“It’s been a wild year and it’s not over yet,” Pure Storage CEO Charlie Giancarlo said on the Q3 earnings call yesterday.

2022 can’t come too soon for the data storage vendor, which missed analyst profit expectations by a country mile, recording a net loss of $74m for the quarter ended November 1. Consensus forecasts were breakeven point – it lost $29m for the same quarter last year.

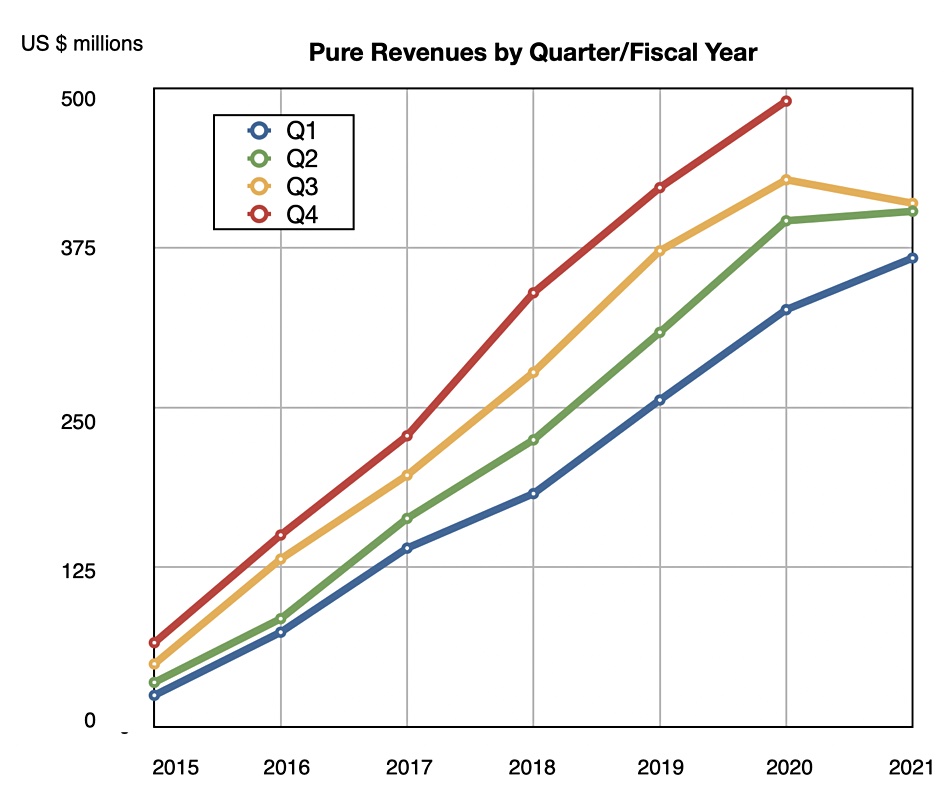

Pure estimates Q4 revenues will come in at $480m, down two per cent Y/Y. That translates to $1.66bn revenue for the full fiscal year, up 1.1 per cent – effectively flat after years of high growth.

The company is still chewing through the effects of the ongoing transition from selling hardware+software, to renting stuff on a subscriptions basis. And the pandemic ain’t helping. Revenues are holding up fairly well nonetheless at $410.6m for the quarter, down 4.2 per cent Y/Y. It anticipates growth will pick up again in Spring 2021.

On the bright side, Pure reported record FlashArray//C and FlashBlade sales, and subscription services revenues climbed 29.5 per cent Y/Y to $136.1m. Product revenue was $274.5m, down 15.1 per cent Y/Y. Pure acquired 316 new customers in the quarter compared to 379 a year ago.

CEO Charlie Giancarlo said in prepared remarks: “The challenges and the changes we’ve experienced this year have been extraordinary and seem never ending and they have certainly reset all of our expectations and assumptions.”

Post-pandemic pickup

The twin headwinds of the pandemic and move to subscriptions have made Pure’s fiscal 2021 one to forget. But CFO Kevan Krysler declared the company is positioned for “strong revenue growth, including growth of our recurring revenues.“

It’s apparent that FlashArray//X sales are not growing as well as //C and FlashBlade. Did Pure see competition from Dell’s recently launched PowerStore array? Krysler said: “We’re just not seeing PowerStore. I mean, the little we’re seeing of it is not being terribly successful.“

Perhaps a FlashArray//X refresh is needed.

Financial summary

- Gross margin 67.3 per cent

- Operating cash flow was $32.8m

- Free cash flow was $7.9m

- Total cash and investments of $1.2bn

- Deferred revenue $762.8m, up 19 per cent Y/Y

- Remaining performance obligations (RPO) exceeding $1.0bn, up 25 per cent Y/Y

We’ve charted Pure’s quarterly revenues by fiscal year to illustrate its wild year.