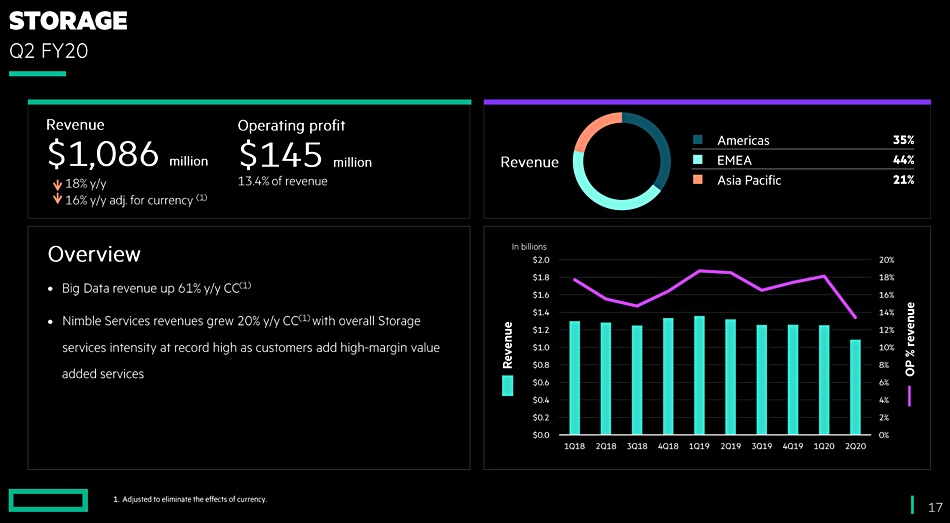

HPE’s storage revenues slumped 18 per cent to $1bn in its second 2020 quarter ended April 30 as “component shortages and supply chain disruptions related to the COVID-19 pandemic…impacted our ability to fulfil customer demand”.

Dell reports its Q1 fy2021 earnings, in the quarter ended April 30, on May 28. This will give us a good indication if HPE’s supply chain woes are representative of the computer hardware industry at large. Or if HPE has entered into a world of extra pain.

The company has an order backlog of $1.5bn, exacerbated by component shortages, and twice it previous record, The Register reports. Our sister publication has covered HPE’s disastrous Q2 Fy2020 earnings with slumped revenues, down 16 per cent to $6bn, and a $1bn cost-saving reorganisation in prospect. Here, we explore the storage segment where revenues fell 18 per cent to $1.1bn.

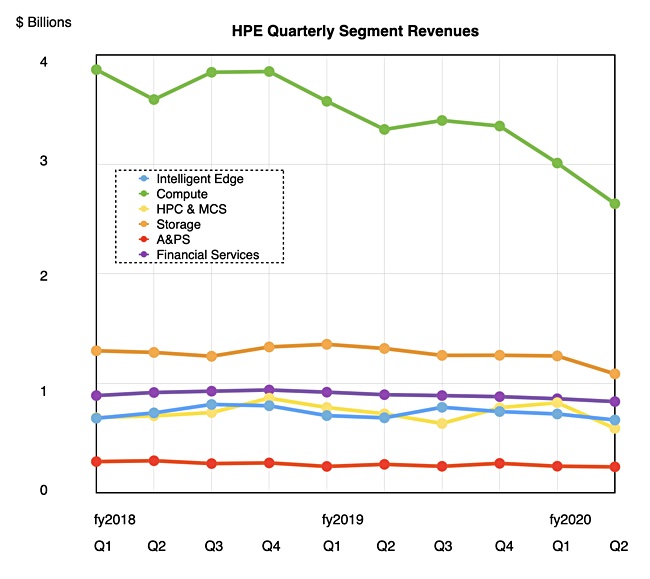

We have charted HPE revenues by segment, below. This is a useful way of illustrating that HPE’s revenue problems for its compute business pre-date the pandemic.

HPE’s storage revenue fall contrasts with IBM’s equivalent quarter which saw 18 per cent storage revenue growth driven by its mainframe refresh cycle. HPE sells XP8 array systems, which attach to mainframes, but did not report any equivalent benefit.

Big Data revenues was a bright spot, growing 61 per cent Y/Y at constant currency – but no actual numbers were revealed. Big Data products used to include StoreOnce dedupe and replication and HPE Data Protector enterprise backup and recovery, but apparently no more.

Storage services bought by Nimble array customers were another positive item – up 20 per cent at constant currency and, again, no actual numbers were disclosed. The composable cloud business – i.e. HPE Synergy – grew one per cent in constant currency.