers and strong growth in the number of new-to-NetApp customers.” Rakers said NetApp gained more than 1,500 new customers in its fy2021, via public cloud services. William Blair analyst Jason Ader pointed to NetApp’s “good progress with its Keystone storage-as-a-service model with many new wins in the fourth quarter (including NetApp’s largest-ever Keystone win).”

NetApp is guiding next quarter’s revenues to be between $1.37bn and $1.47bn. That’s a 9 per cent rise from a year ago at the mid-point, $1.42bn.

In general it sees a strong recovery in the Americas over the next few quarters, Europe lagging 6 to 9 months behind, and the rest of the developing economies maybe 6 to 9 months after that.

Storage industry: Up is down

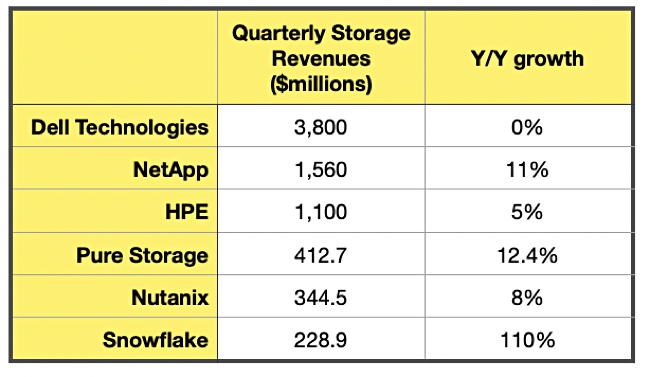

We can summarise recent storage industry quarterly results in a table:

The largest storage company company, Dell Technologies, recorded no year-on-year growth while the smallest one, Snowflake, reported 110 per cent Y/Y growth. NetApp grew more than HPE and was also more profitable, with profits representing 21.4 per cent of revenues versus HPE’s profits being 3.9 per cent of its overall revenues. Pure and Nutanix both made losses.

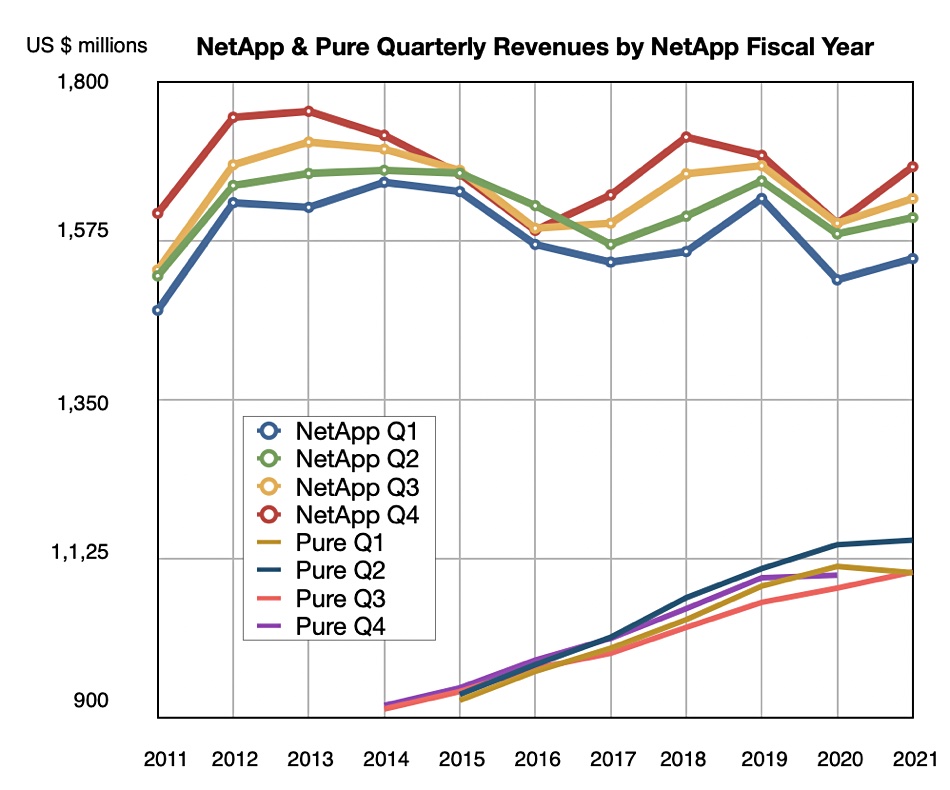

NetApp is also outgrowing Pure Storage, as a look at the rightmost column in the table below indicates:

NetApp has had four successive quarters of growth while Pure has had only two growth quarters in the same period.

Kurian pointed out: “Based on our growth, I am confident that we have gained share in the storage and All-flash markets.” He mentioned a couple of specifics: “The all-flash array market will grow at about 7.5 per cent CAGR, and we expect to outpace that this coming year. We expect that the storage industry will grow around 4 per cent, and our revenue picture expects us to outpace the growth of the storage industry overall.”