NetApp revenues grew five per cent to $1.47bn in Q3, on the back of good performance in cloud and flash storage. Net income was $182m, down 34.3 per cent Y/Y.

All-flash array revenue was $652m, meaning a run rate of $2.6bn, up 11 per cent Y/Y. “We believe we outpaced the market,” CEO George Kurian said, “gaining share from competitors and converting our installed base from hybrid arrays to all-flash. At the end of Q3, 27 per cent of installed systems were all-flash, giving us plenty of headroom for continued growth.”

Public cloud-based annual recurring revenues (ARR) grew to $237m, increasing 186 per cent Y/Y. Azure NetApp Files and Spot both delivered significant growth, CFO Mike Berry said. “Software revenue, recurring maintenance and cloud revenue totalled $1.1bn and increased 13 per cent year-over-year, representing 72 per cent of total revenue.”

NetApp is targeting $1bn in ARR or fiscal 2025. “Given the magnitude of our cloud opportunity,” Berry said, “we plan to pull forward investments in both sales capacity and our product roadmap; positioning our cloud services for continued rapid growth heading into fiscal ’22.”

Cloud revenues are currently 36 per cent the size of the all-flash array business but growing faster. Kurian said cloud is “additive to our business – what we do in the cloud helps expand our on-premises business and … our enterprise-hardened software and experience provide a solid foundation for our work in the cloud.”

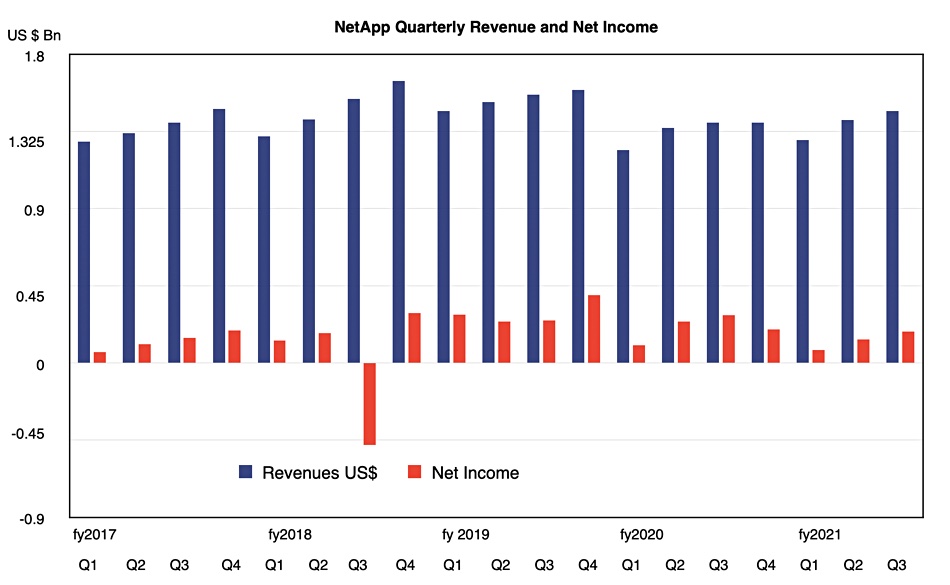

The three successive quarters of growth in Qs 1, 2 and 3 is typical of NetApp’s seasonal earnings pattern, as a chart illustrates,

NetApp’s Q4 is a blow-out quarter seasonally, with revenues typically exceeding Q3. The Q4 revenue outlook, bolstered by a strong cloud pipeline, is $1.49bn at the midpoint up 6.4 per cent on last year and full year revenues five per cent higher at $5.68bn..

Financial summary for the quarter ended January 29, 2021

- Gross margin 67.3 per cent

- Cash, Cash Equivalents and Investments: $3.89bn

- Cash flow from operations: $373m, compared to $420m a year ago

- Billings of $1.6bn, up 6 per cent

- Deferred revenue of $3.8bn, up 7 per cent,