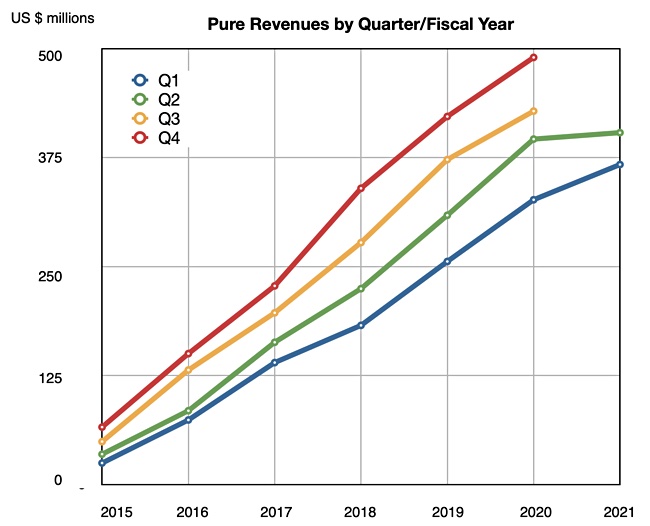

Covid-19 pandemic issues substantially curtailed Pure’s revenue growth in the second 2021 quarter.

Revenues grew two per cent to $403.7m Y/Y and losses improved slightly from $66m to $64.98m. This is much lower growth than the double figure percentages Pure has consistently recorded for the past 20 quarters.

Product revenues of $272.3m were down nine per cent from the year-ago $300.1m, while subscription services revenues grew 37 per cent from $96.2m to $131.4m. The company booked $724.8m in deferred revenue for the quarter, up 2.6 per cent Q/Q and 19.3 per cent Y/Y.

William Blair analyst Jason Ader told subscribers: “Despite the respectable quarter, revenue growth of 2 per cent represented a record low for the company, as the adverse impact of COVID-19 continues to weigh on the global IT spending environment in general and storage industry in particular.”

Wells Fargo senior analyst Aaron Rakers considers the deferred revenue increase “to be reflective of subscription expansion.” Pure’s total pipeline of opportunities for the third quarter is higher than in the second quarter but remains at an earlier stage, according to Rakers. He said this highlights the U.S. reopening and re-closing as negatively impacting spending decisions (relative to Europe re-opening and seeing better spending).

He told subscribers: “With clear pressures in on-premise infrastructure spending, we think Pure’s results will show relative outperformance vs. its storage peers.” Rakers said Pure had seen consistent win rates and most notably competes against Dell EMC high-end PowerMax systems.

In his prepared remarks, CEO and chairman Charlie Giancarlo said: “The current environment continues to challenge us all. … Q2 was a quarter of replanning for many organisations. Companies paused to consider the future and reassess their technology direction, aligning it to the new reality that their organisations face. Although the situation remains fluid, we believe the second half of the year will see businesses return to and even accelerate digital transformation.”

CFO Kevin Krysler said: “We are particularly pleased with the sustained strong growth and momentum of our subscription services that offer customers a cloud-like experience with more flexibility and compelling total cost of ownership.”

Financial summary:

- GAAP gross margin 68 per cent

- Operating cash flow $50.7 million, up $1.9 million Y/Y

- Free cash flow $25.7m, up $5.8m Y/Y

- Total cash and investments $1.3bn

Pure added 350 new customers in the quarter, up from 300 in the previous quarter and 450 a year ago, and taking the total customer count to 8,150.

USA revenues were $282m, accounting for 69 per cent of total revenues and down 4.5 per cent Y/Y while international revenues were $124m, up 20 per cent Y/Y. Giancarlo said: “The growth and strength we saw from our international business in the quarter provides an early, but positive, indication of increased demands for our solutions when crisis levels created by COVID-19 decline.”

Pure is not providing formal guidance for the next quarter but informally expects that total revenue will be approximately flat sequentially. Giancarlo said: “I am confident in our opportunity, long-term strategy and ability to reaccelerate growth upon exiting the global crisis.”