HPE’s third fy21 quarter storage revenues of $1.13bn recovered from the Covid-19 beating they took in Q2 but are still down 10 per cent year-on-year.

A huge order backlog was partly to blame for the company’s woeful performance in Q2. HPE cleared a big proportion of the backlog in Q3, which helped the company record a 4 per cent quarter on quarter revenue rise, from $1.086bn to $1.28bn. The results show it is not out of the pit yet but at least it appears to have stopped digging.

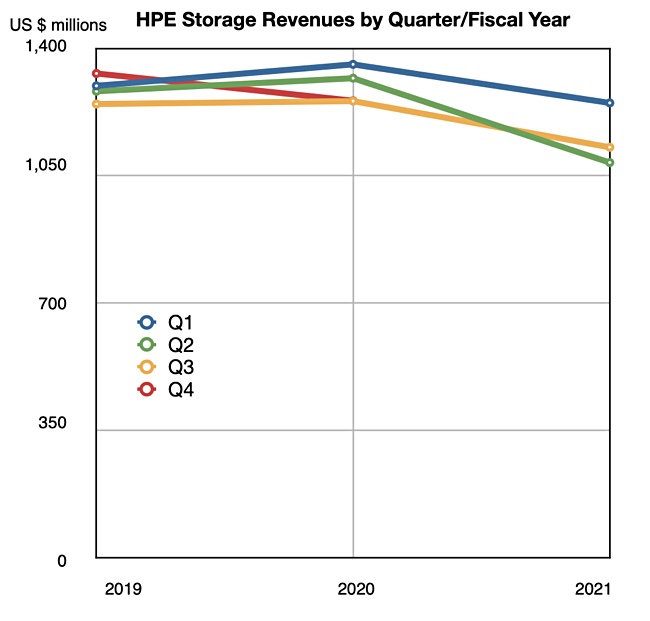

HPE storage revenues have declined for four quarters in a row on a Y/Y basis, as this chart shows:

They have been trending down for some time before but HPE changed its financial reporting metrics, which rendered our historical numbers invalid.

There were several storage bright spots. The company saw a 31 per cent Y/Y rise in big data storage, where its product is built on MapR technology and Apollo servers. HPE reported 104 new customers for its recently refreshed Primera array, the successor to 3PAR, with a 114 per cent revenue rise. Encouragingly, a quarter of the new Primera customers were new to HPE. There was also 112 per cent growth in Nimble dHCI revenues year on year. HPE did not call out 3PAR, Nimble or SimpliVity product revenue.

The composable cloud or Synergy business revenues grew 30 per cent Q/Q, but that revenue is included in HPE’s compute segmente.

In the earnings call, CEO Antonio Neri identified that storage is often tied to compute for HPE. “A lot of our storage platform is basically a compute platform with software, right. Big data storage is a great example of that. It is an Apollo platform that runs our [MapR] software on it.“

He added: “We continue to strengthen our core capabilities in storage and compute, which are essential resources to store and process customers’ data. Every 60 seconds, we ship 46 terabytes of storage in four servers.”

HPE is transitioning to a subscription-based, everything-as-a-service business with its GreenLake offering. Neri said: “GreenLake services orders grew a record 82 per cent year-over-year. We believe this is faster than the orders growth of public cloud vendors, … While others are now publicly declaring plans to offer everything-as-a-service, we have been focused on this for several years and have made significant organic and inorganic investments to deliver a differentiated experience for our customers.”

Growing storage revenues while moving to a subscription business and away from a perpetual license model, which has more revenue recognised at the time of sale, will be challenging to HPE. The company also needs to raise its storage array game to better compete with the likes of Pure Storage.