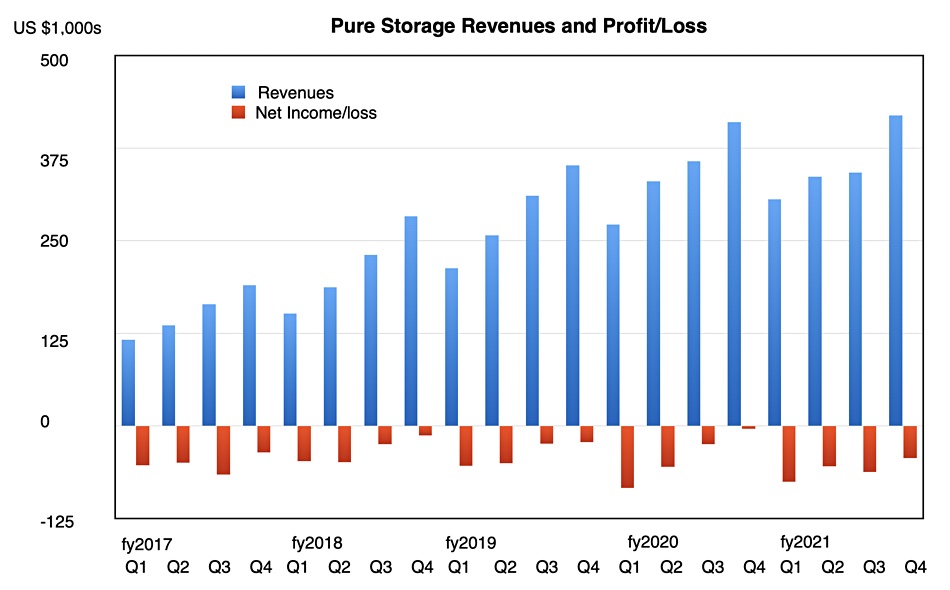

Pure Storage returned to form in Q4 ended January 31, topping expectations with $502.7m revenues booked on the back of “record sales” for Pure as-a-Service, FlashBlade, FlashArray//C and Portworx. The company had a very poor third quarter, missing revenue and earnings estimates.

There was a loss of $52.3m in Q4, more than the year-ago $29m loss, but there is light at the end of the profitability tunnel. Full fy21 revenues were $1.68bn, up 2.5 per cent Y/Y, with a loss of $261m.

On the earnings call yesterday, CFO Kevan Krysler said FlashBlade and FlashArray//C “both achieved consecutive record sales… We completed a record number of deals above $10m and also achieved record sales during the quarter to our Fortune 500 customers.”

Pure gained 471 new customers in the quarter, taking its total customer count to 8,937.

Subscription business

The subscriptions transition is rolling along nicely, now comprising 30 per cent of total revenues and Q4 revenues grew more than 30 per cent Y/Y, CEO Charlie Giancarlo said in the earnings call. New customers for Pure as-a-Service include “one customer over $10m”.

“We’ve had a very high percentage of net new customers on Pure-as-a-Service,” he added “It really has allowed us to enter new customers with a unique value proposition where we might not have been given a chance before.”

Enterprise sales

The enterprise business is growing too, according to Giancarlo, who revealed the company booked “eight 8 figure deals with eight large enterprise customers [in Q4], a new record. It was just two years ago that we began significant investments in our enterprise go-to-market team.”

The company is competing mainly with Dell and NetApp for those big deals, and the quarter included “a very big win up against NetApp,” Giancarlo said. He added that Pure is making changes to bolster its US federal business, which is “still not an area of strength for us, to be honest”.

Pure’s product revenues were $350.4m in the quarter. However, NetApp reported yesterday that its flash array revenues in its latest quarter were $652m, 86 per cent more than Pure and up 11 per cent Y/Y, outgrowing Pure, where product revenues declined 6.9 per cent Y/Y.

Giancarlo said the acquired Portworx is doing well, mentioning an IBM connection: “We saw significant growth of in-cloud deployments of Portworx this quarter, with particular growth through our IBM partnership given our best-in-class support for RedHat OpenShift and IBM Cloud Pak for Data.”

Flash vs disk

Regarding the use of QLC Flash and disk drives for nearline storage, Giancarlo said: “Flash continues to decrease on a per bit basis, faster than magnetic [disk] and what that means is that as those costs converge, we’re going to see more and more of the magnetic market move over to flash.”

Krysler added: “There was some great analyst commentary just this last quarter about how we’re a couple of years off from that complete convergence, but that commentary misses the benefit of data reduction and so today, we actually deliver the value that folks think are years away of being able to replace disk in the data centre completely with flash.”

Pure is “bringing together the strength of FlashArray, FlashBlade and FlashArray//C to go after every use case in the data centre.”

Outlook and profitability

Giancarlo said the company is looking forward to “more significant economic growth as we expect the effects of Covid will begin to diminish during our fiscal Q2.”

Next quarter’s revenue guidance is for $405m, up 10 per cent Y/Y growth, and 14 – 15 per cent revenue growth is forecast for the full year.

Krysler said: “We are forecasting an operating loss of $20 million for the quarter and expect to generate positive operating income during the remainder of the year.” He is “really happy with the fact that we’re looking at almost $90m of profitability for the year.”

Financial summary

- Q4 gross margin – 69.4 per cent compared to 72.1 per cent a year ago

- Operating cash flow – $69m

- Free cash flow – $48m

- Cash at quarter end – >$1.25bn

- Headcount – 3,800