HPE has reported earnings showing a Y/Y increase in overall revenues, as the edge, compute, HPC and storage segments all reported business increases. For the storage segment, it was particularly welcome reprieve after six consecutive quarters of decline.

The firm was confident enough to issue a third dividend for this fiscal year.

In the first 2021 quarter, ended April 30, HPE reported $6.7bn in revenues, up 11 per cent Y/Y, with a profit of $259m, just 3.9 per cent of revenues. It was HPE’s third consecutive quarter of Y/Y top line growth. in Dell’s equivalent quarter, its $938m profit was 9.4 per cent of its revenues, indicating that HPE has comparatively higher costs.

Antonio Neri, HPE’s president and CEO, said of the results: “We are strengthening our core compute and storage businesses, doubling down in our growth Intelligent Edge and HPC businesses and accelerating our pivot to as-a-service, while also advancing our cloud-first innovation agenda to become the edge-to-cloud platform as-a-service choice for our customers and partners.”

Financial summary:

- GAAP EPS – $0.19, above the previously provided outlook of $0.02 to $0.08 per share,

- Cash flow from operations – $822m up $722m Y/Y,

- Free cash flow – $368m, up $770m,

- Non-GAAP Gross margin – 34.3 per cent, up 0.02.1 per cent Y/Y and a record,

- Cash and cash equivalents – $4.625bn, up 9.3 pr cent Q/Q,

- Dividend – $0.12/share and the third dividend in HPE’s Fy2021.

Business segment results:

- Intelligent Edge revenue was $799m, up 20 per cent from the prior-year period,

- High Performance Compute & Mission Critical Systems (HPC & MCS) revenue was $685m, up 13 per cent,

- Compute revenue was $3.0bn, up 12 per cent,

- Storage revenue was $1.1 billion, up 5 per cent,

- Financial Services revenue was $839m, up 1 per cent,

- Corporate investments & other was $350m, up 47.7 per cent.

HPE said the Aruba Edge Services platform supports well over 100,000 customers with 150 new customers added every day.

Within the storage segment, HPE said there was notable strength in software-defined storage, including Nimble, up 17 per cent Y/Y when adjusted for currency, with strong momentum in dHCI growing triple-digits. All flash arrays grew 20 per cent from the prior-year period led by Primera, the 3PAR replacement array, also up triple-digits from the prior-year period.

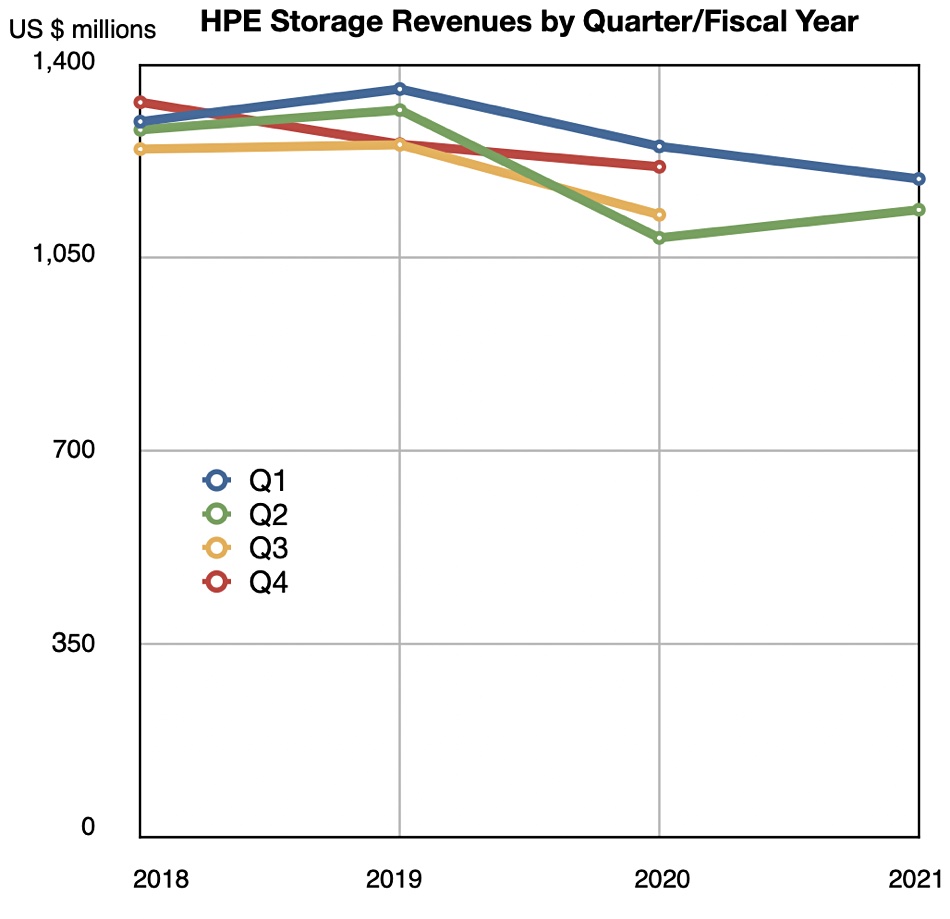

Compared to the latest storage-related results from Pure Storage, Nutanix, Dell Technologies and Snowflake, HPE’s storage revenues show a downward trend since the start of its fy2019 with the latest quarter showing growth after six consecutive quarters of decline. It must be very welcome.

HPE’s switchover to as-a-service/GreenLake product supply delivered a 30 per cent Y/Y increase in annual recurring revenue (ARR) to $678m.

The outlook for the next quarter is for a low single digital revenue increase Y/Y; Wells Fargo analyst Aaron Rakers estimated this to mean $6.921bn, a 1.5 per cent Y/Y increase. Neri said: “We expect to continue to see improvement in customer IT spending throughout 2021” in the earnings call.

Comment

With HPE storage returning to growth, based on strong growth in the Nimble and Primera product lines, HPE must be hoping that the products’ announced successors, the Alletra 6000 (Nimble) and 9000 (Primera), will continue to build on this base. Both have an even stronger as-a-service element than before – aiming for the cloud-style hybrid environment the firm believes customers want. Neri said Alletra was propelling HPE’s “storage business into our cloud-native software-defined data services business.”

The focus is moving away from the storage hardware platforms to subscribed data services delivered across the on-premises and multiple public cloud environments.

We would expect HPE to pivot its on-premises ProLiant and Apollo server base to a consumption model over time, with a lifecycle management focus. Neri said we ”should stay tuned for more announcements here shortly.”